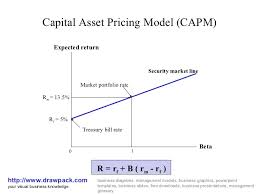

The typical idea behind capital asset pricing model is that investors must be compensated in two ways: time benefit of money as well as risk. The time benefit of money is represented from the risk-free (rf) rate inside the formula and compensates the investors for placing profit any investment over a short time. The other half of the formula signifies risk and calculates the quantity of compensation the investor needs when deciding to take on additional chance.

Capital Asset Pricing Model