Businesses account for bad debt expense when they have a receivable account that will not be paid. It is recognized when a receivable is no longer recoverable due to a customer’s inability to pay an existing debt due to bankruptcy or other financial difficulties. Bad debt emerges when a client either can’t pay in view of monetary challenges or decides not to pay because of a conflict over the item or administration they were sold. Bad debt expense is additionally alluded to as uncollectible records cost or doubtful accounts expense.

Bad debts are shown on the balance sheet as an allowance for doubtful accounts, also known as a provision for credit losses, by companies that issue credit to their customers. If a company sells items on credit, there is always the possibility that the money will not be recovered. This non-recoverability is known as bad debt, and recording such a sum as a cost is known as awful obligation cost. Terrible obligation can be accounted for on budget reports utilizing the direct discount technique or the stipend strategy.

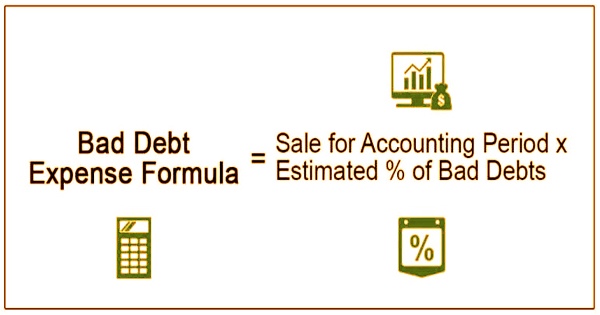

Formula:

Bad Debt Expense Formula = Sale for Accounting Period × Estimated % of Bad Debts

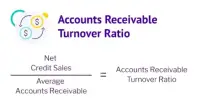

The measure of bad debt expense can be assessed utilizing the records receivable maturing strategy or the rate deals technique. To consent to the coordinating with rule, awful obligation cost should be assessed utilizing the recompense technique in a similar period in which the deal happens. Bad debt can be reported on the financial statements using the direct write-off method or the allowance method.

Direct write-off method: A bad debt charge is written off directly against the related receivable account using the direct write-off technique. As a result, a particular dollar amount from a customer account will be written off as a bad debt expenditure using the direct write-off method. However, because this method violates the matching concept specified in the “generally accepted accounting principle,” it is not widely employed by the company.

According to this rule, costs for the income should be perceived in a similar period in which they are reserved. The diary passage for the direct discount technique is a charge to terrible obligation cost and a worthy representative for debt claims.

Allowance method/ Estimation method: Under this system, a percentage of the transaction made or outstanding debtors based on their aging is recognized and transferred to a separate account called as Allowance for Doubtful Debts. The allowance approach, unlike the direct write-off method, is merely an estimate of money that will not be recovered and is based on the full accounts receivable account. The measure of cash discounted with the remittance technique is assessed through the records receivable maturing strategy or the level of deals technique. Bad debts under the allowance method can be calculated using two methods:

- Percentage of sale method

- Percentage of outstanding debtors

When both balances are included on the balance sheet, the allowance for doubtful accounts is a contra-asset account that nets against accounts receivable, reducing the overall value of receivables. Fundamentally, as with all accounting concepts, bad debt expenditure enables businesses to report their financial status honestly and comprehensively. Sooner or later on schedule, pretty much every organization will manage a client who can’t pay, and they should record a terrible obligation cost.

Almost every business will incur a bad debt expense at some point. Many organizations predict their bad debt expense based on historical averages or as a proportion of revenues because some customers will invariably fail to pay. A lot of bad debt expenses can change the way possible financial backers and friends’ leaders see the wellbeing of an organization. Organizations consistently consider credit misfortunes section, so they relate with the current measurable demonstrating stipends.

The aging approach divides all outstanding accounts receivable into groups based on their age, with different percentages applied to each group. The estimated uncollectible amount is the sum of all groups’ results. An intensive investigation of awful obligation holds after some time can give very significant experiences into how viably an organization is dealing with the credit it stretches out to clients. Also, terrible obligation cost accompanies charge suggestions.

When a bad debt expenditure is reported, it raises overall expenses and lowers net income. As a result, the amount of bad debt charges reported by a corporation will affect the amount of taxes paid within a given fiscal period. If the bad debt reserve has risen considerably, for example, the corporation may be extending credit to riskier clients, jeopardizing the company’s net income and cash flow. On the other hand, the corporation may be padding the bad debt reserve to make things appear worse than they are, in the hopes of improving future performance.

Information Sources: