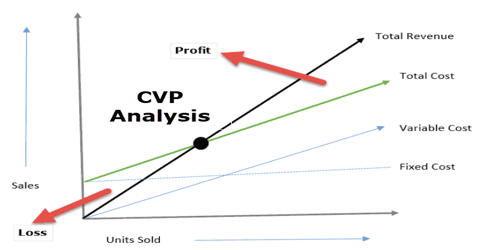

Concept of CVP Analysis Under Changing Situations

Cost-volume-profit analysis, or CVP, is something companies use to figure out how changes in costs and volume affect their operating expenses and net income. It is also known as ‘Sensitivity Analysis.’ Sensitivity analysis is the measurement of responsiveness in outcome with the change in determinant variables. We know that the goal of a business enterprise is to maximize profits. CVP is one of the most versatile and widely applicable tools used by managerial accountants to help managers make better decisions. CVP analysis requires that all the company’s costs, including manufacturing, selling, and administrative costs, be identified as variable or fixed.

Profits are the excess of revenues over the total costs.

Net Profits = Total Sales Revenue- Total Costs

= Sales Units X Selling price per unit) -(Sales Units-Unit variable costs -Fixed Costs -Taxes)

So, Profit= f(Sales volume, Selling price, Variable costs, Fixed costs, Taxes, etc.)

By breaking down costs into fixed versus variable, CVP analysis gives companies strong insight into the profitability of their products or services. It means that profits are the functions of volume, price, variable costs, fixed costs, taxes, and so on. But none of the factors remain unchanged. The amount that remains is first used to cover fixed costs, and whatever remains afterward is considered profit. Sometimes the manager can intentionally change the price and cost factors as a part of strategic decisions. But the strategy should focus more on the factors which are more sensitive or responsive to profits. Companies use this type of analysis to consider possible scenarios that assist them in planning. Therefore, to measure the sensitivity of CVP factors we can see the impact of a certain percentage of change in volume, price, or cost factors on net profits. It simplifies analysis of short-run trade-offs in operational decisions.

Assumptions when using CVP analysis –

- All costs, including manufacturing, administrative, and overhead costs, can be accurately identified as either fixed or variable.

- The selling price per unit is constant.

- Changes in activity are the only factors that affect costs.

- All units produced are sold.

Many companies and accounting professionals use cost-volume-profit analysis to make informed decisions about the products or services they sell. Therefore, sensitivity analysis is the measurement of elasticity of change in cost-volume-profit factors on the break-even point or the given profits. In managerial economics, it is a form of cost accounting. It is a simplified model, useful for elementary instruction, and for short-run decisions. Strategists or managers should focus on the factors which are more responsive to profits.