Target rate of return pricing is a pricing strategy that is almost entirely employed by market leaders or monopolists. Rate of return pricing is a method by which a company determines the price of a product in such a way that it ultimately assists organizations in achieving their ultimate goal or return on capital employed. You begin with a rate of return goals, such as 5% of invested capital or 10% of sales revenue. This is a common practice, but it can only work in cases of products with little competition. Then you structure your pricing to achieve these target rates of return.

Explanation

The rate of return pricing is similar to the concept of return on investment. The only difference is that in this approach, the manufacturer or company can manipulate or change the price of the product to achieve the organization’s ultimate goal. Target return pricing is a pricing strategy used by e-commerce experts to help them set the price of a product based on their business’s expected rate of return.

Target-Return Pricing is a method in which the firm determines the price based on a target rate of return on investment, i.e. what the firm expects from the venture’s investments. The rate of return pricing assists the company in achieving a certain level of profit required to maintain liquidity. The price is set in such a way that if sales continue at the current rate, the ultimate goal of achieving corporate profit is met.

The process becomes easy if there is little competition, as compared to a situation when there is competition. The target return price can be defined as: Target return price = unit cost + (desired return * invested capital) / unit sales

Pricing a product based on the rate of return can also have some drawbacks. It does not consider price elasticity or competition pricing, which are two important factors to consider before determining final pricing.

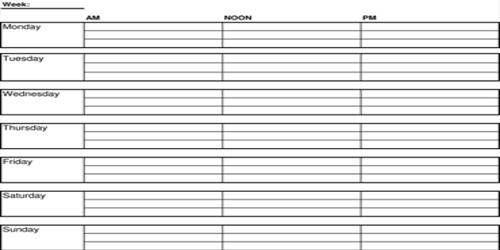

Assume a company invests $100 million to produce and market designer snowflakes, and they estimate that with the current demand for designer snowflakes, they can sell 2 million flakes per year. Furthermore, based on preliminary production data, they know that their average total cost (ATC) at that level of output is $50 per flake. Annual costs would be $100 million (two million units at $50 each). Following that, management decides on a 20% return on investment (ROI). That equates to $20 million (20% of a $100 million investment). Profit margins of $10 per flake are required ($20 million return on 2 million units). As a result, the price per designer flake must be set at $60 ($50 costs plus a $10 profit margin). Similar calculations will be used to determine the price based on the rate of return on sales revenue.

The unusual consequence of this pricing model is that, in order to maintain the target rate of return constant, the firm must constantly change its price as the level of demand changes. Based on market demand projections, the company anticipates operating at 70% capacity. It knows that given its production function and cost structure, its average total costs at that output level will be represented as point A. If the amount A, B is its predetermined rate of return requirement, it will set its price at P*. Because profit equals (P-ATC)*Q, their total profit is defined by the areas P*, B, A, and P70 percent.