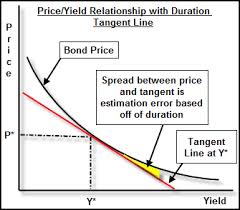

Bond Convexity is a measure of the curvature inside the relationship between attachment prices and attachment yields that demonstrates how a duration of the bond changes as the interest rate modifications. Convexity is used being a risk-management tool, and helps to measure and manage the amount of market risk to which a collection of bonds is exposed. In finance, bond convexity is a measure of the actual non-linear relationship among price and yield duration of an bond to changes in interest levels, the second derivative of the buying price of the bond with respect to interest rates.

Bond Convexity Definition