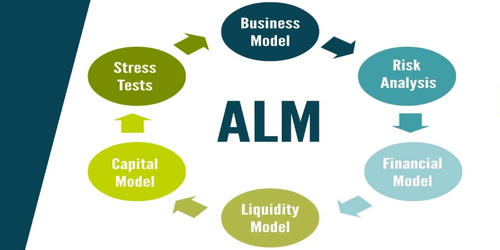

Asset and liability management (ALM) is the process through which an association handles its financial risks that may come with changes in an interest rate and which in turn would affect the liquidity scenario. ALM is the practice of managing financial risks that arise due to mismatches between the assets and liabilities as part of an investment strategy in financial accounting. It is the process of managing the use of assets and cash flows to reduce the firm’s risk of loss from not paying a liability on time. It is one of the main tools for evaluating financial risk and for periodic testing and preparation of financial policies. ALM can be termed as a risk management technique designed to earn an adequate return while maintaining a comfortable surplus of assets beyond liabilities.

Well-managed assets and liabilities increase business profits. ALM sits between risk management and strategic planning. It is focused on a long-term perspective rather than mitigating immediate risks and is a process of maximizing assets to meet complex liabilities that may increase profitability. This process is typically applied to bank loan portfolios and pension plans. It involves conscious decisions with regard to asset-liability structure in order to maximize interest earnings within the framework of perceived risk with quantification of risk. It also involves the economic value of equity.

ALM encompasses the process of managing Net interest margin (NIM), within the overall risk. ALM includes the allocation and management of assets, equity, interest rate and credit risk management including risk overlays, and the calibration of company-wide tools within these risk frameworks for optimization and management in the local regulatory and capital environment. The success of ALM hinges on the matching of assets and liabilities in terms of Rate and maturity to optimize the yield and maintain/improve the NIM. While the elimination of gaps arising due to mismatches is not possible, the ALM aims at minimizing the gaps as they are risk-prone and directly affect the NIM.

In banking institutions, asset and liability management is the practice of managing various risks that arise due to mismatches between the assets and liabilities (loans and advances) of the bank. Banks face several risks such as the risks associated with assets, interest, currency exchange risks. ALM is a tool to manage interest rate risk and liquidity risk faced by various banks, other financial services companies.

In practice, the assets and liabilities of a bank are continuously changing which affects interest cost and interest income. Often an ALM approach passively matches assets against liabilities (fully hedged) and leaves surplus to be actively managed. ALM risk is the potential loss in the value of an institution’s net asset value as a result of changes in market risk variables.