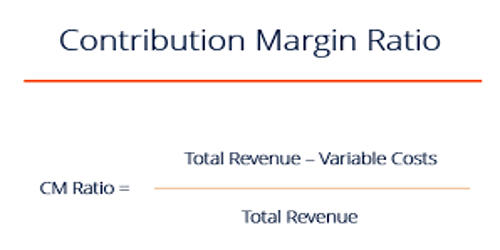

Concept of Contribution Margin Ratio

The contribution margin expressed as a percentage of sales revenue is known as the contribution ratio. The contribution margin ratio is the difference between a company’s sales and variable expenses, expressed as a percentage. The contribution margin should be relatively high since it must be sufficient to also cover fixed expenses and administrative overhead. The contribution margin is computed as the selling price per unit, minus the variable cost per unit. The ratio is calculated by dividing the contribution margin (sales minus all variable expenses) by sales. To calculate the contribution margin ratio, divide the contribution margin by sales. The contribution margin is calculated by subtracting all variable expenses from sales.

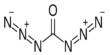

The formula is: (Sales – Variable expenses) ÷ Sales = contribution margin ratio.

The concept of this equation relies on the difference between fixed and variable costs. The contribution margin ratio (CM ratio) of a business is equal to its revenue less all variable costs – divided by its revenue.

CM ratio = (total revenue – cost of goods sold – any other variable expenses) / total revenue.

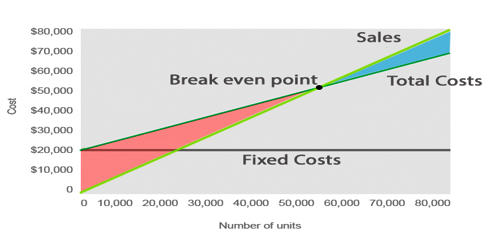

Fixed costs are production costs that remain the same as production efforts increase. Variable costs, on the other hand, increase with production levels.

The percentage of contribution to the total sales is referred to as the C/M ratio. It is also the remaining percentage of the variable cost ratio.

CMPU = SPPU – VCPU

C/M Ratio = (Sales Revenue – Variable Costs)/Sales Revenue

Or,

C/M Ratio = (SPPU- VCPU)/SPPU

Or,

C/M Ratio = 1- Variable Cost Ratio

Or,

C/M Ratio = (Fixed Costs + Net profit(loss)/Sales Revenue

Where,

CMPU = Contribution margin per unit

SPPU = Selling price per unit

VCPU= Variable costs per unit

C/M Ratio = Contribution margin ratio.

The contribution margin per unit (CMPU) of $ 20 means each unit of sales contributes $ 20 towards the recovery of fixed cost first and then the realization of profits. The contribution margin can be stated on a gross or per-unit basis.

A 45% C/M ratio means each dollar of sales revenue contributes $ 0.45 towards the recovery of fixed costs first and then the realization of profits.

The contribution margin ratio sometimes referred to as Profit Volume Ratio(P/V Ratio). But one should be cleared with the P/V ratio that it is not the ratio of net profit to sales revenue. P/V ratio is the percentage of marginal profits(or change in profits) to marginal sales revenue.

Since fixed costs do not change within the relevant range in the short tun, net profits change by the same amount as the contribution margin change.

Therefore,

C/M Ratio = P/V Ratio = Change in contribution margin/change in sales revenue

= Change in net profits/change in sales revenue.

The contribution margin is useful for determining the impact on profits of changes in sales. In particular, it can be used to estimate the decline in profits if sales drop, and so is a standard tool in the formulation of budgets. Management can also use the CM ratio to find inefficient processes that need improvement.