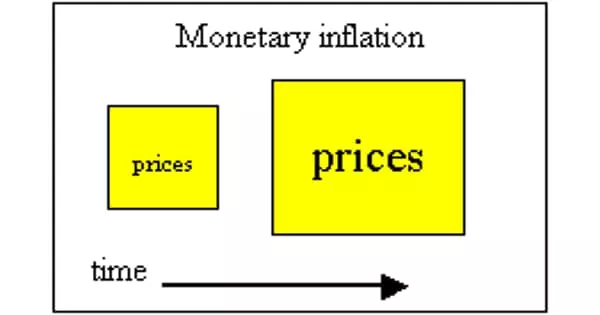

Inflation is a phenomenon of continuous rise in the general price level of goods and services. Inflation is not a rise in the prices of one or just few goods, and it is also not a just one-time rise in the prices of most commodities. During inflationary periods, prices of few goods may fall, but prices of most goods rise. It occurs when prices rise, and deflation is when prices fall. You can have both inflation and deflation at the same time in various asset classes.

It can also be defined as a decline in the value or purchasing power of dollar. If the supply of dollar (money) rises faster than the supply of goods and services in the country, one would expect a decline in the value of dollar. Thus, an increase in money supply can be a reason of inflation. But, there may be other reasons too. If the demand for goods and services continuously rises faster than their supply, prices of goods and services shall rise too. This is called demand-pull inflation. On the other hand, a continuous fall in supply of goods and services or a continuous rise in cost of production pushes up the general price level. This is called cost-push inflation.

Consumer Price Index (CPI)

For measuring inflation, an aggregate representation of prices of commodities is needed. Such a general price level is represented through a price index; GDP deflator is one such price index that we briefly introduced in an earlier chapter. There are other price indices also, most notably the Consumer Price Index (CPI) and the Producer Price Index (PPI).

Hyperinflation

Hyperinflation is a run-away or “out of control” inflation, a very rapid and high growth rate of prices. There is no universally accepted cut-off rate of inflation for hyperinflation. Some economists consider 50 percent or higher monthly inflation as hyperinflation, whereas some other economists consider an annual inflation rate of 200% or more as hyperinflation.

Causes

There are three causes of inflation. The first, demand-pull inflation, occurs when demand outstrips supply. The second is cost-push inflation, which is when the supply of goods or services is restricted, while demand stays the same. For example, since there is a shortage of highly skilled software engineers, their wages skyrocket.

The third, overexpansion of the nation’s money supply, is when too much capital chases too few goods and services. It’s caused by too-expansive fiscal or monetary policy, creating too much liquidity.

Deflation is usually caused by a drop in demand. Fewer shoppers mean businesses have to lower prices, which can turn into a bidding war. It’s also caused by technology changes, such more efficient computer chips. Deflation can also be caused by exchange rates.

Effect of Inflation

People engaged in the business of lending and borrowing generally spend time and other resources in predicting inflation, to form a judicious anticipation of future inflation to appropriately determine nominal interest rate. In a world of low or no inflation, scarce resources do not need to be wasted in such predictions. Therefore, controlling inflation is often an objective of macro policy makers.

Suppose nominal interest rate in a transaction is fixed at 8%, expecting inflation rate of 3% and to have a real interest rate of 5%. But, if actual inflation during the period of lending/borrowing exceeds the expected rate, the actual real interest rate earned by the lender would be lower than 5%. The lender thus loses, whereas the borrower gains, whenever actual inflation is higher than expected. On the other hand, borrower loses and lender gains when actual inflation is below the anticipated rate. Thus, unanticipated inflation redistributes income between lenders and borrowers.

If unanticipated inflation tends to remain high and uncertain, lenders may hesitate from lending, which may retard investment in the economy, because investment often is carried out with borrowed funds. Instead, people start accumulate assets in the form of gold, real estate, and such other real goods to protect themselves from unanticipated inflation.

Information Source: