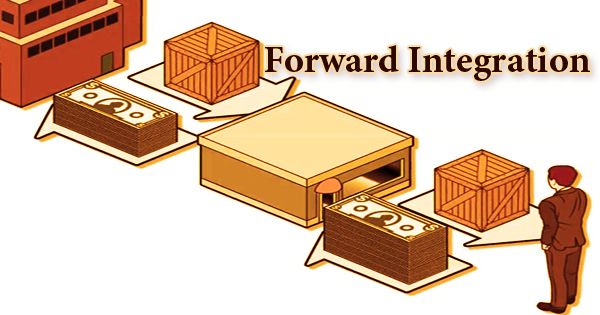

Forward integration is a form of vertical integration that stretches to the next stages of the supply chain, aimed at reducing the cost of production and improving the company’s effectiveness. It is a business procedure that includes a type of downstream vertical mix whereby the organization possesses and controls business exercises that are ahead in the worth chain of its industry, this may incorporate among others direct dispersion or supply of the organization’s items. Essentially, by acquiring or combining with business organizations that were its clients, a corporation undertakes forward integration while still retaining leverage of its original business. All in all, it’s a business technique where a firm replaces outsider dispersion or supply directs with its own in an impact to combine activities, lessen costs, and become a bit nearer to the end buyer.

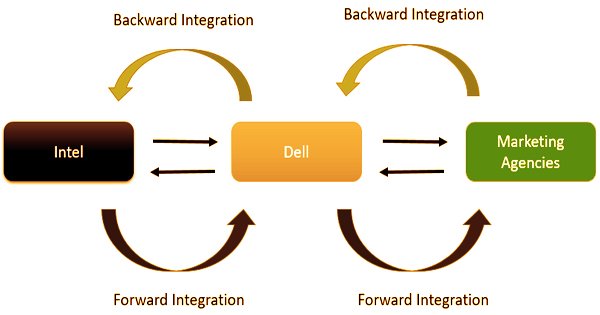

The idea of forwarding integration is inherently connected to the supply chain concept. The major components of the supply chain in many industries include raw materials, intermediate products, processing, marketing and distribution, and after-sales service. Practically speaking, organizations can settle on forward and in reverse incorporation to acquire an upper hand over their rivals. This encourages a business to expand its market reach, allowing it to gain control of the demand side; on the opposite, backward integration enables the business to gain control of the supply side.

Example of Forward Integration

A farmer who sells his crops directly at a local grocery store rather than at a distribution center that manages the location of foodstuffs in different supermarkets will be a good example of forwarding integration. Or, a clothing label that opens its own boutiques, instead of or in addition to selling them to department stores, selling its designs directly to consumers.

Forward integration is something contrary to in reverse coordination, which is a technique of procuring the organizations that were before the providers for the business looking for more reconciliation. The industry is typically made up of five stages in the supply chain, namely raw materials, intermediate products, production, marketing and distribution, and after-sales service. If a business decides to adopt this method, it must step ahead in the supply chain while also maintaining ownership of its original position. This coordination is done to accomplish more noteworthy economies of scale, a higher piece of the pie, or more prominent power over-dispersion.

Forward integration typically helps businesses to retain earnings while minimizing profit losses for intermediate organizations. It is possible to execute the strategy for numerous reasons, including:

- Increase the company’s market share: By implementing a forward integration strategy, a business can increase its market share. The technique usually reduces different transaction and transportation costs. This results in a lower final price for the commodity of the business subsequently. Thus, by lower commodity costs, a business can gain a higher market share.

- Gain control over distribution channels: The strategy is used by a corporation if it wants to maintain leverage of distribution networks in its business. For businesses operating in industries that lack skilled distributors or in circumstances where distributors charge substantial costs, control is essential. Power over distribution networks guarantees a company’s strategic independence from third parties.

- Competitive advantage: Effective execution of the plan could provide a business with a competitive advantage over its rivals. In achieving a competitive edge, lower costs and more leverage over industry distribution networks may become key factors.

- Create barriers to potential competitors: The inclusion of organizations forwarding the output of the business vertically enhances its role in the market and creates barriers for potential competitors. For example, if a business involves a large retailer in the market, possibly rivals may face restricted access to distribution networks.

Frequently alluded to as “removing the broker,” forward mix is an operational technique executed by an organization that needs to build authority over its providers, makers, or wholesalers, so it can expand its market power. Forward integration, considering its advantages, can also involve some risks for a business that wishes to follow the strategy. The following are some of the risks associated with the strategy:

- Bureaucratic inefficiencies: As a result of the expanded bureaucratic apparatus of the new business entity, merger and acquisition deals related to forward integration can generate various inefficiencies.

- Failure to realize synergies between the companies: A business can fail to understand synergies between the involved entities in the forward integration strategy. One of the reasons for the unrealized synergy potential may be the improper implementation of the strategy.

- High costs: Substantial funds may be needed to conduct mergers or acquisitions necessary for undertaking forward integration. A business must be confident that its expenses would outweigh the profits from adopting the strategy.

In contrast to the regressive incorporation, which stretches out to the past levels of the production network, the forward joining is a component for supporting an association’s benefit while maintaining a strategic distance from spillage of benefits to delegates. For a forward integration to be fruitful, an organization needs to acquire responsibility for organizations that were once clients. This method differs from the backward integration in which a corporation aims to expand control of businesses that once were its suppliers. As a consequence of the company’s access to more distribution outlets, the beneficial outcome of this merger is higher profit margins due to improved revenue. Moreover, the firm receives more adaptable creation measures, accordingly expanding its piece of the overall industry and acquiring an upper hand.

For a corporation, the aim of forward integration is to step forward in the supply chain, increasing its overall industry ownership. Five phases in the supply chain are made up of traditional industries: raw materials, intermediate products, processing, marketing and distribution, and after-sales service. Moreover, the firm receives more adaptable creation measures, accordingly expanding its piece of the overall industry and acquiring an upper hand.

When to Follow Forward Integration?

- When the new distributors, as well as the retailers, are costly and are unable to satisfy the company’s distribution needs.

- The lack of quality distributors on the market allows the company to gain a competitive advantage over its rivals.

- If the business has enough manpower such as human resources and the financial benefit to meet the sales channel expenses.

- If the company has very strong manufacturing facilities to meet the customers’ demand. In this situation, it would help to improve the supply chain of the organization, from manufacturing to distribution and product service.

- With the aid of this incorporation, since current retailers and distributors have a higher profit margin, which raises the cost of the product and contributes to the higher price of the product, the business will reduce the distribution cost; thus, the product price would be lower, thereby increasing profits.

Organizations ought to know about the expenses, and degree related with a forward integration. They should possibly take part in such a system if there are money-saving advantages and if the mix won’t weaken its present center skills. It is often more efficient for a business to rely on other vendors’ proven expertise and economies of scale, rather than expanding on its own. The main advantages of forward integration are higher growth opportunities and greater control over delivery. By disposing of outsiders, the firm acquires responsibility for conveyance measures, in this manner having an expanded command over the progression of its items. In the long run, the firm can expand its possible markup and client esteem.

Information Sources: