Monetary economics is a branch of economics that studies various money theories. The quantity theory of money (often abbreviated QTM) is a branch of Western economic thought that emerged in the 16th and 17th centuries. According to the quantity theory of money, the general price level of goods and services in an economy is proportional to the money supply. According to the QTM, the general price level of goods and services is directly proportional to the amount of money in circulation, also known as the money supply. All else being equal, if the amount of money in an economy doubles, price levels will also double, according to this theory. For example, if an economy’s money supply doubles, QTM predicts that price levels will also double.

The quantity theory of money (QTM) also holds that the amount of money in an economy has a significant impact on the level of economic activity. Nicolaus Copernicus, a Polish mathematician, first proposed the theory in 1517, and it was influentially restated by philosophers John Locke, David Hume, and Jean Bodin. With the publication of economists Anna Schwartz and Milton Friedman’s book A Monetary History of the United States in 1963, the theory experienced a significant surge in popularity.

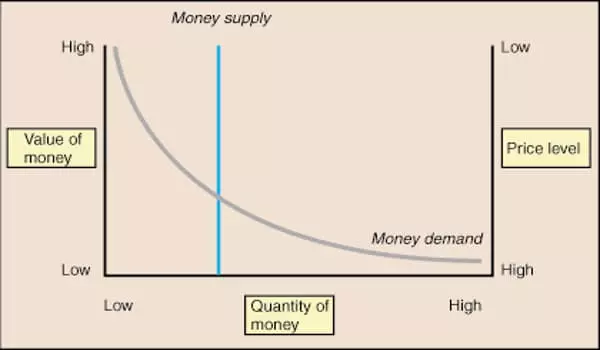

According to the quantity theory of money, the money supply and price level in an economy are proportional to one another. As a result, a change in the money supply causes either a change in price levels or a change in the supply of goods and services or both. When the supply of money changes, the price level changes proportionally, and vice versa. Furthermore, the theory assumes that changes in the money supply are the primary cause of changes in spending.

Many Keynesian economists continue to be skeptical of the basic tenets of the quantity theory of money and monetarism, and they question the assertion that economic policies aimed at influencing the money supply are the best way to address economic growth. Keynesian economists challenged the theory, but it was updated and revitalized by the monetarist school of economics, led by economist Milton Friedman. Critics of the theory argue that because money velocity is not stable and prices are sticky in the short run, the direct relationship between money supply and price level does not hold. Changes in the money supply, according to mainstream macroeconomic theory, have no bearing on the inflation rate as measured by the CPI.

The real bills doctrine and the more recent fiscal theory of the price level are two alternative theories. One implication of these assumptions is that the amount of money available in an economy determines the value of money. Because an increase in the money supply also causes an increase in the rate of inflation, an increase in the money supply reduces the value of money. Purchasing power declines as inflation rises. The purchasing power of a currency is the number of goods or services that one unit of currency can purchase. When a unit of currency’s purchasing power falls, it takes more units of currency to buy the same amount of goods or services.