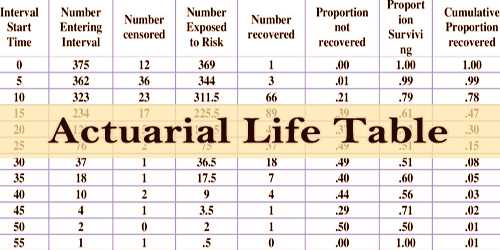

An actuarial life table is a table that indicates the likelihood of a person of a particular age dying before their next birthday. It is also used by life insurance firms. The tables are in spreadsheet form and basically show the likelihood of death within a population for each age group. These statistics calculate the remaining life for people at different ages and stages, and also the probability of surviving a selected year old. In the long term, in terms of their lifespan until death, the table can also be used to mathematically illustrate the calculation of the longevity of a population.

Since there are different death rates for men and women, an actuarial life table is calculated for men and women separately. A death table, life table, or actuarial table is sometimes called an actuarial life table. Demographers such as Graunt, Greville, and Keyfitz played a part in the creation of the tables, as actuarial life tables require the intertwining of actuarial science and demography. Insurance companies use actuarial life tables to help value items and task future protected occasions. It is critical to take note of that actuarial life tables can likewise be referred to just as life tables or mortality tables, and they can be separated into two unique sorts’ period life tables and cohort life tables.

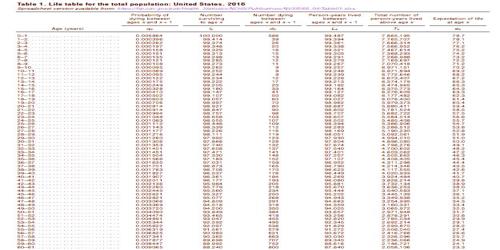

Examples of Actuarial Life Table

Actuarial life tables, mathematically and statistically oriented, support insurance providers by displaying the probability of incidents such as death, illness, and disability. Actuarial life tables can be built by using estimates of potential mortality rates, but usually, they are generated with mortality rates from the recent past that are age-specific. Thus, one can deduce that the life tables are based on existing standards in medicine and protection. An actuarial life table can likewise incorporate elements to separate variable dangers, for example, smoking, occupation, financial status, and in any event, betting, and obligation load.

Without consideration of immigration and emigration, the tables are created so they would preferably look at a particular population within a closed demographic structure. Computerized statistical modeling facilitates the ability to calculate for a wide range of situations and possible results for actuaries. It’s interesting to notice that life tables are typically created separately for men and women thanks to their variance in mortality rates. Moreover, life tables are intertwined with additional information like health information and health expectancy.

Actuarial science uses primarily two types of life tables.

Period life table: The cycle life table, also known as a static life table, displays the mortality rates for a given population for a given time span. It indicates, therefore, the current likelihood of death. Interestingly, individuals are thought to be a stationary population with overlapping generations for static life tables.

Cohort table: It is called the cohort life table, also named as a generation life table. it’s accustomed to represent the mortality rates of a specific population’s entire lifetime. Additionally, the cohort life table takes precedence because it provides the flexibility to research patterns within mortality rates over a period of our time. More generally, a cohort life table is used because it aims to forecast any expected change in a population’s mortality rates in the future. It is important to remember that data can be built for the cohort life tables only by the use of data up to the current point and mortality estimates in the future.

Both varieties of actuarial life tables are supported actual populations of this and educated predictions of a population’s near future. Other styles of life tables could also be supported by historical records. These forms of life tables often undercount infants and understate infant mortality rates. Inside actuarial life tables, it is important to emphasize certain flaws and assumptions. Second, they do not recognize the population’s general wellbeing. Secondly, immigration and emigration are not regarded. If globalization progresses, the capacity of life tables to estimate future mortality rates would be impacted by emigration and immigration. Thirdly, men and women are divided by it.

Insurance companies use actuarial life tables to primarily make two styles of predictions: the probability of surviving any particular year old and therefore the remaining anticipation for people of various ages. Actuarial tables of life are relevant for numerous reasons. It also plays an essential role in biological and epidemiological sciences. It is crucial because, based on mortality rates, it will help to predict future populations. In product life cycle management, actuarial life tables are also relevant. In addition, it can be used to help forecast populations or demographics and to help nationally or globally compare outcomes.

Information Sources: