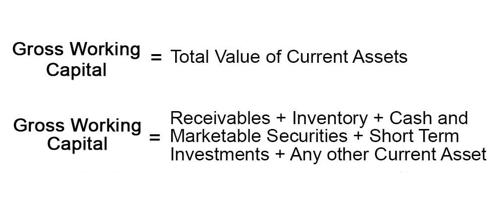

Gross Concept of Working Capital

Gross working capital refers to the total current asset quantum possessed by a company at any given point in an accounting year. According to the gross concept, working capital refers to all the current assets and represents the number of funds invested in current assets. It is the sum of a company’s current assets (assets that are convertible to cash within a year or less). Thus, gross working capital is the capital invested in current assets. Gross working capital includes assets such as cash, accounts receivable, inventory, short-term investments, and marketable securities. Current assets are those assets that can be converted into cash within a short-time period. The concept of gross working capital refers to the total value of current assets. In other words, gross working capital is the total amount available for the financing of current assets. It indicates the amount available to fund current assets and related requirements.

“Gross working capital includes assets such as cash, accounts receivable, inventory, short-term investments, and marketable securities.”

Gross Working Capital = Total current assets

Or,

Gross Working Capital = Receivables + Cash and Marketable Securities + Inventory + Short Term Investments + other Current Asset

It must be noted here that subtracting current liabilities from current assets gives us the working capital or net working capital of a firm.

Now, if the resulting working capital is positive, it would mean that the firm’s current assets are greater than its current liabilities.

In this way, gross working capital refers to the firm’s investment in current assets. Including current liabilities into the equation results in calculating working capital, which is a true picture of a company’s liquidity and its ability to meet its short-term obligations. Gross working capital represents a total of current assets which include cash in hand, cash at bank, inventory, prepaid expenses, bills receivable, etc. However, it does not reveal the true financial position of an enterprise.

This concept is usually supported by the business community as it raises their assets (current) and is to their advantage to borrow the funds from external sources such as banks and financial institutions. It makes up all those assets that can be readily converted into cash within an accounting period. Typically, it includes assets like – cash, inventory, accounts receivable, marketable securities, commercial paper, and short-term investments. It helps to ascertain the financial standing and capability to repay liabilities adequately. It also helps to compute the working capital ratio, which in turn helps to ascertain a firm’s capacity to pay off liabilities on time.