If more than one individual company comes together to create a common organizational structure, it is known as a conglomerate of companies. A “Conglomerate Merger” is a union between companies operating in various industries and engaged in independent, unrelated business activities. All in all, it is a mix of firms in various businesses or firms working in various geographic regions. There are two sorts of conglomerate mergers: unadulterated and blended. Pure conglomerate mergers include firms with nothing in like manner, while blended combination consolidations include firms that are searching for item augmentations or market expansions. The meaning of the mergers of conglomerates lies in the fact that they help the merging companies be stronger than before.

Conglomerate mergers, including the extension of corporate territories and the expansion of a product range, may serve various purposes. The merger between the Walt Disney Company and the American Broadcasting Company was one instance of a conglomerate merger. Adversaries of conglomerate mergers accept that they can prompt an absence of market proficiency when huge organizations unite the business by gaining more modest firms. The main sort the unadulterated consolidation is contained two organizations that work in independent and particular business sectors. The second form of a mixed merger is one in which the merging companies plan to extend their product lines or target markets so that they can potentially not only engage in entirely unrelated core businesses. There are likewise some different developments of aggregate consolidations like the monetary combinations, the concentric organizations, and the managerial conglomerates.

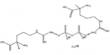

(Example of Conglomerate Merger)

In the 1960s and 1970s, a surge of conglomerate mergers occurred in the United States. Many new companies were, however, rapidly divested. Conglomerate mergers are, at present, very rare. There are a few reasons why an organization may go for a conglomerate merger. Among the more normal reasons are adding to the portion of the market that is claimed by the organization and enjoying strategically pitching. By following the approach of conglomerate mergers, businesses are also looking to add to their overall synergy and efficiency. Since a conglomerate merger is one between two strategically different businesses, the economic benefits for the target or the buyer are unlikely to be produced.

Advantages of a Conglomerate Merger:

- Diversification of Business: The merger of conglomerates helps the company to diversify its market. It helps to resolve the hazards of a vulnerable market. If one market sector is deteriorating, by doing well in the other diversified sector, the organization has the chance to resolve the unfavorable situation. It is also recognized as a diversification strategy for conglomerates.

- Cross-selling products: A conglomerate merger can help them cross-sell their existing products if the merging companies are involved in various enterprises but with the same target markets. Eventually, cross-selling would drive the new business to higher profits.

- Utilization of Excess Cash: At the point when a business has overabundance money however needs more occasions to extend in its area, at that point the business puts such abundance money into another organization of various areas to use the inert assets.

- Improves Customer Base: With this kind of merger, the organization can strategically pitch its items to the clients of the other organization. This assists with building a more extensive client base. This, thusly, assists with expanding the deals and benefits.

- Investment opportunity: It can reduce its risk exposure by investing in a company doing business in a different market while seeking new growth opportunities outside of its own industry. Whenever the need arises, the organization has the choice of using managers from various industries in its sector. It helps in the best use of human resources.

Conglomerate Merger encourages the business to accomplish economies of scale. Different expenses of systematic Research and improvement costs, cost of promoting, and so forth are spread out to various specialty units. It helps in lessening the creation cost per unit and helps in accomplishing economies of scale.

Disadvantages of a Conglomerate Merger:

There are a few ramifications of conglomerate mergers. It has frequently been seen that organizations are going for combination consolidations to expand their sizes. In any case, this likewise, on occasion, affects the working of the new organization. Usually, it has been reported that these businesses are unable to perform as they used to before the merger took place.

- No Past Experience: In this deal, a conglomerate merger can be risky for a buyer as the management of the organization is not likely to have any prior experience in the sector in which its target operates. Accordingly, the gaining organization will be unable to effectively use the expected favorable circumstances of the consolidation, for example, extending product offerings. The absence of “on point” industry experience may even reason the exhibition of the objective organization to decay after the consolidation.

- Focus shift in business operations: Two separate corporations are combining in a conglomerate merger. Management needs a great deal of effort to recognize the new business market, company activities, etc. Therefore, businesses are moving their emphasis from core business operations to other business areas, which can lead to poor results in all industries.

- Hard to merge cultural values: For organizations that work in various enterprises, it is regularly hard to effectively work the organizations’ social qualities. An organization’s business culture joins its business esteems and statement of purpose, its corporate vision, and the administration and working style of its representatives. A company’s corporate culture is critical because it affects the entire activity of a company, from production and sales to accounting, to broad strategic decisions.

- Governance Issue: Governance is a major challenge when two firms come together and have different histories. All former customers are moved to the new company with their accounts, which could follow a different accounting process. For management, this causes a lot of trouble.

Consequently, when the organization, at last, takes the course of amplifying and enhancing into new business fronts without including itself in administration, it appears to be the most ideal alternative for organizations to partake in an aggregate as recorded previously. Merging businesses of different corporate cultures successfully is a challenge for any merger. This is much more so in a conglomerate merger, where there are likely to be greater significant variations between the core values and operating styles of the firms since they operate in multiple industries. Shortly after they are done, several conglomerate mergers are divested.

Information Sources: