The Exchange Stabilization Fund (ESF) is a US Treasury Department emergency reserve fund that is typically used for foreign exchange intervention. It can be used to reduce risk in a variety of financial markets, including credit, shares, and foreign exchange. Rather than making the central bank interfere directly, this arrangement enables the US government to control currency exchange rates without impacting the domestic money supply.

All in all, the Secretary of the Treasury can just go through cash that has been appropriated by Congress. Yet, with the assent of the President, the Secretary has generous slack to utilize the cash in the Exchange Stabilization Fund (ESF) that Congress made in the Gold Reserve Act in 1934. After the United States abandoned the gold standard, the Act created the ESF as a reserve to help support the dollar in the event of foreign currency market turbulence. The fund had $105 billion in assets as of October 2009, including $58.1 billion in special drawing rights (SDRs) from the International Monetary Fund (IMF).

The ESF is, overwhelmingly, involved three sorts of monetary instruments, in particular the U.S. dollar (USD), unfamiliar monetary forms, and extraordinary drawing rights. The depository has generally utilized it loan to different economies near the very edge of default for instance, to settle Mexican government obligation in the 1994-peso emergency. The Act states that “the Secretary…with the approval of the President, can deal in gold, foreign exchange, and other instruments of credit and securities.” It was amended in the late 1970s.

The ESF started operations in April 1934, funded with $2 billion of the government’s $2.8 billion paper benefit from raising the price of gold from $20.67 to $35 an ounce. The demonstration approved the ESF to utilize its money to bargain in gold and unfamiliar trade to settle the trade worth of the dollar. The asset as initially planned was important for the presidential branch not expose to administrative oversight. The ESF was used to help stabilize financial markets during the 2008 financial crisis and the 2020 COVID-19 Crisis.

The Gold Reserve Act allowed the ESF to deal in government securities with reserves that were not required for exchange market stabilization. The Fund, on the other hand, lacked legislative authority to participate in other operations, which it started to do. The chief such incidental movement it gave itself to was loaning dollars to politically preferred governments. The ESF could be used by the US Treasury if it wanted to interfere in the foreign exchange (FX) market to control exchange rates and foster stability in both foreign and domestic currencies.

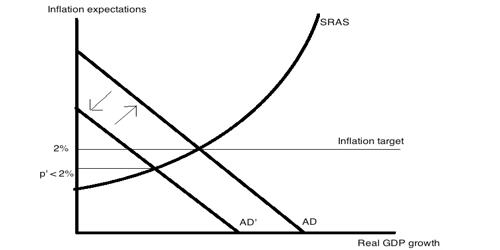

The Treasury is utilizing the ESF as a stopping board to cover any misfortunes the Federal Reserve may cause through loaning programs made to adapt to the emergency. For instance, because of the interconnected idea of the worldwide money market, instability in one cash can immediately spread, and the ESF can be utilized to subdue this unrest. Interventions are usually the domain of central banks, but the ESF enables the US Treasury to participate in what amounts to an interference without having to obtain congressional approval. Harry Dexter White, the director of the Division of Monetary Research, worked on a proposal for loans to Latin America in 1938–40 and was involved in proposals for an Inter-American Bank that never materialized. However, White’s first draft of the subsequent proposals for the International Monetary Fund and the World Bank, which he prepared in 1941 under the guidance of US Treasury Secretary Henry Morgenthau, was influenced by the Inter-American Bank program. Franklin D. Roosevelt financed it through the Emergency Banking Act of 1933, and Archie Lochhead was its first Director.

One of the essential highlights of the ESF is that it incorporates SDRs, which is a worldwide money related save pseudo-cash made by the International Monetary Fund (IMF) in 1969 from a crate of driving public monetary standards and upheld by the full confidence and credit of the part country’s legislatures. If the need to stabilize exchange rates arises, the US Treasury will be able to cooperate with the IMF. The Treasury agrees to cover losses on the Fed’s emergency lending by supplying funds from the ESF. The taxpayers are responsible for any losses.

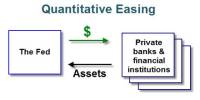

In 1970, a reform in the law enabled the Secretary of the Treasury to use money in the ESF to “trade in gold, foreign exchange, and other instruments of credit and securities” with the President’s approval. The Treasury can change over SDR assets into dollars by trading them with the Federal Reserve (FED), the national bank of the U.S. SDR might be traded for USD, gold, or other worldwide stores held by the FED. Most national banks will keep a stockpile of worldwide stores, which are reserves that the banks can pass among themselves to fulfill worldwide necessities.

The Treasury used funds from the ESF to briefly guarantee deposits in some money market mutual funds in 2008, at the height of the financial crisis. Since none of the money market funds defaulted in the end, the ESF incurred no losses as a result of the scheme. In reality, fees brought in $1.2 billion for the program. Congress along these lines restrict the utilization of the ESF for this reason. Under direct approval by the secretary of the Treasury, and with the endorsement of the leader of the U.S., the ESF can purchase or sell unfamiliar monetary standards and help with financing unfamiliar governments through transient credits.

Following Mexico’s 1994 economic crisis, the US government used the fund to include $20 billion in currency swaps and loan guarantees. At the time, this was a contentious issue because President Clinton had tried and struggled to get the Mexican Stabilization Act passed through Congress. The ESF was used to get around the need for legislative approval. However, because a Republican-controlled Congress refused to appropriate the funds, Treasury Secretary Robert Rubin opted to use the ESF. The step sparked debate and was closely scrutinized by the House Committee on Financial Services in the United States.

In 2008, the Treasury Department vowed assets from the ESF to safeguard the currency market shared asset market, which had endured a sudden spike in demand for the asset following the breakdown of venture bank Bear-Stearns. The US Treasury Department declared on September 19, 2008 that up to $50 billion in the ESF would be made temporarily available to guarantee deposits in some money market funds. Money market mutual funds that participated in the investment scheme were required to pay a premium, which helped improve investor morale and stabilize the market for money market mutual funds.

In response to the COVID-19 pandemic, Congress temporarily allowed the Treasury to use the ESF to stabilize money market mutual funds on March 25, 2020. The ESF offered $454 billion in initial funding to the Main Street Lending Facility, the Municipal Liquidity Facility, the Primary and Secondary Market Corporate Credit Facilities, and the Term Asset-Backed Securities Lending Facility, which the Federal Reserve leveraged into approximately $4 trillion in lending capacity.

Information Sources: