A price-weighted index (also known as PWI) is a type of stock market index in which each component of the index is weighted according to its current share price. The index’s value is calculated by summing the prices of each stock in the index and dividing by the total number of businesses. Companies with a high share price have a greater weight in price-weighted indexes than those with a low share price. A stock with a higher price will be assigned more weight than one with a lower price, having a bigger impact on the index’s performance.

The price-weighted index is a stock index in which the member firms are assigned based on or in proportion to the price per share of the corresponding member firm at a given point in time, and it aids in keeping track of the general health of the economy as well as its current state. It is a stock market index in which each constituent makes up a proportional amount of the index, and the value is proportionate to its component:

Adjustment Factor= Index specific constant “Z”/(Number of shares of the stock*Adjusted stock market value before rebalancing)

A price-weighted index can be used to track a market’s or industry’s average stock price. Price-weighted indices are less frequent than other indices these days. The capitalization-weighted index, on the other hand, is the most common type of market indexes. It’s a stock market index that weights firms’ equities based on their share price. This index is primarily influenced by higher-priced stocks, which are given more weight in the index regardless of the size of the company issuing the stock or the number of outstanding shares.

A price-weighted index is commonly criticized as a result of it considers solely the worth of every part because the driver of the index value. Therefore, even a little value fluctuation in a very higher priced company might considerably have an effect on the worth of the index. In a price-weighted index, a stock rising from $110 to $120 has the same impact on the index as a stock rising from $10 to $20, despite the latter’s much larger percentage change.

Stocks with lower prices have a less impact on the index. PWI is an arithmetic average of the prices of the securities that make up the index. A component’s weight is computed by dividing its price by the total price of all the components. Mathematically, it is expressed in the following way:

Weight = Pi / P1 + P2 + … + Pn

Find the sum of the individual company’s share prices and divide by the number of firms to get the value of a basic price-weighted index. In some averages, this divisor is adjusted so as to take care of continuity within the event of stock splits or changes to the list of corporations enclosed within the index. In theory, the worth of the index will be determined as AN arithmetic average by dividing the whole total of the costs of the elements within the index by the quantity of the index elements. However, because events like spinoffs, stock splits, and mergers impact the index’s composition, such a method is rarely recommended.

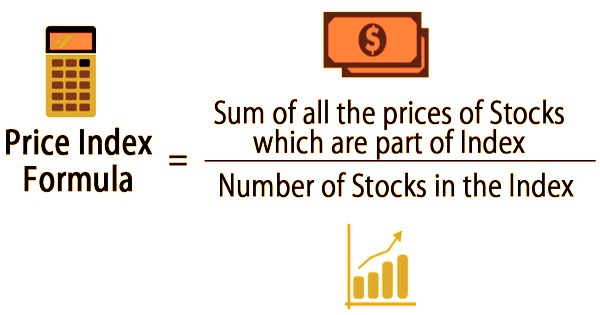

Price-Weighted Index (PWI) Formula:

PWI Formula = Sum of Members Stock Price in index / Number of members in the Index

Weight (i) = Price of Stock (i) / Sum of all the Members Prices

In reality, the worth of a price-weighted index is calculated by dividing the whole total of the costs of the index elements by the divisor. The divisor is AN impulsive worth computed by the index and adjusted for varied structural changes within the index elements. Because the index value will be equal to (or at least proportionate to) the average stock price for the companies included in the index, these indexes are useful. This permits indexes to be built that follow the average stock price performance of a certain sector or market.

The divisor should be modified whenever there are stock splits or dividends; otherwise, the index will not or will not be able to measure actual growth. As a result, stock splits are problematic. One of the foremost common price-weighted stocks is that the Dow Jones Industrial Average (DJIA), that consists of thirty totally different stocks, or parts. during this index, the higher-price stocks move the index quite those with lower costs, so the price-weighted designation. The Nikkei 225 is another example of a price-weighted index.

The price of a security or a stock alone cannot convey its full market value. It overlooks supply and demand market fundamentals. Other basic types of weighted indexes include value-weighted indexes and unweighted indexes, in addition to price-weighted indexes. It is straightforward to trace the health of the economy and therefore the current condition of the economy. It permits investors to form a call, and with the assistance of historical knowledge within the index, it offers a plan to investors however the market reacted to sure things within the past.

The price of a stock is multiplied by the number of shares outstanding to establish its weight in a value-weighted index. One of the most appealing features of the Price-Weighted Index is its simplicity; it is simple to compute and comprehend, and the weighing scheme is straightforward. In an unweighted index, all stocks, regardless of share volume or price, have the same impact on the index. The return % of each component determines how much the index changes in price. It’s worth noting that in a price-weighted index, the divisor changes over time to reflect the index’s present structure.

Information Sources: