A protective put, also known as a married put, is a risk-management technique in which investors use options contracts to protect themselves against the loss of a stock or asset. A synthetic call is another name for a defensive put technique. It is a portfolio procedure where a financial backer purchases portions of stock and, simultaneously, enough put alternatives to cover those offers. The supporting procedure includes a financial backer purchasing a put choice for a charge, called a premium. The protective put serves as a price floor, limiting how much money an investor will lose if stock continues to fall in value. When the stock falls below the safe put’s strike price, the investor is shielded from further losses.

A protective put procedure is practically equivalent to the idea of protection. The primary objective of a defensive put is to restrict potential misfortunes that may result from a sudden value drop of the fundamental resource. A defensive put, on the other hand, gives investors infinite upside opportunity, while the worst-case scenario is that the stock price falls to zero, which is extremely unlikely over the put option’s lifetime. The lone inadequacy of protective puts is that financial backers need to pay a premium for the since quite a while ago put choice, which raises the all out cost of the basic resource.

Stocks, currencies, commodities, and indexes may all benefit from protective puts, which have some downside security. Adopting such a policy does not impose an absolute cap on the investor’s future earnings. Benefits from the methodology are dictated by the development capability of the fundamental resource. A protective put goes about as a protection strategy by giving disadvantage assurance in the occasion the cost of the resource decreases. However, a portion of the profits is reduced by the premium paid for the put.

If an investor is already long a stock, he or she runs the risk of losing money if the stock falls in value. Protective puts serve as an insurance policy by offering downside cover against an asset’s price declines for the expense of the premium. Bullish investors who want to hedge their long positions in the asset usually use a defensive put strategy. Normally, a financial backer who claims stock has the danger of writing off the venture if the stock value decays underneath the price tag. By buying a put choice, any misfortunes on the stock are restricted or covered.

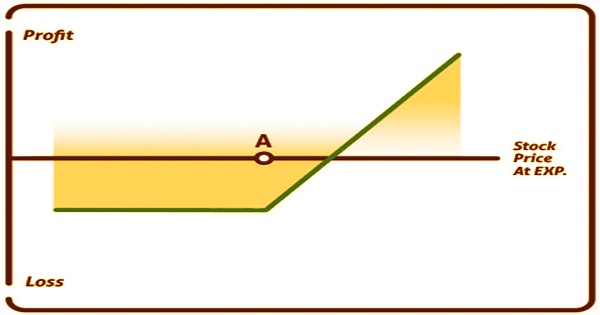

Even if the underlying asset’s price continues to fall, the protective put establishes a known floor price at which the investor cannot lose any more capital. However, by buying a protective put option, an investor ensures that if the stock begins to fall, he or she will be able to sell it at a specific price, limiting their losses. A put option is an agreement that enables the proprietor to sell a particular measure of the hidden security at a set cost previously or by a predetermined date. Not at all like fates gets, the alternatives contract doesn’t commit the holder to sell the resource and possibly permits them to sell in the event that they ought to decide to do as such.

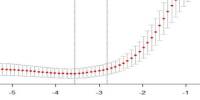

The protective put functions as asset insurance, and it comes with a premium, much like every other form of insurance. The strike price is the contract’s fixed price, and the specified date is the contract’s end date or expiry. One option agreement compares to 100 portions of the fundamental resource. The premium depends on where the financial backer needs to add his/her value floor, just as instability, which addresses the probability of the cost of the stock falling significantly further. The length of time the insurance lasts is also limited; the longer the investor wants his insurance to last, the higher the protective put purchase price would be.

At any time, investors can purchase a security put option contract. Some investors will purchase both of these items at the same time as the stock. An investor has many choices when performing a defensive put, including the amount strike price to use and the expiration date. Ordinarily, financial backers select an out of the cash put choice. A defensive put keeps drawback misfortunes restricted while safeguarding limitless likely gains to the potential gain. In any case, the system includes being long the hidden stock.

Investors who are more concerned about stock price declines can opt to buy at the money put. This more aggressive defensive put offers 100 percent protection against future damages, but it comes at a higher cost. On the off chance that the stock continues to rise, the long stock position benefits and the purchased put alternative isn’t required and will terminate uselessly. All that will be lost is the superior paid to purchase the put choice. The overall profit is limitless since owning the stock helps the owner to profit as the stock rises in value.

Protective puts may be used to protect a portion or all of an investor’s long position. The strategy is known as a married put when the ratio of protective put coverage equals the sum of long stock. The stock price plus the put price is the breakeven point for a defensive put. For instance, $100 stock cost in addition to $1.50 put value implies the stock would need to exchange up $1.50 to take care of the expense of the put, so $101.50 would be the breakeven. Married puts are often used by investors who want to buy a stock and then buy a put to cover their spot. However, as long as the stock is owned, an investor can purchase the protective put option at any time.

Information Sources: