Stocks, shares, mutual funds, securities, real estate, and small businesses all have annualized total returns that can be calculated. It refers to the annual return on investment. It is calculated as a geometric average of the annual returns over a period of time. The annualized return formula is determined as a mathematical normal to show what a financial backer would procure throughout some undefined time frame if the yearly return was compounded. It is otherwise called the Compounded Annual Growth Rate (CAGR). It just gives investors a snapshot of an investment’s success and no hint of the uncertainty or price fluctuations.

At the end of the day, the annualized rate of return is the general return created by the speculation over a period which is then downsized to a year (or one-year) time span. The general return incorporates both capital appreciation and different additions or misfortunes during the venture time frame. It enables investors to compare investments over various time periods. Although the annualized total return provides investors with a snapshot of investment results, it says nothing about market volatility or investment unpredictability.

By deciding annualized total return, a financial backer can look at two unmistakably changed kinds of ventures a stock buy versus land speculation, for instance regardless of whether the ventures are held throughout various timeframes. An annualized rate of return is calculated by dividing the amount of an investment’s initial value and gains or losses for a given period by that value, which is then multiplied by the inverse of the holding period in years and then minus one. Mathematically, it is represented as,

Annualized Rate of Return = ((Initial Value + Gains or Losses) / Initial Value) 1 / Holding Period – 1

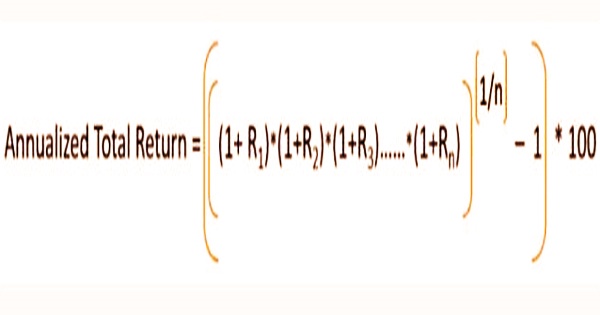

The difference between annualized total return and average annual return is that annualized total return takes into account compounding over time, while average annual return does not. The annualized cumulative return is determined using the following formula if an investor is given the annual rate of return for each year over the investment period:

Where:

R1 is the year 1 annual return

R2 is the year 2 annual return, and so on

n is the number of years

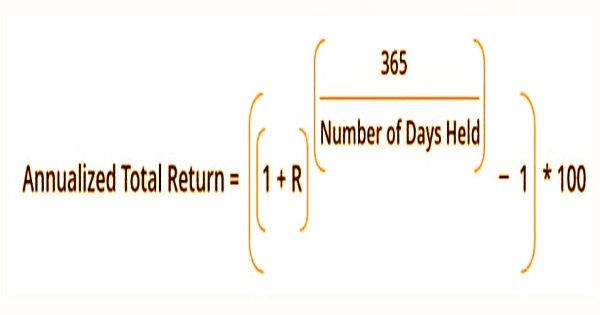

It is not necessary to restrict an annualized return to yearly returns. An annualized performance figure can be estimated if an investor has a total return for a given time, even if it is a particular number of days; however, the annual return calculation must be slightly changed to account for this:

Where:

R is the cumulative return

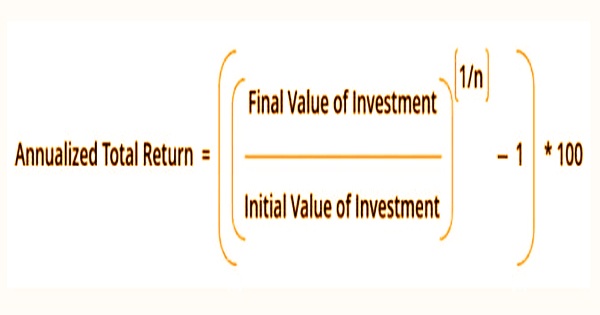

Calculating annualized total return is useful when the arrival of an interest in dollar terms is known, yet the real rate throughout the span of speculation isn’t. It additionally permits financial backers to think about the arrival of different ventures throughout various timeframes. The annualized cumulative return can be calculated using the following formula if an investor is given the initial and final dollar values of the investment:

Suppliers of common assets and other speculation vehicles like to refer to annualized all out return over the normal return since it is by and large a more clear depiction of the value of the venture. Any investment that does not have a track record of at least 365 days cannot “ratchet up” its value to be annualized, according to the Global Investment Performance Standards (GIPS), a collection of uniform, industry-wide guidelines that govern the ethics of performance reporting. Annualized total return provides investors with a snapshot of investment results; however, it does not account for market fluctuations or uncertainty in an investment’s performance.

Consequently, if an asset has been working for just a half year and acquired 5%, it isn’t permitted to say its annualized execution is roughly 10% since that is anticipating future execution as opposed to expressing realities from an earlier time. Organizations utilize the annualized complete re-visitation of gauge their monetary presentation expecting the current conditions will win. Annualization allows taxpayers to turn tax intervals of less than a year into annual periods, allowing them to prepare more efficiently. To put it another way, estimating an annualized rate of return requires using historical data.

Suppliers of shared assets and other venture vehicles like to refer to annualized all out return over the normal return since it is by and large a more clear preview of the value of the speculation, as it sums for compounding. For comparative purposes, short-term borrowing loan rates and expenditures are annualized. In that both formulas aim to capture the geometric return of an investment over time, the Annualized Total Return is conceptually similar to the CAGR (Compound Annual Growth Rate).

While the measurement gives a review of a speculation’s exhibition, it doesn’t give any sign of value vacillations or instability. The fundamental contrast between them is that the CAGR is regularly introduced utilizing just the start and finishing esteems, while the Annualized Total Return is normally determined utilizing the profits from quite a long while. The annualized total return can be used to predict an asset’s or company’s results. The forecasts, however, cannot be guaranteed due to market fluctuations and other factors.

Information Sources: