General Banking:

Some common types of works every bank should be to operate the banking business. Although the mode of performing these works differs from bank to bank but all the banks have to do the task. In the banking perspective these types of works are known as general banking General Banking is the heart of Banking. Here money collection procedure occurs, cherub encashment, account transfer; account closing, bills and remittance are provided he, so general banking section is the life blood in banking service. The activities perform throe some procedures .such as -Dispatch (inward-outward), Deposit, A/C opening and close transfer, Cheque book issue, local remittance (payment order ,DD,TT) collections- trans delivery, IBC, OBC, Cash, Vault ,packing and handling and evening Banking.

Banking Functions of EXIM Bank:

General Banking is the heart of Banking. Here money collection procedure occurs. Other services, like cherub encashment, account transfer; account closing, bills and remittance are provided here, so general banking section is the life blood in banking service. General banking activities of EXIM bank includes the following:

- Mobilization of deposits

- Receipts and payment of cash

- Handling transfer transaction

- Operations of clearing house

- Maintenance of accounts with Bangladesh bank and other Banks.

- Collection of cheque and bills

- Issue and payment of Demand Draft, Telegraphic transfer and Payment Order.

- Executing customers standing instructions. Maintenance of safe deposit lockers

- Maintenance of internal accounts of the bank.

While doing all the above noted work EXIM bank issue cheque book. Deposit account operating form, cheque book, ledgers, cash books Deposit account ledgers, preparation statements of accounts and pass book, balance different accounts and calculates profits.

Customer Services:

Customer services are one of the most talked about subject now a day. In banking, it is a major rule to earn a comparative edge. Customer service means to meet customer needs in a prompt and efficient way. In service-oriented organization like, quality means customer satisfaction. And customer satisfaction depends on the services provided by the organization. So, customer service section is the most important section in EX1M Bank Ltd. First of all customer want to collect information before taking services if he/ she satisfied with the information given by the customer-service section, then he/she come to take services. In the sense, it is very sensitive section in EX1M Bank. To satisfy the customer by giving better services all staff and officers of this section have to take responsibility, be cordial, frank and smiling appearance.

Generally they perform the operation about:

- Accounts opening

- Remittance

- Clearing

- Collection

- Cash Department

- Others

Account opening Section:

Account opening is the scope for clients to enter into business with the bank and can perform their transaction through the bank who is the middleman for the clients. It is the primary way to mitigate the banker customer relationship. This is one of the most important sections of a branch, because by opening accounts bank can raise funds for the investment, so many rules and regulations are maintained and so many documents are undertaken whole opening an account in the EXIM bank. Customers can open different types of accounts through this department by the department o bank.

Account opening sections generally do the account open for the customer. There are several types of account.

i. Mudaraba Savings (SB) Account

ii. Alowdia Current Account

a. Proprietorship

b. Partnership

c. Limited Company

d. Trust

e. Club

f. Educational Institution

iii. Mudaraba short term Deposit (MSTD)

iv. Mudaraba Fixed Deposit receipt (MFDR)

Mudaraba Savings Account:

To encourage savings habit amongst the general public, bank allows depositors to open savings account. As the name indicates, these accounts are opened for the purpose of savings. There are two types of Saving Account. One is “Single Saving Account” and another is “Joint Saving Account”.

Minimum amount of Tk. 1000/- is required for opening this type of account and it s charges yearly is Tk.600/-. A depositor shall be allowed to withdraw per week up to 25% of the balance of his account.

Distribution of profit to Mudaraba Depositors:

The principles of calculation and distribution of profit to mudaraba depositors are as under,

- Mudaraba depositors share income derived from investment of fund.

- Mudaraba depositors do not share any income derived from miscellaneous banking services where the use of fund is not involved, such as commission, service charges, exchange, and other fees realized by the bank.

- Mudaraba deposits get priority in the matters of investment over bank’s equity and other cost free find.

- The gross income derived from investments during the accounting year is, at first, allocated to mudaraba deposits and equity & cost-free fund according to their proportion in the total investment.

- The share of gross investment income of mudaraba deposits as worked out in terms of principle shown against serial no 4 is distributed as under:

- 20% is retained by the bank as management fee for managing the investment. 15% is transferred to a reserve fund for setting investment loss or with a view to maintaining a general level of return on mudaraba deposits the remaining 65% is distributed to mudaraba depositors applying weight ages.

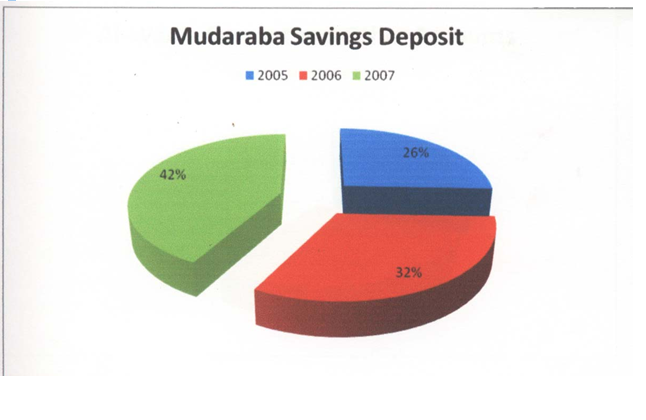

The growth rate of mudaraba savings deposits are increasing day by day.

Table Mudaraba Savings Deposits

Year | Amount TK |

2005 | 1,338,526,248 |

2006 | 1,684,526,998 |

2007 | 2,209,666,103 |

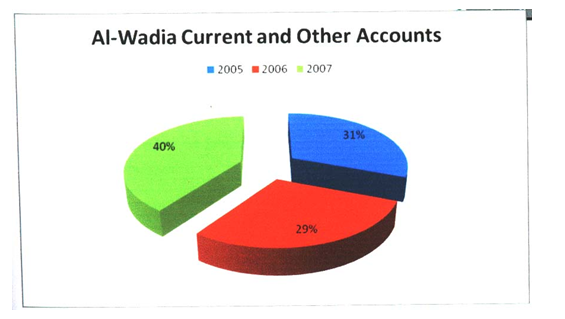

Al-Wadia Current Account:

Current account is an account where numerous transactions can be made by the account holder within the funds available in its credits. No profit is paid on those deposits and its yearly charges is Tk.l000M Current account is mainly suitable for businessman though nobody is debarred from opening such an account for any purpose. Requirements to open an account are almost same to that of savings account except the initial deposit and the introducer must be the saving or current account holder. The growth rate of al wadiah deposits are increasing day by day and it increase in 2007 is in questionable rate.

Year | Amount TK |

2005 | 3,710,805,625 |

2006 | 3,463,314,632 |

2007 | 4,778,629,437 |

Mudaraba Short Term Deposit (MSTD):

In short term deposit, the deposit should be kept for at least seven days to get profit. The interest offered for MSTD is less than that of savings deposit. In EXIM Bank, various big companies, organization, Government Departments keep money in MSTD account. Frequent withdrawal is discouraged and requires prior notice.

| SI | TERM | Revised Rate of profit |

| 1 | Short Term Deposit | 5.50% (no restriction on minimum balance)

|

Mudaraha Fixed Deposit receipt (MFDR):

Different kinds of deposits are also operated in to the bank. These deposits A/C may

be classified as

- STD (Short term deposit ) A/C

- MTD (Mudaraba Term Deposit)

- MSS (Mudaraba Saving Scheme)

- MIS (Mudaraba Investment Scheme)

- Hajj Project.

Savings Schemes:

These savings schemes are –

- Super Savings Scheme

- Monthly Savings Scheme

- Monthly Income Scheme

- Multiplus savings scheme

SUPER SAVINGS SCHEME:

Objectives of the Scheme:

Savings help to build up capital and capital is the principal source of business investment in a country. That is why savings is treated as the very foundation of development. To create more awareness and motivate people to save, EXIM Bank offers super savings scheme.

Terms and Conditions of the Scheme:

- Any individual, company, educational institution, government organization, NGO, trust, society etc. may invest their savings under this scheme.

- Any customer can open more than one account in a branch in his/her name or in joint names. A Deposit Receipt will be issued at the time of opening the account.

- The Deposit will approximately be double in 7 (six) years.

Highlights of the Scheme:

- Some examples are given in the table below. Any amount can be deposited in multiples of Tk. 5,000.00.

Deposit | Payable (approximately) at maturity |

5,000.00 | 10,002.00 |

10,000.00 | 20,004.00 |

20,000.00 | 40,008.00 |

50,000.00 | 1,00,020.00 |

1,00,000.00 | 2,00,040.00 |

2,00,000.00 | 4,00,081.00 |

5,00,000.00 | 10,00,203.00 |

- Savings will be treated as projected and it will be adjusted after the declaration of profit at the end of the year. The weight age of deposit will be 1.17.

- Not less than 65% of investment income shall be distributed among the Mudaraba Deposit holders as per weight age of deposit.

MUDARABA MONTHLY SAVINGS SCHEME (MONEY GROWER)

Objective of the scheme:

A monthly savings scheme. Secure your future with ease. A small savings of today will provide you comfort tomorrow.

Savings Period and Monthly Installment Rate:

The savings period is for 5, 8, 10 or 12 years.

Monthly installment is Tk. 500/-, 1000/-, 2000/- or 5000A.

Not less than 65% of investment income shall be distributed among the Murabaha Depositors as per weight age. The deposit will bear weight age 1.16, 1.17, 1.18, l.lft

respectively.

Bank reserves the right to change the weight age of deposit & percentage of distribution of Investment Income.

Monthly Installment Deposit:

- The savings amount is to be deposited within the 10th of every month.

- In case of holidays the deposit amount is to be made on the following day.

- The deposits may also be made in advance.

- The depositor can have a separate account in the bank from which a standing instruction can be given to transfer the monthly deposit to the scheme account.

- If the depositor fails to make the monthly installment in time, then 5% on overdue installment amount will be charged. The charged amount to be added with the following month(s) installment and the lowest charge will be Tk, 10- (Taka Ten).

Withdrawal:

- Generally, withdrawal is not advised before a 5 (five)-year term, but if it is withdrawn before the above term, profit will be paid at savings rate. However, no profit will be paid if the deposit is withdrawn within 1 (one) year of opening the account.

- In case the depositor wishes to withdraw between the 5, 8, 10 or 12 years period then full profit will be paid for a completed term and savings rate will be applicable for the fractional period.

Reasons for disqualification from this scheme:

- If the depositor fails to pay 3 (three) installments in a row, then he/she will be disqualified from this scheme and profit will be applicable as mentioned in withdrawal clause.

- If a depositor fails to pay 5 (five) installments in a row after completion of any one of these terms, then the Bank reserves the right to close the account and profit will be paid as mentioned in withdrawal clause.

- In case of death of the depositor the scheme will cease to function. The amount will be handed over to the nominee of the deceased depositor. In case of absence of the nominee, the bank wills handover

- the accumulated amount to the successor of the deceased.

Achievement from the scheme:

The accumulated amount may be more or less of following table;

| Term | Monthly Installment | |||

| 5007- | 1,0007- | 2,0007- | 5,0007- | |

| 5 yrs. | 39,0417- | 78,0827- | 1,56,1647- | 3,90,4117- |

| 8yrs. | 74,2027- | 1,48,4047- | 2,96,8097- | 7,42,0247- |

| 10 yrs. | 1,05,0957- | 2,10,1907- | 4,20,3807- | 10,50,9527- |

| 12 yrs. | 1,44,4617- | 2,88,9237- | 5,77,8477- 4,44,61 87- | |

MUDARABA MONTHLY INCOME SCHEME (STEADY MONEY)

Objectives of the scheme:

- A monthly scheme that really makes good sense. A sure investment for a steady return. Actually, steady money makes your money work for you.

- Proper utilization of savings from stipend, wage earning, retirement benefit and so on.

- Higher monthly income for higher deposit.

Formalities of opening an account:

- An account is to be opened by filling up a form.

- The Bank will provide the customer a deposit receipt after opening the account. This receipt is non-transferable.

Highlights of the scheme

- Minimum deposit Tk. 1,00,000/-.

- The scheme is for a 3 (three)-months period.

| Income (Tk.) | |

| 1,00,000/- | 791/-(9.5%) |

- The income is estimated which may be more or less at the year end and accordingly the same shall be adjusted. The deposit will bear 1.15 weight age.

- Not less than 65% of Investment Income shall be distributed among the Mudaraba Deposit holders as per weight age.

- Bank reserves the right to change the weight age of deposit & percentage of distribution of Investment Income.

MUDARABA MULTIPLUS SAVINGS SCHEME

Objective of the scheme:

- To gather public’s idle money in exchange of high return within the shortest possible time.

Terms and Conditions of the Scheme:

- Any individual, company, educational institution, government organization, NGO, trust, society etc. may invest their savings under this scheme.

- The deposit can be made in multiples of Tk. 5,000

- Any customer can open more than one account in a branch in his/her name or in joint names. A Deposit Receipt will be issued at the time of opening the account.

- The period of deposit is 12 (twelve) years.

Highlights of the Scheme:

- Some examples are given in the table below. Any amount can be deposited in multiples of Tk. 5,000.00.

| Deposited Amount | Amount payable (approximately) at maturity

| ||

| 5,000.00 | 15,879.00 |

|

|

| 10,000.00

| 31,758.00

|

|

|

| 50,000.00

| 1,58,793.00

|

|

|

| 1,00,000.00

| 3,17,587.00

|

|

|

- Payable amount will depend on projection and will be adjusted after the declaration of profit at the end of the year. The weight age of deposit will be 1.17.

- Not less than 65% of investment income shall be distributed among Mudaraba Depositors as per weight age.

Commercial bank in Bangladesh offers the facility of transferring funds, from one place to another place, to their customers as well as to the general public. Such transfer of funds can be affected either through Demand Draft or Telegraphic Transfer or Mail Transfer. The aforesaid methods of remitting money from one place to another within the country are known as Remittance, While, it is for outside Bangladesh the same is called foreign remittance. The advantage of this facility is the quick transfer of money with minimum cost and also the risk of physical transportation of cost is eliminated.

Main Key Terms:

- Issue Of Demand Drafts

- issue Of Duplicate Demand Draft:

- Cancellation Of Demand Draft:

- Revalidation Of Draft: ^ Payment Of Demand Draft: ^Payment Of Open Draft: ^Payment Of Crossed Draft:

- Telegraphic Transfer: TT is affected by tile bank through tested telex message by secret check signal, on receipt of which tile paying officer pay the amount to the payee in cash through a telegraphic payment order or credit his account, as the case may be. Both parties must have account in Exim Bank Limited, as money is transferred.

- Giving Payment Order (PO)

- M the time of payment of deposit Income Tax on profit shall be deducted.

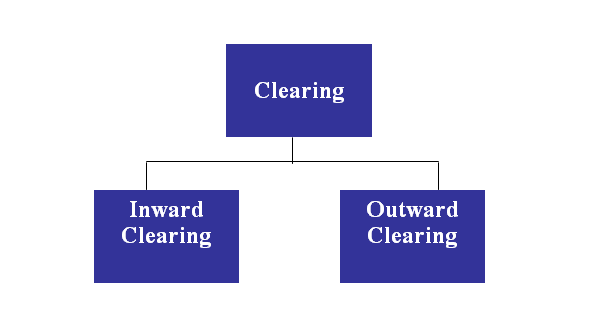

Clearing Department:

Accounts section deals with the income and expenditure of the branch and and every transaction of the bank. The accounts officers check all the paper works like bills, vouchers, checks and deposit slips every day. They also prepare a supplementary sheet. Supplementary sheet is prepared for bank’s transaction security to avoid any fraud or misguidance. A Senior Principal Officer is designated in New Eskaton Branch as the account officer in-charge of the department. Supplementary sheet consists of three heads such as General, Transaction with client’s income and expenditure.

Inward Clearing:

Inward clearing involves clearing Cheques/DD/PO, which come to the EXTM BANK, New Eskaton branch through clearing house for collection. The clearing officer receives then enters them in the inward logbook. Then sends them to the cash department for checking the account condition. If any problem is found with the instrument, it is marked as ‘dishonored’ mentioning the reason as mentioned above and he sends to the clearing officer. The clearing officer removes Cheques/DD from logbook and informs the matter to the New Eskaton branch.

Outward Clearing:

The cheques, PO, DD of different banks, which are submitted to EXIM

Eskaton Branch, for collection, are known as out- Ward clearing cheques. The

procedure is quite lengthy.

Outward Bills for Collection (OBC):

Customers deposit Cheque draft etc for collection attaching with their deposit sleep. Instrument within the range of clearing arc collected through local clearing house but the other which are outside the clearing range are collected through OBC mechanism. A customer of EXIM bank principal branch local office Dhaka is depositing a Cheque of Sonali bank Cox’s-Bazar as a collecting bank EXIM Bank principal branch will perform the following task.

1. Received seal on deposit slip.

2. EXTM Bank local office principal branch crossing indicating them as collecting bank.

3. Endorsement give payees A/C will be credited on realization.

4. Entry on register from where a controlling number is given. Collecting bank can collect it either by its branches of by the drawer’s bank they will forward the bill then to that articulate branch. OBC number will be given on the forwarding letter.

Ex:

Two parties(X, Y), two banks (Exim New Eskaton, Exim Rajuk). Party “y” gives a Cheque of Rajuk branch to party “x” of New Eskaton branch. Party x deposit it to New Eskaton branch than the p.p branch will send it to the Rajuk branch. In that case Rajuk branch will give entry.

Partya/c……… Dr.

New Eskaton ……. Cr.

But when the IBC are collected than the journal will be

Rajuk branch ……. Dr.

Party a/c ………. Cr.

Inward Bill for Collection (IBC):

In this case bank will work as an agent of the collection bank branch forwarding letter and the bill. Next steps are:

1. Entry in the IBC register, 1BC number given.

2. Endorsement given- “our branch endorsement confirmed”.

3. The instrument is sent to clearing for collection.

4. Miscellaneous creditor A/C.

Now following procedures will take place in case of the following two cases.

Ex:

Suppose party X give a Cheque of Islami bank of Saver in the Exim bank panthapath branch. In that case Exirn bank will send a OBC to Tslami bank branch at Saver though there is no branch of Exim bank and it is out of clearing house. In that Case islami bank will give a D.D in favor o f Exim bank Panthapath branch. Than Exim bank Panthapath branch will send it to the clearinghouse for collection.

Cash Section:

Cash is the measure of a business ability to pay its bills in time. This, in turn, depend on the timing and amounts of cash flowing into and out of the business each week and month -i.e., the cash flow of the business,

Cash receiving procedure:

The work of cash receiving counter is examining deposit slips.

Depositor uses the proscribed deposit slip supplied by the bank for deposit cash, check, draft pay order etc. in all types of deposits the teller must check the following things:

- The slip has been properly filled up.

- The title of the account and in its number.

- The amount in figure and in words is same.

- Instrument signed by the depositor.

- Date of the instrument.

After checking all these things the teller will accept cash, check draft, pay order etc.

against deposit sleep. The teller will place the cash in the cash in drawer according to denominations. The teller will place signature and affix cash receipt, rubber stamp seal and record in the cash received register book against the account number. At the end of this procedure, the cash officer passes the deposit slip to the comp for posting purpose and returns the customer’s copy.

Function of cash department:

To state the responsibilities and required procedures related to the safeguarding of cash , segregation of duties involving ash handling, the processing of cash proceeds, and ensuring the completeness of cash transactions.

| Cash payment | 1. Cash payment is made mainly against cheque , and also against instrument i. e., P.O,D.D, FDR &vouchers. 2. This is the unique function of the banking system which is known as payment in demand 3. It makes payment only against its printed valid instrument |

| Cash Receipt | 1. It receives deposits from the depositors in firm of cash 2. It is the mobilization unit of the banking system 3. It collects money only its receipts forms |

Receipt of cash:

Cash shall be received by the cash officer /assistant cash officer over the counter during banking hours. Any transaction outside the counter as well as beyond banking bourn shall not constitute valid banking transaction.

1. While receiving cash, the cash officer must examine the following points/procedures:

a) Receipt voucher is properly filled in i. e. with title of A/C, Account number if any, date particulars .if any denominations of notes, amount in words and figures.

b) In case of DD, PO, TT, TDK etc. Particulars like name of payee, name of Drawee Branch if any, date, have been give

2. All vouchers/application are signed by the depositor

3. Cash tendered for deposit shall be physically counted by the cash officer and shall see that the amounts conform to figures written in the voucher as well as with denominations,

4. He will make a cross entry if the amounts in figures and words over slip (both side)/voucher with red ink and shall put his specimen signature thereon as a token of receipt of cash.

5. Simultaneously he will enter the same in cash register and shall put serial no. of voucher on both side pay-in-slip thereafter shall send the same to the authorized official for counter signature, with initial in the cash receipt register.

6. The authorized official shall retain the cash received stamp under sis direct control and in verifying that all the above formalities have been observed shall countersign the same (both side on vouchers having counter foil) under cash receipt stamp and put initial in the cash receipt book, there after he will return the counterfoil, if any, direct to the depositors on detaching the same.

7. At the close of business, the concerned official shall total the cash receipt book and authenticate the total of the cash of facilitate closing of cash by the joint custodians).

Cash payment:

1. An amount of cash of cash payment shall be made by the cashier against a cheque/instrument /voucher duly passed for payment under full signature of authorized official(s) within his/her/there power schedule preferably in red ink on obtaining respective signature of the presenter of the cheque / voucher /instrument. in case signature does not conform payment shall be made.

2. Payment shall preferably made by the paying cashier as per denomination requested by the presenter on making a not e on the instrument. The instrument shall be branded with gash paid stamp under signature of the paying cashier . He/she will also put his/her initial in paying cashier’s book as a token of payment and return back the pausing cashier’ book to the passing officials to facilities the next entries.

3. The recipient of cash shall be advised to count the cash in presence of the concerned paying cashier. Other in claim for shortage shall be accepted. Payment shall always be made over the counter during business hour. Payment through via media i.e. peon, drawn, etc is strictly prohibited.

4. At the close of the business the paying cashier shall total the pay book and shall put the same to the passing official along with the paid cheques / vouchers/instruments who shall verify the instruments and entries thereof and confirm the total by putting his/her signature after verification of the total.

5. No customer, staff, guest, outsider shall the cash enclosure.

6. Cashier must not leave the cash counter until cash in balanced and in case of exceptional need, shall leave the counter for brief period with permission of custodian/joint custodian.

7. In cash of shortage and if any suspicion arises manager/joint custodian is authorized to check the cashier in presence of other officers/cashier.

Accounts Section:

This is a very much crucial department for each branch of a commercial bank. Records of all the transactions of every department are kept here as well with other respective branches. Accounting department verifies all financial amounts and contents of transactions, if any discrepancy arises regarding any transaction this department report to the concerned department. Tasks of accounts department

Accounts department plays a vital role in commercial banking. In private banking sector accounts department of EXIM Bank Bangladesh Ltd. Performs its tasks properly. The activities of accounts section are as follows

- Record all transaction in the cash book.

- Record all transaction in the general and subsidiary ledger.

- Prepare daily fund function, weekly position ,periodic statement of affairs etc.

- Prepare necessary statement for reporting purpose.

- Pay all expenditure on behalf of the branch.

- Made salary statement and pay salary.

- Branch to branch fund remittance and support for accounting treatment,

- Budgeting for branch.

Chapter –4

Recommendation and Conclusion

Recommendation :

- The entire department should be well informed regarding their goal and objectives, it is essential to execute company objective into individual target.

- Efforts should be made to increase Bank’s investment under Mudaraba & Musharaka modes.

- To appoint manpower having sufficient knowledge on Islamic Shari’ah at all the branches to ensure proper buying & selling in the investment operations o£ the Bank.

- Though the loan system is good in Exim bank but Investment approval policy it tough. It is difficult to get loans from Exim bank.

- Exim bank should start SME service. It will increase its customer base and also it will increase the acceptability of the bank to the customers.

- Exim bank does not have a huge product line. They add more products and services and grab other markets also.

- r One of the most important problems Exim bank is having at this moment is the online service. Online service of Exim bank is not impressive and to be in the market and to compete with other banks online service of the bank has to be improved.

- The management of Exim BANK should regularly administer marketing research activities in order to keep a regular track of satisfaction levels. Regular research should also be conducted to find out customer expectations about various service aspects. As customer expectations and satisfaction are not static figures, regular research at sufficient intervals should be conducted.

- ATM card is not an extra service in the present time but a requirement for any bank. Exim bank has lacking in this sector. Though I have not included this question in my questionnaire but while talking with customers and also with employees of Exim bank I have understood that ATM card their demand.

- The Bank should persuade the government to introduce a separate Islamic Banking law with a view to operating their activities more smoothly.

Conclusion:

As an organization the Exim Bank Limited has earned the reputation of top banking operation in Bangladesh. It is relentless in pursuit of business innovation and improvement. It has a reputation as a partner of consumer growth. Though it is a new bank, Exim Bank makes a strong position through its various activities, its number of clients /amount of deposit and investment money increases day by day. This bank already has shown impressive performance in Foreign Exchange Business.

Exim bank introduced a specialized banking service in Economic. With’a bulk of qualified and experienced human resources, Exim Bank Limited can exploit any opportunity in the banking sector, since its establishment it is rendering its services with qualified and knowledgeable staff. The environment of Exim Bank Ltd is very modernized and friendly. The staffs are specialized in their respective fields. Each of them works on their own and there is supervision from the top. The motivation of the staff, I believe comes from the very sense of responsibility. Each member is individually responsible for his or her work.

Consumers are or less satisfied with the present services of the bank. Management should think to start new services and take different types of marketing strategy to get more customers in this competition market of banking.

This report tries to figure out most of the indicators of problems and strengths of Exim Bank Limited as a valid pretender in the competitive banking sector of Bangladesh. The main philosophy of Exim Bank is to diminish interest and charge or pay fixed interest on loans or deposits and at the same time establish an egalitarian society based on the principle of social justice and equity Instead of predator mined interest on deposits.

Bibliography:

1) Annual report of Export Import Bank of Bangladesh Limited(2004-2007)

2) Investment Operation Manual by Muhd. Mubarak Hussein,deputy

Managing Director, Exim Bank Bangladesh Ltd.

3) Manual of Exim Bank Ltd.

4) Statement of affairs, Exim Bank Ltd. New Eskaton Branch.

5) Investment manual and guidelines of Exim Bank.

6) Islamic Banking- By Abdur Rakib and Shekh Muhammad.

7) Prospectus of Exim Bank Ltd.

8) Website; www.eximbd.com.