Credit Appraisal System of Habib Bank Limited Bangladesh

Habib Bank Limited is a Pakistani international bank operating in Bangladesh. The bank is recognized as one of the leading financial institutions in South Asia, and a dynamic international bank in the emerging markets, providing customers with a premium set of innovative products and services. The bank has been in Bangladesh since 1976 and has five branches in Dhaka (Gulshan, Motijheel & Uttara), Sylhet and Chittagong.

Habib Bank has been taking deposits and giving out loan for approximately three and a half decades and has been successful in capturing the attention of the market in which it is serving.

This bank was looked upon as a Pakistani bank and clients preferred not to get involved with the bank. However with immense coaxing and explanations the bank now has sufficient clientele but they don’t have enough deposits which are their liabilities to increase the loans which are their assets.

As we know that a bank is dependent mainly on the deposits and loans because the loans are assets and the deposits are the liabilities. The liabilities have to match the assets otherwise the bank will have insufficient amount to pay off their liabilities. The difference between the interest on loan and the interest on deposit is the profit for the bank. The more deposits the bank has the more loans it can give off and create a good portfolio which can be managed well.

For having good deposits the bank needs good schemes and product. The features and the distinct products are mentioned in the report and what are the schemes are also mentioned there. Recently the Banking Regulation and Policy Department of Central Bank instructed to all local and foreign commercial banks operating in the country to develop a new deposit product and that to be named as ‘Special Notice Deposit’ by merging all short term deposit schemes i.e. Special Notice Time Deposit (SNTD), Call Deposit Receipt (CDR), Call Accounts, SND Accounts and Short Term Deposit being currently offered in accordance with the given guideline.

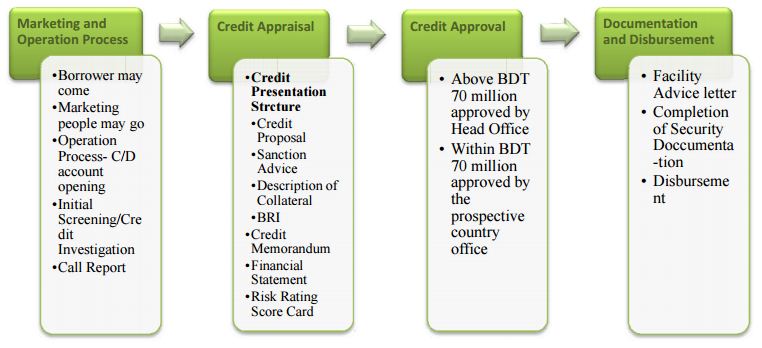

Therefore we know that to have a profit there needs to be deposits and loan. Moreover for a giving loan we need good deposit scheme and for giving loan we also need a good loan processing and credit appraisal system. So when the loan is taken the first process is marketing the product. Where either the bank goes to the customer or the customer comes to the bank. Then the C/D account is opened and a further investigation is carried out and then a call report is prepared. After the call report is submitted to the respective branch managers it is their duty to check all the documents and understand whether the company is able or not. Then the branch manager asks the respective RMs to prepare a credit presentation structure of the whole loan which is then submitted to be further processed.

Moving along we describe the credit approval system which is how the amount is which has been approved by the RM and Credit Administration Department In-charge which is approved further by the Branch Manager, Risk Manager, and then by Regional General Manager. If the amount is within the credit limit which has been approved by the Head Office of Karachi for all the respective branches, then the loan is approved by the branches’ Regional General Manager after the credit appraisal is done. However if the credit limit increases then the loan needs to be approved by first the branches’ Regional General Manager and then it is further send to the Head Office Karachi to be further approved.

Then the Documentation and Disbursement process is described. This process is basically carried out by the Credit Administration Department, where the checking whether the documents which have been provided are valid or not is done. Once the documents are verified the facility advice letter is given and then the security documentation is completed and later the disbursement process is carried out where the loan amount is handed over to the respective party and the respective party withdraws the amount as and when they require. After the disbursement it is up to the credit Administration Department to further keep a track of the loan whether it’s being paid off on time or not.

The next process is the credit appraisal where certain documents are prepared on the basis of the process done under marketing and operations. Here the documents that are prepared are credit proposal form which contains credit proposal, sanction advice, description of collateral and basic information report. The descriptions of these documentations are provided in details and also it is mentioned how a part works and importance of that part. Next the credit memorandum comes which describes in detail about the organization which is to be given loan and also contains the detail of the credit proposal, sanction advice, description of collateral, basic information report, financial spreads, risks, industry’s description, third party information, etc. Then the financial spreads are there which gives a description of the financial statements which are prepared in the excel sheet of Microsoft. Even though it is basically a comparison of two years in the description the third year is also considered at times when financial spreads are described in the credit memorandum part. Even if the third most previous year is not described the data are still presented in the excel sheet for the RM to consider it and refer to it for any clarification.

Furthermore it is utilized in reconciliation of the net worth which is also an important factor in the financial statements. The next part which also comes in the credit appraisal is another essential component which is the risk rating scorecard. This scorecard basically describes and evaluates the how risky the organization’s business and whether the bank will be falling into a risky business or not. The risk rating scorecard is structured in such a way that it is based on industry volatility, quantitative factors and qualitative factors.

Finally a brief conclusion is stated where the descriptions of the loan process system and the descriptions of the credit appraisal system is described in brief. Also mentioned along with it is the understanding by preparing the report and also some recommendations provided in general.

Purpose

The purposes of this report cognates the internship purpose. The internship objective is to gather practical knowledge and experiencing in the corporate working environment in the close proximity to the business firm and the experts who are leading and making strategic decisions to enhance the growth of a financial institution. To this regard this report is contemplating the knowledge and experience accumulated from internship program.

The prime objective of organization part is:

- To present an overview and brief introduction of Habib Bank Ltd.

The prime objectives of project part are:

- To describe Habib Bank Limited

- To provide a sketch of HBL products

- To give a complete picture of its operations in Bangladesh.

- To examine the loan processing system of Habib Bank Limited in Bangladesh

- To examine HBL’s Credit Appraisal System

- To give a brief description of loan processing system of Habib Bank Limited.

- To gather and provide a detail description of the Credit Appraisal System of Habib Bank Limited.

- To provide a conclusion based on the information provided by all the information collected.

Organizational Mission and Values

Mission Statement

To be recognized as a leading financial institution of Pakistan and a dynamic international bank in the emerging markets providing our customers with a premium set of innovative products and services and granting superior value to our stakeholders – shareholders, customers and employees.

Secondary Values

HBL is firmly grounded with a corporate philosophy that incorporates seven solid values which each individual associated with the bank abides by.

Humility

To encourage a culture of mutual respect and treat both team members and customers with humility and care.

Integrity

For HBL, integrity means a synergic approach towards abiding core values. United with the force of shared values and integrity, it forms form a network of a well-integrated team.

Excellence

This is at the core of everything we do. The markets in which we operate are becoming increasingly competitive, giving our customers an abundance of choice. Only through being the very best – in terms of the service we offer, our products and premises – can we hope to be successful and grow.

Meritocracy

At every level, from selection to advancement, they have designed a consistent system of human resource practices, based on objective criteria throughout all the layers of the organization. They are, therefore, able to achieve a specific level of performance at every layer of the organization.

Progressiveness

Believe in the advancement of society through the adoption of enlightened working practices, innovative new products and processes, and a spirit of enterprise

Team Work

The team strives to become a cohesive and unified force, to offer the customer a level of service beyond your expectations. This force is derived from participative and collective endeavors, a common set of goals and a spirit to share the glory and the strength to face failures together.

Culture of Innovation

The aim is to be proactively responsive to new ideas, and to respect and reward the agents, leaders and creators of change.

Social Commitment

The Public Relation Division of HBL maintains effective rapport with the general public by communicating the policies and schemes of the bank through press and electronic media. Besides maintaining close relationship with journalists & advertising agencies, the Division also receives the visiting dignitaries and delegations from abroad.

HBL believes in serving their nation, Pakistan and building the country strong. HBL is always at the forefront to support noble causes and promote the social & cultural activities in the country.

The Public Relation Division of HBL sponsors various social, cultural and sports events to generate healthy activities in the society. The Division represents the bank at important forums to exchange views on national & international issues with various organizations to boost the intellectual activities.

Habib Bank Limited (HBL), Bangladesh –

Habib Bank Limited (HBL) started operation in Bangladesh as early as the 1960s. At that time, the bank was a nationalized bank under the Government of Pakistan. After liberation of the country, in 1971, the bank was taken over by the Government of Bangladesh and Agrani Bank was formed. HBL reentered this financial market in 1976. It has five branches in Bangladesh.

There are three branches in Dhaka (Gulshan, Motijheel and Uttara) and one branch in Sylhet and one in Chittagong The bank maintains a low profile in the Bangladesh market. It has a market share of only 1% of foreign banks here, and 0.2% in Bangladesh. This may be because the bank provides the services of only Commercial and Corporate Investment banking, aiming at serving the business-related part of the financial sector.

Overview of the Products:

In Bangladesh all commercial banks including local and foreign banks have time to time introduced different type of deposit schemes and liability products to cater their customer’s day to day need and to secure maximum liquidity from the market to build their balance sheet.

Accordingly HBL Bangladesh since its inception in this market has also introduced certain depository products for its customers that include demand deposit and time deposit using different nomenclatures like term deposit, (short term and long term) call deposit, interest bearing and non interest bearing deposit accounts as per following details:

- Current Deposit Account (LCY/FCY)

- Saving Bank Account

- Value Account

- Daily Progressive account

- Business Value Account

- Special Notice Time Deposit (7 days & 30 days)

- Fixed / Term Deposit (1 month to 60 months in both LCY/FCY)

- Call Deposit Receipt

- Security Deposit Receipt

- Short Term Deposit Account

- Bhabnahin Term Deposit Account

- Convertible Account (linked with FCY Account for encashment)

As per Bangladesh Bank the “regulator” all local banks as well as foreign banks are obliged to upload pricing offered on such deposit scheme on bank’s website as well as reporting on monthly basis inclusive intermediately change if any to Bangladesh Bank.

Among the deposit mixture of our bank, the above underlined three products are going to be amalgamated under single product to be named as ‘SND’. The comparative analysis of these products of us is presented as under for your better understanding.

Loan Processing System of Habib Bank Limited, Bangladesh

Credit Appraisal System Introduction

The procedures given below are to be adhered to by Global Relationship Managers (GRM)/ Relationship Managers (RM), to obtain approval for credit risks. The Bank’s credit process entails submission of a credit presentation for initiation of credit facilities and evaluation of the proposal by the designated authorities (depending on the amount of global obligor exposure, per the Bank’s three signature approval process) leading to a decision, i.e., an approval, a conditional approval, or a decline. Subsequent to approval/conditional approval, the credit facility is released (subject to fulfillment of all requirements) in accordance with the terms of the approval, by the Credit Administration Department. Once a relationship is in place, a credit review is required on an annual basis for renewal of credit facilities.

However, assessment of credit risk is a dynamic process and should not be limited to the annual review exercise. The GRM/RM must maintain contact with the Borrower through personal visits on a regular basis. This should be done to remain abreast of credit risk related developments in the Borrower’s business/industry and to prospect for spin-off business and other opportunities.

This process is to be documented in call visit reports. The GRM/RM must seek and use information available from all sources, whether internal or market/third party. Conduct of the account, unusual requests, impact of changes (whether global, local, or regulatory/ fiscal) in the environment/ dynamics of the industry, all provide invaluable sources of information. Such information must be responded to, proactively, in order to ensure that timely steps are taken to capitalize on opportunities and to protect the Bank’s interests.

Group Classification History:

The space allows for details of three classifications revisions. If the entire group was classified in the same category, each column can be utilized for entering the date of each respective classification revision, the classification category and the amount of total classified exposure (on a group basis) for the three most recent revisions. For example, if the entire exposure on X Group (which prior to this was classified current) is classified IA then subsequently downgraded to substandard and thereafter reclassified IA. The three columns would state the date and total classified exposure for each of these revisions. If different entities in the group had different classifications at the time of review, then each column can be utilized to state most recent details for up to three different classification categories. Take example of Y group comprising of six entities. Company MNP (belonging to Y) was classified IA and subsequently reclassified Substandard, whereas, company STU was classified IA six months ago. The balance exposure on the Group is classified ‘Current’. In this hypothetical scenario, at the time of review two entities of the Group have an adverse classification. Therefore, two columns can be utilized to give the details for the classifications existing on review date, i.e. Substandard for MNP (date of classification and amount of exposure classified Substandard) and IA for STU (with date of classification and exposure classified IA), while the third column ought to be left blank.

Group Revenues Grid:

The aggregate amount of revenues (from various products/services) earned from the Group/Borrower in the twelve-month period preceding the Credit Proposal Date, is entered here. The purpose is to obtain an overall earnings figure for the bank’s credit exposure on the Group relationship.

Originating/Control Unit:

Originating Unit- Approval Requirements:

The amount of aggregate facilities (for the Group/Borrower) approved/recommended and depending on the approval requirements, the names, designations, initials of the credit officers from the Originating Unit who are involved in the approval.

Approval/Seek Consent:

When the credit facility is secured by cash collateral/Government of Pakistan securities and the Borrower is part of a Group for which it is not the Control Unit, the Originating Unit may approve the facility provided that the facility amount does not exceed the limit prescribed by Credit Policy Committee/Credit Risk Officer. However an approval would still require greater than the aggregate amount of facilities (at the Originating Unit). In such cases, subsequent consent of the Control Unit must be obtained.

Requests Approval/Recommends:

In all other cases the Originating Unit must seek approval of the Control Unit prior to extending any new facilities or agreeing to any material changes in existing facilities.

Control Unit-Approval Requirements:

The amount of the aggregate facilities (for the Group/Borrower) approved, etc. and depending on the approval requirements, the names, designations, initials of the credit officers from the Control Unit who are involved in the approval.

Approves:

An approval requires the signatures of at least three credit officers, one of whom must have a credit limit equal to or greater than the amount of aggregate facilities extended to a Group/Borrower.

Recommends:

If not within the Credit Authority of the Credit Officer at the Control Unit, Proposal should be elevated to the next/higher authority for approval.

Approval:

The designated Credit Officer/Senior Credit Officer/Group Risk Manager/Group Executive/Chief Risk Officer should sign in the assigned space along with affixing the name & the designation.

Sanction Advice:

Group: Here only the name of the Group is entered.

Group Code: In the above mentioned category a Group Code is allocated centrally, in order to ensure that all Credit Facilities are aggregated for a Group of Borrowers, solely from the bank’s perspective and regardless of whether common legal ownership exists or not.

Control Unit: This is the Business Unit with the primary credit responsibility for a Group/Borrower. The Control Unit also coordinates the marketing effort viz. a Group/Borrower, where credit facilities are extended at a multiple locations. It is the Control Unit’s responsibility to keep line management, and Originating/Extending Units fully informed, on a timely basis, of any events or information that might impact the Group/Borrower’s credit worthiness. The Control Unit is responsible for approval of credit facilities and/or securing credit approval from the appropriate approving authority, where the aggregate Group facilities exceed its delegated authority.

Proposal No.: A serial number is assigned by the Credit Administration, of the respective Originating Unit, for each Credit Proposal. The first four numbers will denote the year, followed by a four digit serial number. For e.g. the first Credit Proposal being send out for 2007, from an Originating/Control Unit would be XXXX20070001.

Date: The date (DD/MM/YYYY) when the Credit Proposal should be completed (at the Relationship Manager level) is inserted in this area.

Borrower: The name of the borrower is entered here.

Borrower Code: A code is allocated centrally for each borrower is entered here.

ORR: Existing & proposed (if different from existing) Obligor Risk Rating ORR (refer to section 5.1.1.4 on Risk Rating Scorecard) of the borrower is mentioned here.

Originating Unit: The name of the business unit/branch initiating the Credit Proposal needs to be entered. The Originating Unit may approve the credit facilities secured by cash/Government of Pakistan securities up to the limit specified in the loan processing system. Subsequent consent of the Control Unit must be obtained, however. In all other cases, approval of the Control Unit (which is in turn responsible for securing approval of the appropriate approval authority) is required prior to the extension of credit facilities.

Total Proposed Facilities: Total amount of facilities (both Fund based and Non-Fund based) is entered here.

Industry: Refer to Annexure 6 for the list of Industries and Codes.

Industry Code: Refer to Annexure 6 for the list of Industries and Codes.

External Rating: If the borrower is rated by a rating agency, the rating is mentioned here.

National Tax Number: Here the National Tax Number of the borrower is entered.

Facility No.: Facility numbers (beginning with 1) are to be filled in one continuous series for all Borrowers belonging to a group. For e.g. if there are two Borrowers in a Group and the facilities numbered 1 to 5 are proposed for Borrower ‘A’, the facility numbers for Borrower ‘B’ will begin with the number 6.

Branch/Centre: The name of the Originating Unit is entered here.

Nature: A brief description (as per standard bank definitions) of the nature of the facility, stating any limitations on the usage or availability of the facility is mentioned here.

Existing: The previously approved amount of facilities being renewed, amended, enhanced, etc. is mentioned here.

Proposed Fund Based: Proposed (whether new, being renewed and/or amended) Fund Based facilities is entered here first. Then the amount of (proposed) Fund Based Facility is entered in this column (leaving the Proposed Non-Fund Based Facilities blank).

Overdue Outstanding/Facility Classification: The total overdue/default amount outstanding against the respective facility (inclusive of accrued mark-up), as of the proposal date and the proposed classification for the respective facility separated by ‘/’ sign.

Comments/Procedural Requirements: Any additional condition that may be required by the approving authority, as a condition of the approval is stated here.

Authorized Signatures: The sanction advice is signed by the approving authority or by an officer delegated with the authority to do so. Moreover this section does not require signatures of all the approving authorities. However if any approving authority makes an amendment or adds any covenant in the sanction advice he/she is required to put his/her initial to authenticate the amendment.

Basic Information Report:

National Tax number: Here the National Tax Number of the borrower is entered.

Reporting Date: The date of completion of the Basic Information Report (BIR) is entered here.

Originating Unit/Branch: The name of the business unit/branch initiating the Credit Proposal needs to be entered. The Originating Unit may approve the credit facilities secured by cash/Government of Pakistan securities up to the limit specified in the loan processing system. Subsequent consent of the Control Unit must be obtained, however. In all other cases, approval of the Control Unit (which is in turn responsible for securing approval of the appropriate approval authority) is required prior to the extension of credit facilities.

Date A/c Opened: The date of commencement of banking relationship with the borrower is entered here.

Date of Establishment: The date of establishment of the business is entered here:

- For corporate entities, the date of Certificate of Commencement of Business would suffice

- For public sector entities date of formation (or date of the specific piece of the legislation under which the body may have been formed)

- For sole-proprietorships/partnership firms approximate date of formal commencement of business activities

Group/Borrower’s Name & Address: In this category the full legal name and address of the borrower is entered. In case of a Group it is required to mention the name of the group and address of the principal place of business.

Line of Business: Here the primary business activity/activities of the Group/Borrower need to be entered.

Ownership: The form of organization/legal status and interests of significant stakeholders is stated here.

Directors: The names of the directors (stating functional responsibilities, if applicable) are listed here.

Key Management: The names of the key officers of the borrower, along with their respective designation are listed here.

Facilities with Other Banks: The type and amount of facilities with other banks are listed here. Where possible outstanding and collateral extended to other banks are also mentioned here.

Group/Associated Companies: The names of the Group/Associated companies (regardless of whether common legal ownership exist or not or whether they belong with HBL or not) are listed here.

Compliance with Central Bank Regulations: In the case credits originating in the domestic operations the SBP prudential check-list (self explanatory in nature) is used. In case of finance against shares the SBP mandated margins is considered for each class of securities. Any exceptions is noted on the Credit Proposal form (in the block for ‘Purpose/Exceptions’) and discussed in the text of the Credit Memorandum.

Branches in the International banking Group list and comply with their respective Central Bank regulations/requirements (if any).

Credit Bureau Report: A fresh credit checking from an approved (by credit policy) credit bureau/agency (SBP CIB report for credits in Pakistan) is obtained prior to submission of the Credit Proposal and the appropriate box filled. If the report is clean ‘Yes’ is entered in the appropriate box, otherwise the amounts that are overdue and/or have been defaulted upon are stated.

Borrower (Gross) Revenues Grid: The aggregate amount of revenues (from various products/services) earned from the Group/Borrower in the twelve-month period preceding the Credit Proposal Date, is entered here. The purpose is to obtain an overall earnings figure for the bank’s credit exposure on the Group relationship. The data however which is filled here should pertain to individual borrower (as opposed to the Group).

History:

- A brief history of the borrower, listing significant events (new product lines, capacity expansions, forward/backward integrations, etc.) in chronological order followed by a brief account of the borrower’s relationship with the bank

- Its main business activities/key products

- Plant & machinery (production process, installed capacity, utilization levels, etc.)

- Main suppliers, purchasing terms, trade requirements

- Main buyers and selling terms

Group Overview

The Group Overview provides a summary of the business activities and financial health of the Group, stating company-wise (regardless of whether the individual companies have a relationship with the Bank, or not):

- Lines of business

- Competitive position in respective industries

- A (tabular) summary of key financials and ratios

- Inter-company transactions

- An organizational chart (attached as an Appendix) giving shareholdings, cross shareholdings, formal/informal bases of association, etc.

- Group profitability report, i.e., earnings from the Group in the preceding twelve months

- Bank’s strategy viz. the Group

Financial Spreads

When the RMs are asked to prepare Credit Proposal the part that discusses and shows a picturesque view of the business’s financial whereabouts is the financial documents or statements. These statements are prepared on basing some rules and formulae which are followed by Head Office, Karachi. All the branches in 26 countries follow a universal format and are supposed to keep track about the changes if any made in the statements. These statements are prepared on Excel sheet Head Office, Karachi and the formulae are entered according to the rules governing the Habib Bank Policy. The Financial Statements basically describe and highlight the financial position of the company on the basis of the audited report submitted by the respective organizational Group/Borrowers who are taking the loan. The audited report submitted by the borrowers are of three preceding years basing on which the financial statements are prepared.

These are also a numerical presentation of the financial data of the organization. The first part shows the financial summary which is a basic gist of the company’s main information such as key figures. Then the annual growth in percentage format is shown. The annual growth is shown for 2 yrs. Further ahead we see the cash flow summary which states the cash conditions of the organization. Then it shows the key ratios which describe the conditions of the profitability condition of the business using accounting ratios. It also shows the turnover rations that explain how long it takes the cash cycle to complete. Then shows the liquidity ratios which show how much sufficient cash the company has to pay off their liability. After that it shows the leverage ratios which show whether the company has more or less debt to equity ratio.

Balance Sheet

In the second part the balance sheet is being shown which gives full information of the company’s fixed assets, current assets, long-term liabilities, current liabilities and equity.

Income Statement

In the third part the income statement shows the operating revenue, operating expenses, net income and net worth reconciliation which shows the ending net worth.

Supplementary/Information and fixed assets reconciliation

In the fourth part it contains a spreadsheet that shows the reconciliation of net fixed assets showing the ending balance which is supposed to match with that of the amount in the balance sheet. Also it contains the amount and rate of the principal repayment during the period and the effective tax rate which help in calculating of the debt service coverage ratio.

Cash Generation Statement

In this part the operating cash is given, then all the additions and subtraction that help in calculating of gross operating funds generated which later is used to calculate total operating sources which in turn help in calculating non-operating sources and then finally the net increase or decrease is shown.

After each statement there is a part which checks and shows the differences and then the RMs checks which areas need considering and all the related procedures are done match with the actual amount. These financial statements are basically used so that the RM has a clear and concise view of the company’s financial strengths and weaknesses which he/she further discusses in detail in the Credit Memorandum.

Risk Rating Score Cards

Introduction

Effective risk management requires an accurate and forward looking estimation of the probability of default over the next 12 months. This can be effectively achieved through allocation of an appropriate Risk Rating to all borrowers updated on a regular basis when new information is received.

Risk Rating Scorecards have been developed for different types of borrowers in the bank’s portfolio that will be updated if needed. At present the following Risk Rating Scorecards are being launched:

- Corporate Banking Group (CBG) Scorecard is to be used for borrowers with sales of Rs 300 million and above.

- Commercial Banking Group (CBD) Scorecard is to be used for borrowers with sales between Rs 25 million and Rs 299 million.

- International Banking Group (IBG) will use the above two scorecards i.e. For borrowers with sales in excess of USD 5 million – CBG Scorecard and for borrowers with sales between USD 0.5 million to USD 5 million – CBD Scorecard.

- Group Risk Rating Scorecard is to be used for all borrowers risk rated by CBG, IBG and CBD.

International Banking Group is to use these scorecards for customers where financials are disclosed.

This policy document sets out the key principles of Risk Rating appropriate to all scorecards when determining the most appropriate rating for both performing and non-performing relationships.

Benefits

The risk rating system provides a framework for:

- Recognizing early warning signals and effective problem loan management;

- Risk-based loan pricing;

- Development of marketing strategies aimed at attractive risk segments;

- Portfolio performance management;

- Portfolio re-balancing decisions; and,

- Determination of loan loss expectations.

Borrower Risk Rating Principles

- A Risk Rating reflects the probability of a borrower defaulting on its financial arrangements in the 12 months after the date of rating such that the better the rating the lower the probability of default.

- The Risk Rating is determined at a point in time using all the information available at that time.

- Scorecards are tools to determine a borrower’s Aggregate Score based on assessment of quantitative and qualitative factors. However, security will not form part of the rating decision as this influences actual loss not the probability of default. Security Indicators to reflect the likely value of security/collateral taken in support of the borrowers’ debt shall be launched at a later date when the concept of Facility Risk Rating is introduced.

- Scorecards shall record the Assigned Rating determined through a combination of the Aggregate Score as well as exercise of judgment. Judgment plays an important role in the scoring of qualitative factors as well as recommendations made to change the risk rating in cases of disagreement.

- Industry Volatility is a key driver in the Risk Rating as it has been proven that the probability of default is higher in industries with higher volatility. Each industry has been assigned a volatility factor based on trends observed in the past.

- Risk Rating is a continuous process; not an annual event.

Risk Rating Grid

The Risk Rating Definitions detailed in Annexure 8 are intended to provide a broad guideline for assessment of credit risks. Differences of opinion may exist in cases where there are border line calls, however, significant differences beyond one rating are not expected and these definitions are to be used for guidance purposes only.

Investment Grade Ratings

Risk Ratings 1 to 2 are assigned to Investment Grade companies that include entities with parents rated investment grade by Moody’s or Standard & Poor’s. These risk ratings are not included in the Rating Scale in the CBG scorecard as the policy for calculating these ratings will be advised at a later date. Risk ratings 3 and 4 are assigned to local investment grade companies.

Regular Ratings

This will be defined as those companies with ratings falling between 5 and 9. Start-up ventures shall be assigned a risk rating of 8 or worse.

Classified Ratings

Borrowers with a score of 10 to 14 will constitute a classified rating. All borrowers presently classified 1A or worse should be risk rated on the scorecard, however, in circumstances where this is not possible due to litigation or non availability of financial information, the rating should be appropriately mapped on the Credit Proposal or CLMR by referring to the Risk Rating Grid e.g. a ‘Doubtful’ relationship would be mapped with a Risk Rating of 13 on the Credit Proposal or CLMR.

Group Risk Rating

A Group Risk Rating (GRR) Scorecard has been launched to enable the management to gauge the risk profile of various companies in a group by assigning a consolidated risk rating. The derived GRR is based on Risk Ratings of individual borrowers in relation to their weighted average exposures within the group.

The Group Risk Rating Scorecards for all groups in CBG, IBG and CBD will be submitted annually to the SCO for approval. Where group exposure exceeds the discretionary authority of the SCO, approval should be sought from the CRO.

While risk ratings for individual borrowers within a group would be reflected under the column “BRR”, the Group Risk Rating should be shown on all Credit Proposals, short forms and CLMRs under the head ‘GRR”.

Half yearly reports of total limits and approved assigned Group Risk Ratings for all the groups must be submitted to the SCO. A Group Risk Rating Scorecard is attached as Annexure 9.

Conclusion

The report is based on the information collected from the Habib Bank Limited’s Credit Policy Manual. Not only that the respective interviews and discussion done with the respective authority mainly the Relationship Managers in the Credit and Marketing Department. The information collected has been used in this project to give a view of the Loan Processing System and Credit Appraisal System of the Habib Bank Limited.

Loan Processing System: This system is a bit complex as the Relationship Managers, Credit Administration Department In-charge, Branch Managers, Risk Managers and Regional General Manager have to keep a track of the organizations that are getting loans whether they are complying with the obligatory rules and regulations as compiled in the Credit Policy Manual as presented under the Habib Bank Pakistan which is the Head Office in Karachi. This manual is prepared by keeping in mind the best interest of the bank and that of the customers. It is a very strong process and gives the organization great increase in the assets as their main business is to get deposits which are their liabilities and give loans which are their deposits. As their target is likewise of any other bank to gain deposits they do have pretty attractive and descent products and as they are unable to give out that many loans what I would recommend them to do is that they open more branches so they get more clientele in Bangladesh and thus cover a huge market.

In this manner they will be able to fulfill their desire to become a top most bank and expand their clientele with the huge network they have.

Credit Appraisal System: In this system the respective Relationship Manager (RM) has to very carefully and with precision prepare and produce relevant documents which will help the other respective officials to judge the authenticity of the organization’s or an individual’s. The documents prepared are Credit Proposal forms containing; credit proposal, sanction advice and basic information report. Other documents the RM has to prepare are: credit memorandum, financial spreads and risk rating scorecard. Each document unfolds the information regarding the client, the business and the organization, and helps the respective authorized officials to review and decide whether the loan needs to be further processed or not. If they have any query they request the respective RM to provide them with certain documents if needed to clear the doubts that are present.