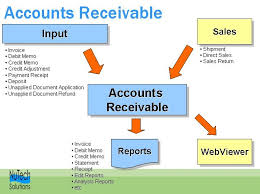

Basic objective of this lecture is to Presentation on Factoring of Accounts Receivable. Funding or financing against invoices raised from the supplier after making this delivery successfully. Here briefly explain on Revolving Temporary Facility, Permanent Assignment regarding Payment, Financing against debts and Post-delivery Financing. Finally analysis Major Terms and Conditions, Book Keeping, Security (mandatory and optional), Documentation, Marketing and Risks in terms of Accounts Receivable with examples.

Presentation on Factoring of Accounts Receivable