Definition of Demand-Pull Inflation –

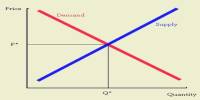

Demand-pull inflation could be a term won’t describe when prices rise because the mixture demand in an economy is bigger than the combination supply. This imbalance essentially ends up in an excessive amount of money chasing too few goods and services. For instance, when many individuals try to buy a brand new gaming system or a brand new Smartphone that’s limited in quantity, the value will usually rise. When this happens across the complete economy for several different goods and services, rising prices may result.

In simple terms, ‘Demand-Pull Inflation’ is a type of inflation that occurs when aggregate demand for products and services outruns aggregate supply due to monetary factors and/or real factors. The increase in aggregate income results in an increase in aggregate demand for goods and services, causing demand-pull inflation.

Definition of Cost-Push Inflation –

Cost-push inflation means the rise within the general index number caused by the increase in prices of the factors of production, because of the shortage of inputs i.e. labor, stuff, capital, etc. It ends up in the decrease within the supply of outputs which mainly use these inputs. So, the increase in prices of the products emerges from the availability side.

To understand this definition, we must understand the aggregate supply. Aggregate supply is defined as “the total volume of the products and services produced in a very country” or the provision of products. To place it simply, when the availability of products decreases as a result of a rise within the cost of production of these goods, we get cost-push inflation. As such, cost-push inflation is thought of like this: prices for consumers are “pushed up” by increases in cost to supply. Essentially, the increased production costs are passed along to the consumers.

Key Differences between Demand-Pull and Cost-Push Inflation –

The differences between Demand-pull and cost-push inflation can be drawn clearly on the following grounds:

- Demand-pull inflation is most likely to occur when an economy is becoming stretched and is said to be the danger of over-heating. This is often seen towards the end of a boom when output I expanding beyond the economy’s usual capacity to supply, the result being higher prices and also a larger trade deficit.

- Cost-push inflation occurs when businesses respond to rising costs, by increasing their prices to protect profit margins. The reasons why cost might rise are an increase in prices of raw materials and components, rising labor costs, higher indirect taxes imposed by the government; for example, a rise in the price of petrol/diesel or a rise in the standard rate of Value Added Tax and a fall in the exchange rate.

- Demand-pull inflation arises when the aggregate demand increases at a faster rate than aggregate supply. It describes how price inflation begins?

- Cost-Push Inflation is a result of an increase in the price of inputs due to the shortage of cost of production, leading to a decrease in the supply of outputs. It explains Why inflation is so difficult to stop, once started?

- If the demand for a product increases for whatever reasons and the supply of the product is not able to keep pace with the demand then the seller will try to increase his margin taking advantage of the shortage, this hike in the sale price is known as Demand-Pull Inflation.

- If the price of a product goes up because the price of the raw materials, manufacturing process or the expenses on sales like transmission and distribution or taxation goes up then it is cost-push inflation.

- The reason for demand-pull inflation is the increase in money supply, government spending, and foreign exchange rates.

- Cost-push inflation is mainly caused by monopolistic groups of society.

- Demand-pull inflation is like performing a deadlift. People have to “pull” or “lift” the weight (read price) upwards.

- Whereas cost-push inflation is like performing a weighted barbell squat. People “push” the bar (price) upwards!

- The policy recommendation on demand-pull inflation is associated with the monetary and fiscal measure which amounts to the high level of unemployment.

- The cost-push inflation policy recommendation is related to administrative control on price rise and income policy, whose objective is to control inflation without increasing unemployment.

- In modern economies with fiat currency and central banks running monetary policy, all inflation is demand-pull inflation. Many people confuse real supply and real demand for inflation, but inflation may be a nominal phenomenon, not a true phenomenon. And also the nominal economy is controlled by the financial organization, through its management of the money supply.

- “Cost-push” is an old, outdated, and discarded notion of how inflation happens. Especially before fiat currency, there was a theory that the inputs to production could become costlier, and maybe these higher costs would be passed along at each stage until consumers paid the ultimate higher prices. But this can be not actually how modern inflation works.

Therefore, we will conclude with the above discussion the most reason for causing inflation within the economy is either by demand-pull or cost-push factors. It’s often argued that which is that the supreme factor for inflation, which one among the two-factor causes rises within the general index for the primary time. Experts hold that demand-pull factor the leading factor for inflation in any economy.

Information Sources: