The Modified Accelerated Cost Recovery System (MACRS) is the existing framework approved in the United States (U.S.) for calculating tax deductions for depreciable assets (other than intangible assets) attributable to depreciation. Depreciation by MACRS allows the capitalized cost of an asset to be recovered through annual deductions over a specified period. In the Internal Revenue Code, the lives are narrowly defined. The Internal Revenue Service (IRS) is publishing comprehensive tables of life by asset class. MACRS allows for a greater deduction in the early years and lowers deductions in later years compared with the straight-line process.

The modified accelerated cost recovery system (MACRS) allows for faster depreciation during the first years of the life of an asset and is actually slowing the depreciation. This is often beneficial to businesses from a tax perspective. The deduction for depreciation is computed under one in every of two methods (declining balance switching to line or straight line) at the election of the taxpayer, with limitations. There are two sub-systems of MACRS: the general depreciation system (GDS) and the alternative depreciation system (ADS). GDS is the most important and is the most commonly used asset.

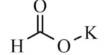

Formulas of MACRS:

Depreciation in 1st Year =

Cost × 1/ Useful Life × A × Depreciation Convention

Depreciation in Subsequent Years =

(Cost − Depreciation in Previous Years) × 1/ Recovery Period × A

Where,

A = 100% or 150% or 200%

Under MACRS a taxpayer may use defined lives and methods to measure tax deductions for the depreciation of tangible assets. Depreciation is a deduction from income tax, as specified by the Internal Revenue Service (IRS), which enables a company to recover the cost base of such goods. It is an annual allowance for the damage and tear, deterioration, or obsolescence of the property. Assets are divided into classes by form of asset or by business within which the asset is employed. Most tangible assets are depreciable.

Calculating depreciation under MACRS involves the following steps:

- Figure out the class of the property: Properties are divided into various classes depending on their useful life, and a period of recovery for each type of property is determined.

- Figure out the required depreciation convention: In order to simplify the measurement, the IRS has recommended whether an asset should be regarded as acquired by the middle of the month, quarter or year. These conventions are respectively called Mid-Month, Mid-Quarter, and Half-Year Conventions.

- Determine the depreciation method to be applied: Cost depreciation is paid on the basis of 3 different types of depreciation: declining balance of 150 percent, the declining balance of 200 percent, and the straight-line method.

The method and life utilized in depreciating an asset is an accounting method, change of which needs IRS approval. The modified accelerated cost recovery system (MACRS) is the proper depreciation method for many assets. MACRS accounts for more gradual depreciation over longer periods of time. Taxpayers, as in the old ADR system, which monitor the basis and cumulative depreciation of assets individually or on vintage accounts. Where assets are recorded in vintage accounts, typically a first-in-first-out rule is applied to determine the basis of the retired assets.

MACRS is useful since faster acceleration allows individuals and businesses to deduct greater amounts during the primary few years of an asset’s life, and comparatively less late. Additional depreciation deductions are permitted at different times to promote investment. MACRS depreciation can be attributed to properties like computer equipment, office furniture, vehicles, walls, farm buildings, racehorses, etc. Under the Alternative Depreciation System (ADS), certain properties must be depreciated using specified lives and the straight-line method. It may be applied at the election of the taxpayer in lieu of regular depreciation.

The basis for MACRS property depreciation is the cost base of the land, compounded by the percentage of business/investment usage. Account depreciation is measured as if the account as a whole was one asset. The amount derived is recognized within the company’s tax return and accustomed to determine taxable income by factoring in any tax credits and deductions that may be claimed on the property. Proceeds from disposition of a depreciable asset in a multiple asset portfolio are treated as ordinary income under default law, and depreciation on the portfolio is not affected by the retirement.

Information Sources: