Banking Strategy of Trust Bank Limited

Trust Bank Limited is one of the leading private commercial banks along with an extent network. A few years back Trust Bank Limited started their Journey with acceptable vision as a commercial bank in Bangladesh. It has been now operating their business with number of 72 branches, 7 SME centers, 105 ATM Booths and 60 POS in 50 Branches across Bangladesh and plans to open more branches to cover the important commercial areas in Dhaka, Chittagong, Sylhet and other areas in 2013.

Trust Bank has been functioning in Bangladesh with extensive aspects of modern corporate and consumer financial products since 1999 and has achieved customer assurance as a sound and stable bank.

The bank, sponsored by the Army Welfare Trust (AWT), is first of its kind in the country.

Consecutive Developments of Trust Bank Limited:

In 1987 first generated the idea about run out a bank in Bangladesh commercially.

In 1994 foreign investment took place.

1999 15th July Trust bank limited got the license and permission to operate their journey of banking in Bangladesh.

After that in 1999, 5 August the bank got the branch license to represent the bank in Bangladesh. Finally with a small mission and vision the bank successfully complete the inauguration to execute their operation in Bangladesh.

In 2001 it involved in automatic banking. Then in 2005 they have been starting to use of ATM Machine to make the transaction easier. The bank redecorated themselves in 2006 by changing their logo, name and retail banking.

In 2007 the banks gets inside of online banking and allow using visa card for their customer. The bank has been completely trying to spread out their network through establishing new branches in Bangladesh. Since bank’s business volume increased over the years and the demands of the customers enlarged in manifold and technology has been upgraded to manage the growth of the bank and meet the demands of our customers.

Trust Bank is a customer oriented financial institution. It remains dedicated to meet up with the ever growing expectations of the customer because at Trust Bank, customer is always at the center.

Vision

Build a long-term sustainable financial institution through financial inclusion and deliver optimum value to all stakeholders with the highest level of compliance

Mission

Long Term Sustainable Growth- diversified business with robust risk management Financial Inclusion- bring unbanked population into banking network through low cost and technology based service delivery

Accountable to all stakeholders- customers, shareholders, employees & regulators

Highest level of compliance and transparency at all levels of operation

Positioning statement

Trust Bank is a contemporary, upbeat brand of distinctive quality of service and solution that offers a rewarding banking experience as preferred choice of banking partner every time, everywhere.

Value

- Trustworthy

- Dependable

- Reliable

- Professional

- Dynamic

- Fair

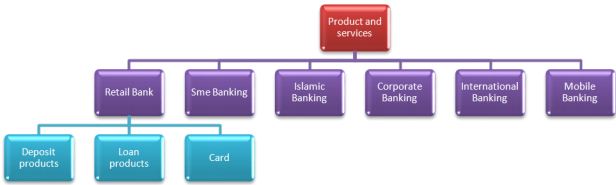

Product and Services

Retail Banking:

Retail banking of trust bank consists of their wide range of products that are pointed out below: Current Deposit account: Open a Current Account at Trust Bank to suit your business needs and avail of a range of benefits as listed below.

- MICR Cheque Book facility containing 20 leaves.

- Free 24 hours ATM facility for individual current account holders at over 200 ATMs across Bangladesh.

- Login to your account anytime, from anywhere using our free Trust Bank Online Banking facility.

- Carry out shopping at all Visa Electron merchants using your Debit card, which is linked to your current account.

Saving Deposit account: Choose from a range of savings accounts that allow you to withdraw your funds at any time for easy, convenient banking.

- Bank pays attractive interest.

- Personalized MICR Cheque Book is available.

- Nominal service charge.

- Any branch banking facility.

- Rate of Interest : 6.00%

- Bank accepts and supports Standing Instructions.

- Interest is payable on half yearly basis.

- Option is available to collect e-Statement

- Dedicated phone service team available to answer your Trust Savings Deposit Account queries

- Make your money work harder with interest paid on your savings

- Access to your funds via TBL ATMs/any Visa ATMs.

- Have peace of mind knowing that your money is safe with the security.

SME Banking:

SME banking divided into three sectors which are described below

Agricultural Loan:

- Trust Shufola Bangladesh

- Peak Seasons Loan

- Agri-Business Loan

- Trust Shufola Bangladesh

- Loan for Poultry Farm

Entrepreneur Loan:

- Entrepreneurship Development Loan for Retirees

- Women Entrepreneur Loan

Islamic Bank:

Islam is a complete code of life. The prime objective of Islamic life style is to conquer success in life here and hereafter. Islamic way of life as enshrined in the Holy Qur’an and the Sunnah should be followed. Islamic Banking trade and transaction is based on the core rules & regulations affirmed in the Holy Qur’an and the Sunnah. Trust Islamic Banking is solely committed to conduct and manage the banking system abiding the Islamic law. Islam has given right to attain and own assets.

Deposit Account:

- Al-Wadiah Current Account

- Al-Wadiah Term Deposits

- Mudaraba Savings Account

- Mudaraba Spacial Notice Deposits

Loan Scheme:

- Barakat Car Scheme

- Barakat Home Construction Scheme

- Qard Scheme

Corporate Banking:

In generally trust bank divided corporate banking sector into three different aspects these are given and describes below in shortly.

Cash Management:

- Cash Trade Overview: An easy and convenient way of managing your finances. Whether you want to make or collect payments, manage company accounts efficiently, we have a service to suit you.

- Liability Products: Bank also offers various transaction and investment opportunities to their clients for their long and short term fund.

- Securities Services: Primary services offered where trust Bank will be responsible for maintaining the safety of custody assets held in physical form at the custodian’s premises.

Corporate Loan:

- Overdraft

- Short Term Loans

- Syndicated loan

- Term Loan

Trade Finance:

- Letter of Credit (LC)

- Letter of Guarantee (LG)

Nature of the Bank:

The nature of the banking business is to connect those in need of funds (borrowers) with those with an excess of funds (savers) for the purpose of lending or investing. Banks can lend money to borrowers in a variety of ways depending on how the money supply is defined and the nature of the deposits it holds.

Banking is an important aid to industry and trade, and that it also provides a variety of services to the public in general. Indeed banking may be regarded as an essential part of the economy of every country. The significance of banking has increased all over the world with the rise in income levels and growth in the volume of financial transactions. In addition to accepting deposits and lending funds, banking also involves providing various other services along with its main banking activity. These are mainly agency services, but include several general services as well.

The essential features of banking activities are as follows:-

i) Accepting deposits from public

ii) Lending or investment of such deposits

iii) Related to the activities of accepting deposits for lending or investing, banks undertake activities like —

- Promoting and mobilizing savings of the public;

- Providing funds to trade and industry by way of discounting bills, overdraft, cash credit facility, and transfer of funds from one place to another

- Providing agency services to customers, such as collection of bills, payment of insurance premium, purchase and sale of securities and other general services, such as issue of traveller’s cheques, credit cards, locker facility etc.

Money depositors deposited the amount of money in the bank for purpose of safety. Further the depositor is allowed to withdraw it whenever required. Banks allow interest on deposits.

This is what bank is doing their business in terms of providing service to the customer.

Duties and responsibilities:

Though I entered into the bank as intern the treated me as an employee so that I had to follow the rules and regulation of the bank and most importantly the duties and responsibilities that are given by the bank within a certain period of time. Whatever the work it is if it’s related to bank you have to gone through it under the regulation or process of banking. The bank is a financial institution so that you need to know about some financial conditions and terms it’s not mandatory to know but it will help you out during the work they are given. My roles and responsibilities throughout my internship tenure are pointed out below.

- At first Trust Bank Limited (SCB) were going to place me in the account opening session where I got lesson about opening an account ,what are the requirements of opening up an account and so on.

- I receive account opening form from the customers. In the Trust Bank Ltd for defense persons their account opening procedures is different instead of general people. There is account opening number list given from where the account number should be taken and placed into the form then kept in the software for future purpose.

- The bank is following the software name Flora Banking for doing banking activities. Through this software the bank reports to its current status to the head office and make transactions from one place to another place which actually saves time. I got an experience to operate the software for putting information into server, to check transactional status, customer bank statements, making customer profile, activation of an account and many more.

- Verifying customers application form whether it’s correct or not, the required papers are attached or not like (ID card /voter ID card or birth certificate photo copy, nominee ID card or voter ID card, photos of applicant and nominee etc.)

- Verifying signature card with three identical signature then add the signature card for the purpose of issuance cheque book, making transaction to other branch so on.

- Providing online permission to every account holder to transact any of the branches in Bangladesh.

- Issuance of cheque book,fill up the form properly according to verify signature card.

- Issuance of the card, receiving the application form and delivered the ATM card to the customer properly along with proper entry into the software.

- Sending ATM card to other branch, for this processing all the related procedures.

- Sending cheque book requisition to the Head office and receiving Cheque book from the Head office.

- Taking charge from the customer for issuing cheque book through software.

- If it’s other branch customers then sending cheque book requisition slip along with forwarding letter to authorize the cheque book.

- Same as receiving other branch requisition slip along with forwarding letter to make authorization of cheque book.

- Kept all the forwarding letters, requisition slip, cheque book issuance copy according to the file as documents.

- In card division sending request for the new ATM card through software in the Principal branch IT and Card division.

- Receiving ATM card along with hidden pin number from IT department and make it in process by the software.

- Put the card number for activation in order to make transaction from ATM booth. It requires three ours to activate the card.

- For the purpose of lost debit card, date expired, pin number reissue in that case reissue the card, or apply for new pin number through a card application form.

- In the Clearing Department receiving all cheques from customer then then according to the clearing of Bangladesh bank verifying all the cheques, input all the cheque numbers into the register book according to date wise.

- In the Remittance department assist to the completion of customer pay order slip. Verifying the customer to whom it’s favoring, amount of taka, take the charges and vat for purpose of issuing pay order. If the customer belongs to the Trust bank then the charges will be lesser than regular customer. Put an entry of this pay order number, amount, favoring person or bank into the register book.

- Analyzing the month amount of remitted money that is receiving from the abroad and sending money to other country through exchange houses.

- Verifying the pin number that belongs from the customer to withdraw remitted amount from this bank through different exchange houses.

- Put the amount of money and exchange house name, customer name into the register book for keeping as a document.

These are the roles and responsibilities that I had been going through during my internship period.

Aspect of Job Performance:

Banking sector is one of the vast place in the world where all the employees of this industry has been enhancing their effectiveness and competitiveness though different aspect of job performance .The performance level at this sector basically depends on its role of its administration ,working environment and quality of service they are ensuring to the customer. Though banking industry is termed as a stressful sector, employee has to confirm their best possible service during the working period. To measure or enhance the effectiveness of the job performance Banking sector in Bangladesh designed training session before enter into the service area which ensure their capability on working under pressure.

There are some terms and conditions regarding with service of bank that is severely followed by the employees which also executes their job performance. The Human resource department can play the significant role of measuring job performance. The way to boost up employees, management team are arranged allowances, reward, bonus and incentives for purpose of doing better performance. This is the way to motivate stuffs for their hard working service indeed.

Overall bank is place of transaction, getting involvement with financing and providing services to customer which is actually continuous process of working under pressure so as an employee he /she has to find out his/her job satisfaction through involvement in the activities.

Critical Observation and Explanations:

In focusing on general banking a bank’s activities run with some critical situation which is essential to monitor accurately. The majority of risk that is associated with the general banking so that it considered as a significant area of the Bank.

Account opening:

In the training session of Trust Bank the authority always says that money laundering starts from opening of an account in the bank.

- Exact address of the account holder along with documents it required.

- Nature of the customer/account holder

- Transaction amount, number.

- Recent photograph of the account holder and nominee

- Relationship with the account holder and nominee

Issuance of cheque:

- Minimum balance of the account holder to charge of cheque book

- Signature card verification

- Posting of cheque book

- Lost cheque book

Pay order:

- Purpose of pay order

- Total cost with commission and vat

Transfer balance:

When an account holder deposited money to a branch where he does not has an account.

- Justify whether it is online or not

- Inform that branch the account holder deposited money here

- Process of IBCA (inter branch clearing area )

Risk management:

Risk management policy or process of Bank encompasses risk appreciation basing on the risk appetite for the particular sector/segment of the customers and subsequent risk identification, measurement and controlling of risk components to safeguard the interest of the bank and to keep the business range performing to the maximum level.

Credit risk:

Credit risk originates from the

- Market Risk

- Interest Risk

- Foreign Exchange Risk

- Supplier’s Risk

- Financial Risk

- Business Risk

- Management Risk

- Structural Risk

- Security Risk

- Infrastructural Risk

- Information/Data Risk

- Technological Risk etc.

Bank manages its credit risk in the following manners

Maintaining Appropriate Credit Administration and Monitoring

Bank has in place a system for monitoring proper documentation and credit disbursement. After disbursement the status of individual accounts including determining the adequacy of provisions and reserves are continuously monitor to safe guard the good health of the bank.

Effective NPL Management

There is an established system in the bank to provide Early Alert for accounts tend to be non performing for taking early precautions to avoid classification. For NPL management ongoing regular review is done with all concerned and the results of such reviews are communicated to the respective authority for taking appropriate action timely.

Asset liability risk management:

TBL has formed an Asset liability Management Committee (ALCO) with senior management headed by Managing Director which is responsible for Balance Sheet Management or specifically Balance Sheet Risk Management. ALCO also responsible for managing the asset and liability with a view to lead the bank to a balanced and Sustainable growth through minimizing various business risk factors such as market risk, liquidity risk, and Interest rate risk. ALCO covers the entire balance sheet/business of the Bank while carrying out the periodic/monthly analysis as per guidelines and Bangladesh Bank’s regulations.

Foreign Exchange risk:

Foreign Exchange risk represents the fluctuation in exchange rate movements, which may affected the Bank’s open position on some currency. Foreign exchange rate risk arises when the bank is involved in foreign currency transactions, which may result in deficits or surpluses in the Bank’s foreign currency position. These transactions include for instance foreign currency exchanges, investments, loans, borrowings and contractual commitments etc.

IT risks management:

IT risk can be defined as any threat to information technology, data, critical systems and business processes. Management of TBL has developed a process to identify areas of control weakness and respond in a timely fashion to IT risk by improving processes, augmenting controls and even reducing the cycle time between control testing to ensure that the organization is properly identifying and responding to IT risks. IT Risk includes Data Security Risk, Data Confidentiality Risk, Data Integrity Risk, Data Availability Risk, Hardware Risk and Network Risk.

Overcomes:

- Identify informational assets and theirs value;

- Identify threats and vulnerabilities to information security;

- Evaluate and analyze the risks;

- Plan the means and methods to minimize information risks;

- Control measures implementation;

- IT risks monitoring and control.

- Build a risk-aware culture,

- Develop manpower and

- Managing IT risk using the effective, efficient and right tools

Recommendation:

Some necessary recommendations for Trust Bank Ltd are pointed out below:

- To retain and attract quality employees the bank should always try to follow competitive strategy in case of employee benefits, working conditions and other motivational approaches.

- The higher authority of the bank should always try to make a fair evaluation of employee’s performance. They should develop the procedures of the evaluation each and every year in accordance with demand.

- The bank can also star campus recruiting that could bring a yield of highly educated graduates for the entry level organization could arrange seminars in the top business schools across our country.

- The higher authority of the bank should always concern about the fairness of recruitment and selection. Without having efficient, energetic, enthusiastic people an organization can’t achieve its ultimate goal.

- The bank should always follow the world’s latest HR policy to increase the management skills and development.

- The bank should place the right people for the right position in order to achieve their sustainability of the service. For this reason they first attempt to find out the human need of the bank in various department, different branches and different positions.

- The number of ATM booth should be increase in potential numbers to raise the customer reliability.

- The bank should raise robust promotional activities to get the sustainable brand loyalty.

- Ensuring the facilities of the employees both financial and environmental which are help to motivate employees to work.

- By developing more branches are help to cover up more area of business in the banking sector.

- TBL should introduce more product and service scheme for people which can also attract the customer indeed.

- The bank should allow arranging training session for the employee’s one or two times in each year with the advanced banking program.

- The position of Foreign exchange, General banking division and credit division operate through officers with commerce back ground.

Conclusion:

Trust Bank Limited is one of the major commercial bank in Bangladesh to play important role in involving so many developments activities of the country. TBL has been performing various roles in economy. It has a greater contribution to growth of the economy. Trust bank limited known as a prominent commercial bank in Bangladesh which plays a significant role for the development. The bank has been emphasizing to development of the business sector since it was started their voyage. The bank is committed to provide satisfactory service to the customer. To make the economic condition stable the role of a bank is more important. The economic progress of a country in recent can be arbitrated from the efficiency of its banking arrangement. Trust bank limited trying harder to reach their potential customer in order to provide satisfactory services, increases number of branches every year so that customer makes transaction from their nearer branch whenever they need. They also put emphasis on their contribution to increase number of ATM booth accordance to customer’s demands. TBL is moving forward to delivering the highest possible services to their respected customers so that it will help to increase its bank value all over country. TBL believes proving best service to customer will make a good relationship between bank and customer which will help to operate banking service for long time or create sustainability in future.