INTRODUCTION

While every other group or individual might be choosing a well known organization to carry out their projects on, we have chosen a relatively new company, which is at its early stage of development, and does not even have its financial papers published yet anywhere, and does not even have a website of its own, yet. The organization we have chosen is “Ahang Fashion & Crafts Limited”, which most people of Dhaka know as one of the fastest booming fashion house in the country.

About AHANG Fashion & Crafts Limited:

Ahang is a fashion house which started its operations as a full fledged fashion house in the late 2004. By saying full fledged we mean to say that Ahang acquired a large showroom to display and sell its products, also diversified its products into local and imported, and acquired a larger factory for its local production. Before that, it was only a small room where only the local products were kept for sales, and the factory did not have more than 12 employees. At present, only the showroom of Ahang has 11 employees consisting of seven sales personnel, two managers (who also maintain the accounts and cash), and two security guards. The factory of Ahang has about seventy employees – consisting of its Director, floor supervisor, store-keeper, tailor masters, chemical master, tailors, embroidery men, handwork people, helpers, screen printers, block printers, iron-man, and security guards. We are concentrating only on the manufacturing (production) system of Ahang for this project, thus avoiding the trading (sales) and importing sides. Though Ahang is both a trading and manufacturing company, we have only discussed about the organization’s manufacturing side. We shall now move towards viewing the Working Capital Framework of Ahang.

WORKING CAPITAL FRAMEWORK OF AHANG

Before we show the working capital framework of Ahang, we shall see why the management of working capital is important for an organization like Ahang. The financial management of business firms involves three basic functions: the management of long-term assets, the management of long-term capital, and the management of short-term assets and liabilities. The management of short-term assets and liabilities is the management of working capital (ref. MODERN WORKING CAPITAL MANAGEMENT-TEXT AND CASES, FREDERICK C. SCHERR, PRENTICE HALL INTERNATIONAL EDITIONS). The part of the balance sheet that consists of the short-term assets and liabilities includes assets such as cash, marketable securities, accounts receivable, inventory, prepaid expenses, and other current assets. Decisions that are analyzed are like some of the following:

- How should the firm manage its cash?

- To whom should the firm grant credit?

- How much inventory should the firm keep?

- What should be the composition of the firm’s current debt?

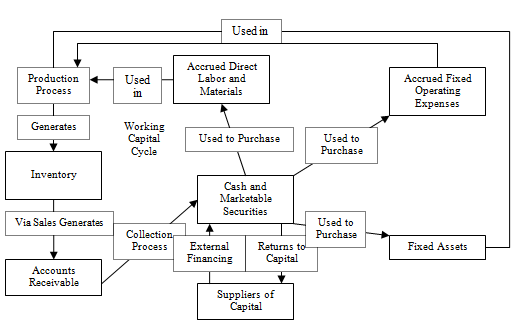

The following figure shows the resource flows for a manufacturing firm such as Ahang:

The working capital of Ahang Fashion & Crafts Limited consists of more or less all the forms of short-term assets and liabilities known. But the usage and management of these short-term assets and liabilities depends on each of the type of operations carried out at Ahang. The various activities taking place at Ahang are:

- Block/ Screen printing,

- Embroidery,

- Handwork (locally known as Karchupi),

- Cutting and Tailoring,

- Falls setting and border weaving (piko) of sarees.

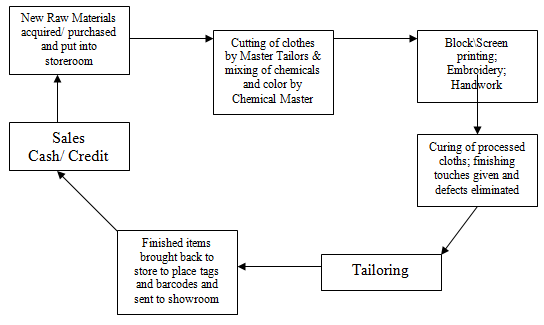

A brief flowchart of the working capital framework of Ahang is shown below:

We shall now see the system maintained by Ahang to manage its liquidity and overall cash flows for regular manufacturing.

LIQUIDITY MANAGEMENT AT AHANG

In our learning about liquidity management we have known that it mainly consists of a Cash Cycle, which is the time period that elapses between the points at which cash begins to be expended on the production of a product or group of products, and the collection of cash from customers, known as the cash collection period. Liquidity, as we know, is that quality of a good or service which makes it easily convertible into cash without much capital loss and within reasonable time, and financial flexibility is liquidity in the long-run.Ahang’s liquidity management is maintained depending on three factors-

- The sales generated during regular season, or off-season as it is said for fashion ware;

- The sales generated in the peak seasons, such as during Eid, Puja, and other religious and cultural ceremonies such as the Bengali New Year (Pahela Baisakh), New Year etc.

- The cash collection period, i.e. the total period taken to collect receivable amount from customers (both corporate and regular).

The sales in the regular season has never been very low at Ahang since its start of operation, as the type of clothes it produces are those which local women prefer to wear everyday, which are the block and screen print salwar suits, sarees and also embroidered salwar suits. These are all fixed price items and are sold at a fixed price with a fixed profit, thus while the cash is generated from the sale of these items, the amount is put back into manufacturing again. The sales in the peak seasons always generate direct cash, and almost 99.98% times the cash collection period for those sales is zero. So we were assured that there is stability in the earnings of Ahang, and the overall cash collection period never exceeds 20 days. Furthermore, Ahang has a credit line with a local bank from which loans can be taken at any time of the year in order to make high amounts of purchase in cases of emergency, local and overseas.

FINANCING OF AHANG

We know that in general, there are 2 major sources of financing for any type of business organization, whether manufacturing, or trading, or both, they are Short-term financing and Long-term financing. Ahang uses short-term financing as its major source of financing for regular production.

The primary source of short-term financing for Ahang is Payables, which in other words, is the purchase of all or some raw materials of production in credit from the suppliers. Ahang makes its purchase of cloth for local production in credit from local suppliers who supply materials like Terry Voile, Terry cotton, Khaddar (a heavy type of cotton), N. D. cotton, Crape (Chinon), Chiffon (Georgette), and various other types of materials from different, qualitative suppliers. Ahang believes that there good relationship with all the suppliers is a plus point for the company to acquire such huge amounts of cloth in credit. Other suppliers like that of threads, sewing materials, chemical and color etc. are paid in cash always, because of their requirements (as they are all retailers).

The secondary source of short-term financing is accruals (regarding liquidity), which are the wages of employees, land and factory rent (since the factory and land is not owned by Ahang), and other expenses such as utility bills. For the production based employees, i.e. those who get payments based on the amounts they produce, Ahang pays half the amount of total production of a week at the end of weekdays, which is Thursday; for other employees who work on a permanent basis on salaries, Ahang pays the total amount at the end of the month. Here, a point to be noted and learnt from Ahang’s management is that, most of its employees are employed on production basis, thus, the accruals of Ahang is a large amount that is to be paid off at the end of each month, whilst Ahang gathers the amount throughout the month. This is maintained successfully because the sales forecast of Ahang is very much accurate almost always, and thus, Ahang produces an optimum amount of each type of dress each month by following its sales forecast. Other sources like building rent, utility expenses are obviously paid at the end of each month.We know that, other than these two sources, there must be another source of short-term financing maintained or kept by an organization in order to avoid large inventory accumulation, and also to maintain production whilst the collection of receivables is slow. But in Ahang’s manufacturing process, there is little scope for inventory to accumulate in large amounts as all finished products are directly sent to the showroom for sales, and we have already mentioned that the local products are sold regularly. In cases when there are circumstances that the receivables collection is slow, the alternate source of short-term financing is from the personal bank account of the owner of Ahang.

We have shown approximate values of DIH (Days Inventory Held), DSO (Days Sales Outstanding), and DPO (Days Payables Outstanding), as follows, and the maximum working days for the factory of Ahang are 340 days a year:Þ DIH = Inventory / (COGS/340) = 150,000/ (2,300,000/340) » 22 daysÞ DSO = Receivables / (Sales/340) = 600,000/ (10,800,000/340) » 19 daysÞ DPO = Payables / (COGS/340) = 250,000/ (2,300,000/340) » 37 daysSo, the Cash Conversion Cycle (or C.C.C.) of Ahang is:C.C.C. = (DIH + DSO) – DPO = (22 + 19) – 37 = 4 days It is not that Ahang does not use long-term financing at all; Ahang took its first long-term debt from a local bank when it started off, in order to decorate the showroom and make purchases from abroad. Ahang also takes the help of long-term financing in cases when the designer (who also happens to be the managing director of Ahang) along with the chairperson of the fashion house thinks of extending the product line and also to make big purchases from foreign countries like India, Singapore and Dubai, which is because the use of long-term debt, otherwise being expensive, is less risky for an organization like Ahang. In other cases like acquiring a new showroom or factory building in the near future, Ahang will seek for long-term financing also.

INVENTORY MANAGEMENT AT AHANG

In general, for any fashion house or boutiques in Bangladesh, inventory management should be a big headache. This is because the fashion industry of Bangladesh is still developing, and the sales and recovery of receivables of each and every fashion house are two factors that would determine the acquiring of inventory and managing it for the organization. Let us see our findings about inventory management at Ahang.Obviously, a manufacturing company like Ahang would need to keep all three basic types of inventory, which are:

- Raw Materials Inventory:

- All cloth materials, threads for sewing and embroidery, colors and chemicals used for producing the dresses.

The raw materials are purchased at the beginning of every week. As the requirement of raw materials is either stable or on a rise in any season, the calculation of the EOQ (Economic Order Quantity) is done approximately by the director along with the production manager, a model of which is shown below:Here, T = 10,500, F = BDT. 200, H = BDT. 10,EOQ = Ö[(2 * T * F) / H] = Ö [(2 * 12,000 * 200)/ 10] » 693 unitsWhich means the average inventory balance is = 693 / 2 = 346.5 units

- Work-In-Process Inventory: The centre point of concentration of this project. This type of inventory is also referred to as a production buffer, a term used to describe something that allows flexibility and economies that would not otherwise occur (ref. MODERN WORKING CAPITAL MANAGEMENT-TEXT AND CASES, FREDERICK C. SCHERR, PRENTICE HALL INTERNATIONAL EDITIONS). This is the list of goods that are being produced at the factory of Ahang everyday. All the cloths at the block/screen printing table, those at the cutting table, at the embroidery and sewing machines, and at the curing (heat processing required to straighten the cloth and make the color stable and permanent) table, are all the work-in-process inventory at Ahang.

- Finished Goods Inventory: This is the type of inventory that Ahang has to keep anyways to provide immediate service, in this case the service is being given by the factory of Ahang to the showroom of Ahang when there is demand for the goods (or dresses, we must say in this case) by the customers. In case of Ahang, this demand for the finished goods is not uncertain, as it might be in other small boutiques, because the sales of Ahang is regular and never even near to nil, as the management of Ahang has confirmed us. But still, Ahang is never over-confident about it and so, it keeps its production optimum, which is listed as follows:

- Block/ screen print Salwar suits: 70 sets per week on average

- Embroidered Salwar suits: 20 sets per week on average

- Sarees of all types (embroidered, printed etc.): Minimum 10 pieces per week on average, this is because most of the sarees sold by Ahang are the imported ones, which makes the demand for local ones very limited.

- Shirts, Punjabees and Fatuas (men’s traditional tops): Depends on seasons as these are not regularly worn by men, but only during festivals. It also applies to shirts because the shirts produced by Ahang are casual, and the company is planning to produce shirts for official use in the near future.

Thus to manage its inventory most efficiently, Ahang follows the MRP (Materials Requirement Planning) method. There is bill of materials that are required for the production of the various types of dresses which are submitted by the production manager, and purchases of the materials are made accordingly. Lead time is not a problem for Ahang as all its major suppliers have outlets nearby within a distance reachable within an hour, and purchases are finished within 2-3 hours at maximum.

Problems identified by our group regarding Ahang’s management of inventory:

The major problems that are taking place in Ahang’s inventory management system are-Þ The production manager himself is the person looking after quality management, purchase of raw materials, and store-keeping. This is a huge problem because in this way, a lot of trust is put on the production manager and, he might not keep the trust till the end, and there might be some misconduct.Þ One person performing four different duties at one time will consume time anyways, because while doing one job, if the person is required at the other job at the same time, then he will not be able to perform at full speed nor would he be able to maintain his quality of performance.Þ Ahang uses one particular store-room for both raw materials and finished goods inventory, which may create a mess in the inventory management, as inventory problems might not be clearly seen.Þ Ahang does not involve an accountant to look after the balance sheet and maintain the overall accounts.Our recommendations on how to overcome these problems will be discussed in the concluding part of this report. Let us now have a look at how Ahang manages the recovery of its receivables from customers.

RECEIVABLES MANAGEMENT AT AHANG

Credit is provided to most customers at Ahang Fashion & Crafts Limited. This is because Ahang recruits the types of sales personnel who can achieve the primary goal of the company, which is to create long-term relationships with almost all of its customers. By doing this, Ahang will be able to provide more credit to its customers by increasing its sales. A point to be noted here is that the customers who purchase on credit from Ahang are mostly affiliated with political groups and other rich businessmen, and thus whenever they are making purchases, it is not less than BDT. 50,000/= , and the credit amount is also near to that amount. By providing customers with such big amounts of credit, Ahang is making the sales of its dresses speedier, and also maintaining goodwill in business.The other customers who are also enjoying buying at credit from Ahang are those who are giving orders of clothes- either to be tailored or to be produced on a bulk amount. One such customer is HSBC (Honk Kong-Shanghai Banking Corporation) in Bangladesh. HSBC orders the uniforms of its female employees to Ahang in every six months, and it is one of Ahang’s major corporate clients. The method in which Ahang receives its credit amount from the HSBC is a cheque is given to Ahang by HSBC, fifteen days after providing the dresses completely.In case of its other customers we have already mentioned above, Ahang does not give any reminders to the customers for payment of the credit unless it is really necessary. Now this “really necessary” time is a time when Ahang requires some cash in very little time. But no time limit is given to the customers to pay back the credit within a certain time. This may become a problem when a customer may not pay in time and take a very long time to pay.

PAYABLES MANAGEMENT AT AHANG

We have already mentioned some facts about how Ahang uses its payables as its primary source of financing its production operations. Let us see how Ahang manages its payables amount, in details.Ahang’s largest credit providers of raw materials are all its cloth suppliers. Ahang takes all its clothing materials on credit from its cloth suppliers, and maintains a good relationship with them, too, in order to make the payment float as flexible as possible.The largest provider of cloth in credit for Ahang is its supplier of Terry Cotton and Terry Voyle. Ahang takes credit from this supplier at a time flexible manner. The credit amount reaches BDT. 200,000/= to BDT. 300,000/= at times when the season is peak. This amount is paid off regularly in monthly installments by Ahang. The installments vary from BDT. 50,000/= to even BDT. 150,000/= at times. This variability in the amounts of payments is because of the variability in sales of Ahang in its day-to-day operations.For the other suppliers also, Ahang uses the installment payment method, but for these suppliers the time limit is short because their production depends upon receiving this amount.This ends our body part of this project, we shall now move on to the conclusion and recommendations’ regarding Ahang’s manufacturing development.

CONCLUSION & RECOMMENDATIONS

Ahang Fashion & Crafts Limited has achieved a lot of appreciation in its years of operations. The organization’s manufacturing processes are smoother than those of other similar organizations mostly because of the management’s past experience regarding the production system of garments in Bangladesh. But we have some recommendations on how Ahang could overcome the problems regarding its management of inventory and receivables.Ahang should employee at least two more persons in its purchase and production system so that time and money can be saved and the job performance of each employee can be developed. The whole production system should be computerized also.An accountant and also some business graduates must be recruited by Ahang in order to design its inventory management system in a way which is better than the present and much more efficient.This is all we have from our part about Ahang Fashion & Crafts Limited and its manufacturing system.