Relationship Between the Borrowers and the Employees of Grameen Bank

In this report I have tried to discuss and define all of the major activities related with to Relationship Banking of Grameen Bank (GB). In this report I have chosen to evaluate the relationship activities with the borrowes of Grameen Bank. The key purpose of the report has been to identify overall condition of Relationship Banking of Grameen Bank.

By identifying the overall condition and process of doing microcredit business with the poor people in villages I can relate my theoretical knowledge to practical implications. Grameen Bank is actually providing service to the poor people(specially women) to develop there current financial condition and also try to remove poverty from Bangladesh and I found that GB is providing good better service to the people with whom they are doing business by maintaining a good relation and also they are very dependable among those people. As a result, GB is thinking to expand their service more widely. For this instance GB is taking necessary steps to cope up with the stream of competition.

To conclude, Grameen Bank is has broad network with the different countries around the world. And in near future they might remove the majority of poverty from Bangladesh.

Background

Grameen Bank is one of the oldest Banks operating in Bangladesh. The Grameen Bank is a Nobel Peace Prize winning: micro-finance organization and community development bank started in Bangladesh that makes small loans (known as micro-credit) to the impoverished without requiring collateral. The name Grameen is derived from the word gram which means “rural” or “village” in the Bengali language.

The system of this bank is based on the idea that the poor have skills that are underutilized. A group-based credit approach is applied which utilizes the peer-pressure within the group to ensure the borrowers follow through and use caution in conducting their financial affairs with strict discipline, ensuring repayment eventually and allowing the borrowers to develop good credit standing. The bank also accepts deposits, provides other services, and runs several development-oriented businesses including fabric, telephone and energy companies. Another distinctive feature of the bank’s credit program is that the overwhelming majority (98%) of its borrowers are women.

The origin of Grameen Bank can be traced back to 1976 when Professor Muhammad Yunus, a Fulbright scholar at Vanderbilt University and Professor at University of Chittagong, launched a research project to examine the possibility of designing a credit delivery system to provide banking services targeted to the rural poor. In October 1983, the Grameen Bank Project was transformed into an independent bank by government legislation. The organization and its founder, Muhammad Yunus, were jointly awarded the Nobel Peace Prize in 2006.

Specific Objectives of this report

It is not possible to carry out a research to figure out the overall effect of Relationship banking on Customer loyalty of Grameen Bank, which will need more resource and time. So, I narrow down the topic and now it stands that “The Effect of the Relationship Banking on Borrowers and Customer Loyalty of Grameen Bank in micro-credit Banking Sector”.

- To find out the effect of Grameen Bank Relationship Banking on borrowers and Customer loyalty in microcredit Banking Sector.

- To find out the perception of the borrowers and the Customer about the Grameen Bank service.

- Measure the importance of Relationship Banking in this industry.

Methodology:

Data source:

Data for this report has been extracted from primary sources as well as secondary sources. I have used three techniques of Primary Resources for my research and they are as followed:

Primary Data Collection:

- Personal observation.

- Face to Face Interviews.

- Practical Work.

Secondary Data Collection:

To complete my report along with primary data need some secondary data related with my topic. Relevant literature like published and unpublished thesis, books, reports of Grameen Bank etc have been reviewed with a view to increase the knowledge and regarding the issue. Above all the storehouse of knowledge, “the internet” will also be big part of the literature review. Majority of the data will be collected from Annual Report, brochures, Grameen Bank official web sites.

Name and Location of the Company:

Muhammad Yunus, the bank’s founder managing director, earned a doctorate in economics from Vanderbilt University in the United States. He was inspired during the terrible Bangladesh famine of 1974 to make a small loan of US$27.00 to a group of 42 families so that they could create small items for sale without the burdens of predatory lending. Yunus believed that making such loans available to a wide population would have a positive impact on the rampant rural poverty in Bangladesh.

The Grameen Bank (literally, “Bank of the Villages”, in Bengali) is the outgrowth of Yunus’s ideas. The bank began as a research project by Yunus and the Rural Economics Project at Bangladesh’s University of Chittagong to test his method for providing credit and banking services to the rural poor. In 1976, the village of Jobra and other villages surrounding the University of Chittagong became the first areas eligible for service from Grameen Bank. The Bank was immensely successful and the project, with support from the central Bangladesh Bank, was introduced in 1979 to the Tangail District (to the north of the capital, Dhaka). The bank’s success continued and it soon spread to various other districts of Bangladesh. By a Bangladeshi government ordinance on October 2, 1983, the project was transformed into an independent bank. Bankers Ron Grzywinski and Mary Houghton of Shore Bank, a community development bank in Chicago, helped Yunus with the official incorporation of the bank under a grant from the Ford Foundation. The bank’s repayment rate was hit following the 1998 flood of Bangladesh before recovering again in subsequent years. By the beginning of 2005, the bank had loaned over USD 4.7 billion and by the end of 2008, USD 7.6 billion to the poor.

The Bank today continues to expand across the nation and still provides small loans to the rural poor. By 2006, Grameen Bank branches numbered over 2,100. Its success has inspired similar projects in more than 40 countries around the world and has made World Bank to take an initiative to finance Grameen-type schemes.

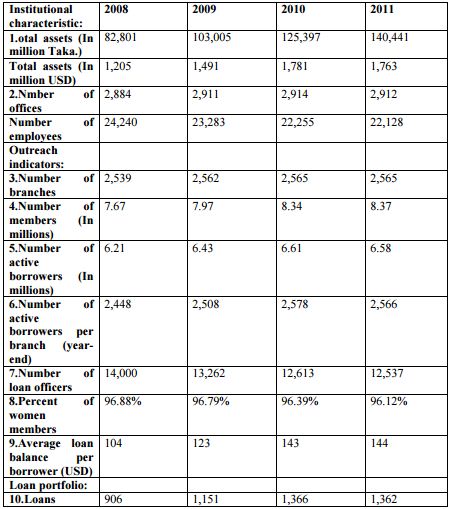

The bank gets its funding from different sources, and the main contributors have shifted over time. In the initial years, donor agencies used to provide the bulk of capital at very cheap rates. In the mid-1990s, the bank started to get most of its funding from the central bank of Bangladesh. More recently, Grameen has started bond sales as a source of finance. The bonds are implicitly subsidised as they are guaranteed by the Government of Bangladesh and still they are sold above the bank rate. Below there is a look at a glance of Grameen Banks Performance Indicators & Ratio Analysis till December 2011.

Grameen Bank

Performance Indicator till December 2011 from 2008

What Is Microcredit:

The word “microcredit” did not exist before the seventies. Now it has become a buzzword among the development practitioners. I think this is creating a lot of misunderstanding and confusion in the discussion about micro-credit. We really don’t know who is talking about what. I am proposing that we put labels to various types of micro-credit so that we can clarify at the beginning of our discussion which micro-credit we are talking about. In my view micro-credit is, the lending of very small amounts of money at low interest, especially to a start-up company or self-employed person. It is also called microlending.

Difference between Grameen Bank and Commercial Bank.

GB does not require any collateral against its micro-loans. Commercial banking is No Collateral based on collateral, the principle that the more you have, the more you get. Grameen methodology is not based on assessing the material possession of a person. While commercial banks look at what has already been acquired by a person, Grameen looks at the potential that is waiting to be unleashed in a person.

Since the Grameen does not wish to take any borrower to the court of law in case of No Legal Instrument non-repayment, it does not require the borrowers to sign any legal instrument. There is no stipulation that a client will be taken to the court of law to recover the loan, unlike in the conventional system. Commercial banks go into punishment mode when a borrower is taking more time in repaying the loan than it was agreed upon. Grameen Bank allows such borrowers to reschedule their loans without making them feel that they have done anything wrong.

- Branches in the Rural Area

‘Grameen’ means “rural” or “village” in Bangla. Grameen Bank branches are located in the rural area, unlike the other commercial bank which tries to locate themselves as close as possible to the business districts and urban centers. First principle of Grameen is that the clients should not go to the bank, it is the bank which should go to the people instead. Grameen Bank has 2,565 branches,works in 83,566 villages with 22,128 staff.

Government of Bangladesh has fixed interest rate for government-run micro-credit programmes at 11% at flat rate. It amounts to about 22% at declining basis. Grameen’s interest rate is lower than government rate. There are four interest rates for loans from GB : 20% for income generating loans(so-called “Basic Loan”), 8% for housing loans, 5% for student loans, and interest-free loans for beggars. All interests are simple interest, Low Interest Rates calculated on declining balance method. If a borrower takes a basic loan, and pays back the entire amount within a year in weekly installments, borrower will pay a total amount of principle, and equivalent to 10% interest for the year.

Grameen Bank Methodology

Basic unit of the Grameen system is the group, and the group is organized based on following criteria.

Group

1) Must be poor. You must own less than 50 decibel of land, and must own less than 1500TK value of asset. In general, GB define it as “Landless & Assetless”

2) You must gather at least 5 members to form Group (Minimum 5~Maximum 10).

3) Members must not be blood-related.

4) Group members must have permanent residence of locality and neighboring each other, and they must be in similar mentality and economic situation.

If the group is organized, they elect 1 person as a chairman, and 1 person as a secretary.

Term of service is 1 year, so every member can be the chairman.

Chairman represents her/his group. She/He consists of counting and collecting money from group members, and raises any issues that her/his group has encountered: in terms of repayment, illness etc. When the group first joined in GB, they must complete seven consecutive days training course(without holiday). During this course, GB’s center manager teach them discipline(sixteen decisions, meeting schedule time etc.), how to sign their name, how to save the money etc. And they also introduce the products of GB.

Every day, group member must take at least 10TK to learn how to save the money.

- Center

Center consist of 8~10 groups. And they have meeting once a week(before noon) for loan installment, savings, and communication. It is called “Center Meeting”. Center meeting is the place where the borrowers and the center manager get together. There are center leader in the center, who represents the center.

Center Leader’s Duty

1) Discipline and motivate center members

2) Supervise check loan utilization.

3) Propose for loan on behalf of the members.

4) Sign on a loan proposal form which will be given to center manager.

5) Take care of total center in all regards.

It is almost similar to Group chairman’s task, but there are two differences between chairman and leader. First, center leader have authority to propose for loan on behalf of the center member. Second, she/he signs on a loan proposal form.

<Function of Center as a whole>

- To ensure the financial possibility that has been created through GB among the borrowers, the center must work to make sure the discipline and to make them hardworking, interacting. First duty of the center will be to create a balance and healthy atmosphere in center that can help the borrowers in all regards.

- The center must be attempt to create awareness of the borrowers so that they can be self-motivated, interactive among the groups, and the groups can utilize their loan properly and repair very well.

- The center will help the borrowers to make themselves productive, and to find new sources of income, and in this case, the borrowers will help other borrowers in case of transportation, marketing, and getting a standard of market price.

- If there is a problem in the center, they will try to solve themselves.

- The group leader and the conter leader will be communicating with bank all the time, and they will help the bank in all respect.

- If there is any beggar in locality, the center will find them out, and manage to get loan for him/her and try to make his/her life productive.

- Branch

Branch is the place where the actual loan task is occurred. People who want to get a loan, propose to center manager at the center meeting. Center manager fills up form and submit to the branch manager. Then, branch manager visits the house of the member to review his qualification. If he is eligible to get a loan, the loan proposal form goes to area.

After approval of area manager, the work is finally done. After these processes, branch manager finally fills up <Loan Disbursement Ledger>.

Loan installment and saving deposit working take place in center, but the branch is the essential core of micro-financing.

<Viability of Branch>

- Well-Motivated & Disciplined staff.

- Well-Motivated & Disciplined borrowers.

- Planning and Monitoring to maintain right number of members

– Need to replace leaving member

– Loan utilization checking

– Supervise all the time

- Process of Loan – 3 steps to loan proposal making

Step 1. First, people who want to get a loan discuss with the group member. If all group member agree, group chairman propose it to center leader. Then, center leader propose to center manager in behalf of center member at the next center meeting.

Step 2. Center manager fills up form and submit to the branch manager.

Step 3. Form goes to the area. Program officer verify the form and check eligibility, then Area manager approve the loan.

All the process from step 1 to step 3 take a week.

- Struggling Members Programme

Struggling Member Loan is one of the loan product from Grameen. However it is not only finance loaning, but also social work. It started from July 2002, as countermeasure for begging. Begging is the last resort for survival for a poor person, unless they return into crime or other forms of illegal activities. Among the beggars, there are disabled, blind, and retarded people, as well as old people with ill health.

Objective of this program is to provide financial services to the beggars to help them find a dignified livelihood, send their children to school and graduate into becoming regular Grameen Bank members. About 108,741 beggars have already joined the program. Total amount disbursed stands at 124.81millionTK. Of that amount of 91.60millionTK has already been paid off.

- Basic features of the program are :

– Existing rules of GB do not apply to beggar members; they make up their own rules.

– All loans will be interest-free. Loans can be for very long term, to make repayment installments very small. For example, for a loan to buy a quilt or a mosquito-net, many borrowers are paying TK 2.00 (3.4 cents US) per week.

– Loan limit: 500~5000TK

– No interest rate, No time limit, No condition

– Beggar members are covered under life insurance and loan insurance program without paying any cost.

– Groups and Centers are being encouraged to become patrons of struggling member.

– Each struggling member receives an identity badge with Grameen Bank logo.

She can display this as she goes about her daily life, to let everybody know that she is a Grameen Bank member and this national institution stands behind her.

– Members are not required to give up begging, but are encouraged to take up an additional income-generating activity like selling popular consumer items door to door, or at the place of begging.

Company’s Value:

The main vision of the Grameen is to remove poverty from the country with best practices and highest social commitment.

- Result Driven

- Engaged & Inspired

- Accountable & Transparent

- Focused on Borrowers Delightment

- Courageous & Respectful

Banking Division:

I worked in two branch office in Grameen bank. All the employees are very experienced at their work. They know what to do for the betterment of their organization. In a branch office there are 8-9 employees.Among them,

- 1 branch manager,

- 1 second officer,

- 5-6 centre manager,

- 1 caretacker.

Generally Banking Division of Grameen Bank contains following Sections and activities:

- Deposit Section (for both borrower and non borrower)

- Savings section( only for the borrower)

- Loan Section

Company Competitive Scenario:

There are many NGO’s in Bangladesh who are doing microcredit banking in Bangladesh. Some of them are BRAC, PROSHIKA, ASA etc. Bangladesh is witnessing steep growth in the uptake of microcredit loans for the past 5-6 years. Microcredit banking has been growing at a fast rate for the past few years, for the development of the infrustraucture of Bangladesh and to remove poverty from Bangladesh. Now, all privateand state-owned microcredit organizations have come up with more and more benifits to attract customers. BRAC, Grameen Bank and ASA are leading microcredit organizations who are growing their revenue through Microcredit Banking. City Bank is one of the oldest private Commercial Banks operating in Bangladesh. It is a top bank among the oldest five Commercial Banks in the country which started their operations in 1983.

SURVEY FINDINGS & ANALYSIS

Measuring the effect of the Relationship Banking on Borrowers Loyalty: During my internship in The Grameen Bank at Head office in Mirpur-2 and after in the branch office, I have analyzed various aspects of those particular branch. I did a qualitative analysis of satisfaction and performance level of customer towards those branch office of The Grameen Bank from a borrowers point of view. I conduct a probability random sampling which is random in nature to collect the data from Borrowers and non borrowers(only depositor) to measure the satisfaction level and customer loyalty in general banking. As we know the customer loyalty and customer satisfaction level indicates the effectiveness of the relationship banking of GB. Moreover

I did a descriptive analysis by observing the different aspects of The Grameen Bank. The sample size used in this study is 20. The sample size was low assuming that the homogeneity prevails in borrowers perception related to service quality of microcredit banking. And this service quality driven the borrowers loyalty and providing those special services are in the part of relationship banking. I asked them some questions regarding the relationship banking of Grameen bank to fulfill my criteria to know about its operations with the borrowers.

Sample Size:

The sampling technique used in this study was random probabilistic in nature. More accurately convenient sampling was used. The sample was taken randomly. To analyze the customer perception about GB, I conducted ,

Sampling Technique and Procedure:

SWOT Analysis of Relationship Banking:

Strength:

- Large client base all over the country

- Quality Product & service( in case of microcredit)

- Company reputation & goodwill

- Large number of Branches all over the country

- Awards and excellent Brand Value

- Skilled Human Resource.

Weakness:

- Lack of adequate marketing effort

- Lack full scale automation

- Lack of Trained employees

- Do manual accounting in the branch offices

Opportunity:

- Value addition of product & service for the borrowers

- Increasing purchasing power of people specially the women

- Increasing trend in doing small business

- Economic growth of Bangladesh

Threat:

- The term “ Microcredit” can be used in negetive way

- National & global political unrest

- Market pressure for lowering of lending rate

- Increased competition for market share in the industry

- Price war

Analysis of Customer Satisfaction Level and loyalty for Relationship Banking in GB:

- Facility you get from the GB micro-credit banking is it appropriate?

Interpretation

When I asked the Both the borrowers and non-borrowers of GB about the facility they getting from Microcredit banking and their satisfaction level, the 70% of the responded are strongly agreed, 20% responded are agreed and 10 % responded are neutral . And the 0% of the responded are disagree and strongly disagree. From this analysis we come to the point that most of the people are fully satisfied with the facility GB banking have, only few responded are neutral and have confusion about the service. As the most of the people strongly agreed so they are delight about the service and its also represent the strong relationship banking of GB.

- Is the GB give better service than other microcredit organizations?

Interpretation

Here I asked the Customer that is the GB give better service then other microcredit organizations, and the 20% of the responded are strongly agreed and 25% are agreed and 50% are neutral about the GB general banking service. And 5% of the responded are disagree because they think other organizations give better service then GB. As the few number of responded are not going with GB, most of the people are agreed or like the GB banking. So, as a result GB maintain a good relationship and give better service to their existing customer.

- Do you expect any sort of benefit from the loan you take from GB rather than using your own money while you have sufficient money to do business?

Interpretation

I asked responded about the expectation of any sort of benefit from GB. Then I found that the 45% of the responded are agreed it means they expect sort of benefit from GB. And 55% responded do not expect any sort of benefit from GB. As a result the GB is providing appropriate service toward of the customers.

Do you think it is effective(ex:the loan) to solve your problem?

Interpretation

The most of the customer of the GB microcredit banking think that all the products or services of the GB microcredit banking is effective to solve the problem. From this analysis I found that the 45% of the responded are strongly agreed and 45% of the customer or responded agreed. And 5% responded are neutral and the 5% of the responded is disagreed, it shows that the GB Microcredit banking is effective for solving customers problem and which is the result of GBs’ relationship banking.

- Are you satisfied about the communication of Grameen Bank?

Interpretation

In microcredit banking Customer wants the frequent communication from the bank, and in this point the GB customer is satisfied about the frequent communication. From the analysis I found that the 5% of the customer is strongly agreed and 60% of the customer are agreed and 15% are neutral and only few number of customers are disagreed like 20% of responded. As a result the communication of the GB is effective and it is the important factor of relationship banking.

- Do you get proper response from GB when you need them?

Interpretation

In any problem or confusion borrowers want the solution or proper response from the bank and in this situation the 65% responded are strongly agreed and 30% of responded agreed and only 5% of the customer are confused about it. From this analysis we found that as there is no complain and most of the borrower is getting proper response from the GB. So GB is very concern about their existing customer and maintain proper relationship with them.

Are you satisfied with the Approach of the employees in The Grameen Bank?

Interpretation

Employee is the assets of every organization and to guide them organization maintain the relationship with their customers. Employee represent the organization and it is the 1p (people) from the 7ps of service marketing. Here the 5% of the responded strongly agreed and 25% of the responded are agreed and 60% of the responded are neutral and only 10% of the responded are disagreed or dissatisfied with the approach of the employees in GB.

As there few customers are dissatisfied than satisfied customer, so GB is properly guide their employee to maintain good relationship with the customer.

Is there any objection against microcredit banking of GB?

Interpretation

As the need and choice is vary from borrower to borrower thats why borrower can have some objections about the service. So in this point only the 5% of the responded have objections and the 25% and 20% of the responded are disagreed and strongly disagreed and 50% of the responded are neutral about it. So, we found that the GB providing better service and maintaining strong relationship with their borrowers.

- Are you satisfied with their service?

Interpretation

From this analysis we found that the satisfaction level of the GB of microcredit banking is very high. Here the 35% of the customer is strongly agreed so they are delight and 40% of the customer agreed so they are satisfied and 15% are neutral they neither satisfied nor dissatisfied. However the 10% of the customer is disagreed so they are dissatisfied for some reasons. As, in this analysis the satisfied customer is more than the dissatisfied, the relationship banking is effective for GB microcredit banking.

- How satisfied are you with the quality of micro-credit banking service?

Interpretation

When I want to know the satisfaction level of the customer about the service giving by the GB I found that the 25% of the responded are delight and 55% of the customer are satisfied and 10% of the customer are neither satisfied nor dissatisfied and 5% of the responded is not satisfied and very few only 5% responded are very dissatisfied about the service of GB microcredit banking.

- Did you recommend Grameen Bank to your relatives/ Friends / Colleagues?

Interpretation

From this analysis we can see that the 85% of the customer will recommend GB to their friends, family members and colleagues. And the 15% of the customer will not recommend the GB. As the most of the customer recommend the GB and it proves that the GB maintaining relationship banking very effectively for this reason they are also getting the result.

- How satisfied are you with the fees/service charge of the Microcredit banking?

Interpretation

Here the most of the customer of the GB are satisfied with the fees/ service charge of the retail banking. 5% of the responded are strongly agreed and 35% of the responded agreed and 50% of the responded are neutral and only 10% of the responded are disagreed. So, most of the customers are satisfied with the fees and service charges of GB banking.

- Do you have trust on the system of microcredit Banking of Grameen Bank?

Interpretation

From this analysis the customer of the GB microcredit banking have trust on the GB banking system. 35% of the responded are strongly agreed and 25% of the responded agreed and 25% of the responded are neutral and 10% of the responded are disagreed and 5% of the responded are strongly agreed. As most of the customers have trust on the GB, it means the GB providing effective service to their existing customer.

- How satisfied are you about the market reputation of the Grameen bank?

Interpretation

Here the most of the customer is satisfied about the market reputation of GB. The 25% of the responded are delighted and 55% of the responded are satisfied and 20% of the responded are not satisfied about the market reputation of GB. So GB has good market reputations, which also increase the satisfaction level of customer.

- Are you satisfied when the bank updates you about your account/loan information?

Interpretation

Here the 15% of the responded are strongly agreed 65% of the responded are agreed and 15% of the responded are neutral and only 5%of the responded are disagreed. From this analysis we found that most the responded are satisfied when the bank informed them about their loans and accounts information.

Findings and Analysis

The major findings of the analysis represent that,

- The responded or the customer of the Grameen Bank of micro-credit Banking are Satisfied with the Services and Product.

- The customer or the responded are very much loyal and spread positive word of mouth.

- The responded feel honored to relate with the GB banking because of the market reputation of GB is high in case of micro-credit.

- Existing customers are satisfied with the current banking process and do not want any kind of changes but if happens then it should be positive.

- The employee of the Grameen Bank also performing well because the customers are satisfied with their approach and service.

- In terms of fees and charges customers are satisfied with current fees and charges. As the fees and service charges are almost same with the competitor, the customers are satisfied for quality service with same charges.

- For the relationship banking the Grameen bank try to delight their existing customer and maintaining superior relationship.

- Most of the responded or customer are introduce with the Grameen bank from their Friends and family members.

- Facilities and offerings of the GB are appropriate for the customer but some customer wants more benefits from the Gb microcredit banking.

- The frequent communication is very important in relationship banking and customers of GB are satisfied about the frequent communication.

- The GB is very much responsive about the customer problem. And the most of the customers are satisfied about the response from GB.

- As the customer are satisfied with the service quality and new product and also the response and communication of the Grameen Bank so, the GB Relationship Banking on microcredit department is very effective.

Conclusion

Grameen Bank is working with passion and activity, allowing the poor people to get a microcredit. As Dr. Yunus said, “Credit is a human right.” During this internship, I realize that poverty is actually caused by the social structure rather than any lack of capability on the part of the people. I am one of the witness who saw how microcredit helps people, how the poor people get a loan, how they overcome the poverty. After this internship I have realized the effectiveness of microcredit and how it has revolutionized the life of the poor. Of course, financial aid is not the one and only solution to the poor.

However, if this kind of institution can give hope and courage to the poor, we could surely put poverty into museum.