The price-to-cash flow ratio (also known as the price/cash flow ratio or P/CF) is an indicator of stock valuation or a multiple that calculates the value of the price of a stock compared to its per-share operating cash flow. It is determined by dividing the market value of the company by the operating cash flow of the company in the most recent fiscal year or the latest four fiscal quarters); or, equivalently, by dividing the per-share equity price by the operating cash flow per share. Essentially, the price-to-cash flow ratio measures the contemporary charge of the company’s stock relative to the amount of money generated by means of the company. In theory, the decrease a stock’s price/cash flow ratio is, the better value of that stock is.

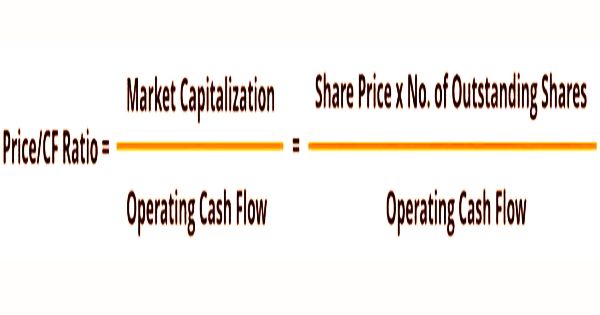

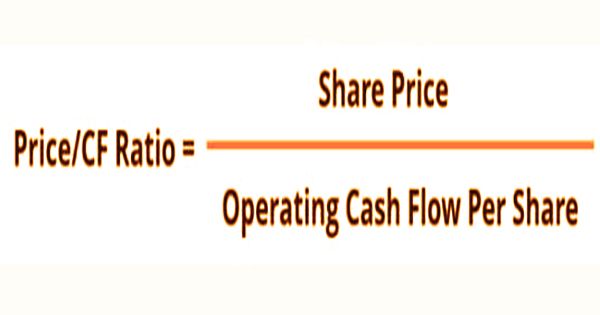

The Formula for the Price-to-Cash Flow Ratio – P/CF:

The price-to-cash-flow ratio contains two measurement methods from the description. First, using the market capitalization of the company, the multiple can be determined. The price-to-cash-flow formula in such a situation is the following:

Even on a per-share basis, the ratio can be determined. The formula for the price-to-cash flow ratio on a per-share basis is:

In addition to doing the math on a per-share basis, by dividing the overall market value of a company by its total operating cash flow, the calculation can also be performed on a whole company basis. Nevertheless, the P/CF ratio doesn’t account for the company’s monetary health, as the enterprise might also be full of money owed and the cash waft ought to only be the by-product of leveraged investments. The profitability of these investments and the business capacity to fulfill its monetary tasks must additionally be taken into account for valuation purposes.

A high P/CF ratio suggested that the individual company is selling at a high price but does not produce enough cash flows to cover the multiple, depending on the company, market, and its specific operations, this is often OK. Since cash flows cannot be manipulated as easily as earnings, which are influenced by depreciation and other non-cash products, the price-to-cash-flow ratio is said to be a stronger investment valuation metric than the price-earnings ratio. Smaller price ratios are generally preferred, as they may disclose an association generating enough cash flows that are now not but proper regarded in the modern share price. Some agencies appear unprofitable because of large, non-cash costs even though they have positive cash flows.

For annual operating cash flow, the P/CF measured would always be lower than the calculated P/CF for quarterly cash flow estimates. Owing to their high non-cash costs, businesses with positive cash flows are not profitable. The P/CF ratio enables analysts and investors to get a less skewed view of the financial standing of a firm. Although there is no single determine that factors to a superior price-to-cash flow ratio, a ratio in the low single digits may also indicate the inventory is undervalued, while a higher ratio may endorse plausible overvaluation.

For businesses in their early stages of development, high P/CF ratios are prevalent when the share price is mainly priced based on their potential growth prospects while a limited amount of cash is generated. Holding all variables constant, a smaller P/CF is favored over a larger multiple from an investment perspective. Free Cash Flow comes from the elimination of essential capital expenses (CapEx) and improvements in the composition of working capital to the net profits of the corporation plus its depreciation and amortization fees.

Information Sources: