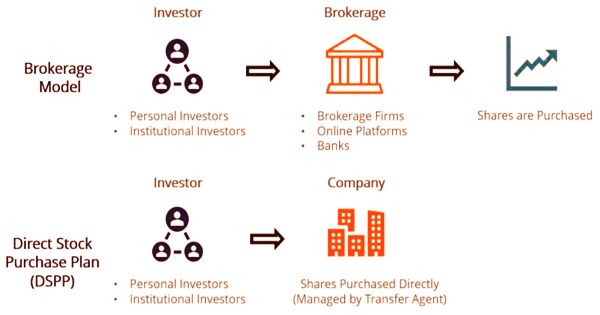

A direct stock purchase plan (DSPP) enables investors to purchase directly from the company the shares of a company’s stock. It is a way for individuals, rather than through a brokerage, to buy stocks directly from a company. For investors to acquire stock of a specific business over time, DSPP can be a cost-effective strategy. As investment has become cheaper through online brokers, it has become less popular; but direct purchases of stocks can still be an efficient way to invest. A few organizations that offer DSPPs make the arrangements straightforwardly accessible to retail speculators while others use move specialists or other outsider chairmen to deal with these exchanges. Such plans offer low charges and in some cases the capacity to buy shares at a markdown.

Investors usually buy stocks, such as banks or online investment platforms, via brokerages. The brokerage serves as an intermediary between the investor and the business in this situation, providing investors with access to a variety of stock offers on a single platform. Not all organizations offer DSPPs, and these plans may accompany limitations about when an individual may buy shares. Over the last two decades, such plans have lost some of their appeals as investing through online brokers has become less costly and more convenient, while DSPPs still provide benefit for long-term investors who do not have much capital to get started.

(Direct Stock Purchase Plan)

Nonetheless, businesses normally charge commissions or cash trade expenses per exchange. Through an immediate stock buy plan, a speculator can avoid the go-between and buy shares straightforwardly from an organization. A DSPP enables individual investors to create and pay for deposits to be made directly from a given company for the purpose of purchasing shares. The firm can directly sell the plan or use a transfer agent. Move specialists play out a few regulatory capacities identified with an organization’s stock yet are not a piece of the organization. These capacities incorporate account exchanges and giving stock testaments, among others. While commissions are reduced by DSPPs, there are other disadvantages, such as purchasing requirements and transfer fees.

DSPPs by and large work on a fixed timetable; this permits speculators to put a fixed dollar sum in portions of the organization’s stock, which is a type of dollar-cost averaging. DSPP additionally offers an option in contrast to the financier model most generally utilized in the purchasing and selling of stocks. Investors may invest directly in a firm by ignoring the middleman while eliminating any fees that would be paid to the brokerage. DSPPs surely advantage financial specialists who use them to collect offers in the organization. The low essentials assist more modest speculators with contributing to the organization’s stock.

This mechanism makes it simple and automatic for a given business to steadily accumulate shares. Since these plans also have very low fees (and often no fees), DSPPs are an affordable way to access capital markets for first-time investors. However, direct stock buy plans are arrangements between a speculator and a solitary organization. Accordingly, each organization may have various necessities with respect to the acquisition of offers. Walmart, Starbucks, and Coca-Cola are examples of businesses that sell direct stock purchasing plans.

One downside of a DSPP is that the securities are very illiquid, i.e., without using a broker, it is difficult to re-sell one’s shares. As a result, for investors with a long-term investment policy, these strategies usually perform best. Organizations likewise advantage; The DSPP fills in as a way to raise extra capital and extend the investor base. However much that immediate buy plans can profit speculators, they additionally can be advantageous to the organization that offers them. DSPPs could bring in new investors who would not have been able to invest in the business otherwise.

Direct stock purchases are overseen by move specialists, which are outsider foundations that record exchanges, issue endorsements, and perform regulatory obligations. For institutional financial specialists that buy huge amounts of offers, direct stock buys might be useful in light of the fact that organizations can offer limits that are inaccessible through customary business models. In addition, at a reduced cost, a DSPP may provide a business with the opportunity to collect additional funds. Companies typically put on their website data regarding their DSPP. The specifics include minimum investments, any software related fees, etc. This in and of itself, tends to generate some additional company interest.

A Direct Stock Purchase Plan (DSPP) has a few preferences or advantages for the two speculators utilizing the arrangement and for the organization giving the arrangement.

Advantages of Direct Stock Purchases:

- Offers cost savings: For investors, the cost savings gained by eliminating brokerage fees are one of the main benefits of direct stock purchases. Price discounts and dividend reinvestments can also be given by businesses.

- Provides a simplified purchasing experience: In the buying experience, avoiding the brokerage model may also provide greater simplicity.

- Promotes stronger investor relations: Direct stock purchases may be advantageous for the company itself because it facilitates better investor ties. Since shares are bought directly, the business may directly approach investors to promote and exchange knowledge.

- Prevents short-selling: Shares bought by direct stock purchases can also not be shortened, avoiding short-selling and reducing volatility in prices.

Disadvantages of Direct Stock Purchases:

- Charges other fees: There are also other fees that can occur, such as account setup fees, transaction fees, or fees to sell, while direct stock transactions remove brokerage fees.

- Reduces portfolio diversity and limits trading options: Direct stock purchases are between an investor and a single company. Although thousands of stock options can be sold by a brokerage, a direct stock purchase restricts the holder to one stock. It decreases portfolio diversity and limits the trading options of an investor.

Organizations that offer DSPPs for the most part refer to data about the plans on their sites, under the financial specialist relations, investor administrations, or frequently asked questions (FAQ) segments. With direct stock buys, it’s hard to know the cost of each offer prior to buying as the costs are normal. This makes it impossible for investors to time the market and more challenging to sell. So while the process for investing in DSPPs is somewhat different from going through a broker, irrespective of how the stock is bought, the risks of buying stock are similarly present.

Information Sources: