Executive Summary

This report is on the Overall banking & Foreign Exchange Procedure of Exim Bank Bangladesh. So report title is “Analysis of over all Banking & Foreign Exchange Banking Services of Export Import Bank of Bangladesh”. So to recover the total financial soundness and management skill I have tried to analyzed how they are operating their banking system. A company’s main objective is to gain more profit to benefit its stakeholders using a perfect management system. Exim Bank Bangladesh is not different from them. So my internship report entitled “Analysis of over all Banking & Foreign Exchange Banking Services of Export Import Bank of Bangladesh” refers how the bank drives its banking operation and how it benefits itself and its stakeholders.

Banking service in Bangladesh is characterized as a highly competitive and highly regulated sector. With a good number of banks already in operation and a few more in the pipeline, the market is becoming increasingly competitive by the day. With the global slowdown in the face of rising competition, the commercial banks are constantly looking for ways to develop their market and quality of service and product offers to remain ahead of others. A significant amount of regulation by Bangladesh Bank prevents the scope of introducing newer products into the market and thereby restricts a banks’ ability to outer form others with a diversified product range.

Export Import Bank Ltd, one of the leading private commercial banks, is promoted by a group renowned Bangladeshi entrepreneur and started operation on 3rdAugust 1999. The Bank offers the full range of banking and investment services for personal and corporate customers, backed by the latest technology and a team of highly motivated officers and staff.

The report is divided into the following seven parts- Introduction, An Overview of Banking Sector in Bangladesh, An Overview of Exim Bank, Overall Banking process of Exim Bank, Foreign Trade Operations, Financial Analysis, Recommendation and Conclusion.

Introduction section deals with some elementary issues regarding the background and the process of preparing this report. The next section following the introduction helps to know the brief history of Export Import Bank Ltd. Further, have tried to focuses on the services provided by Export Import Bank Ltd.

Foreign trade operation is the starting point of all the foreign banking operations. It is the operation, which provides day-to- day services to the customers. It involves with import, export and remittance. Financial analysis part shows the financial position of Exim bank, where Trend analysis & SWOT analysis included. Final section shows Findings, conclusion & recommendation.

In this report the promoters and the equity holders are aware of their commitment to the society to which they belong. Export Import Bank Ltd plays an important role in mobilizing domestic resources with its stupendous operating performance and wants to make a substantive contribution to the society where it operates.

Background of the study:

Bachelor of Business Administration is a specialized course. Stamford University of Bangladesh arranges a four year specialized course to provide some efficient graduates in this business sector of the country. The whole course design is not limited within the theoretical boundary but it also extends to the practical exposure through the internship program. After completion of 4 years in the BBA program of the faculty of business studies, department of Marketing, University of Stamford, three months organizational attachment is must. So the preparation and submission of this report is partial requirement for the completion of the Bachelor of Business Administration (BBA).This report is outcome of the three months long internship program conducted in Exim Bank Limited, one of the reputed private commercial banks of the country .While working operating procedures carried out by the bank were observed and supportive effort with the trainers, bankers & under the guidance of my faculty respective advisor Ellina Mahbuba Shahid.

This internship program has been prepared on the basis of my practical experience in the general banking along with the foreign exchange banking division activities. This report will also provide the essential information’s how the private commercial banks contribute for the economic development of the country.

I have tried my best to utilize the opportunity to enrich my knowledge on banking system and incorporate it with the theoretical course.

Rational of the study:

There are three specific sectors in the EXIM Bank. General banking, Investment & Foreign Trade are those. Basically under those sectors EXIM Bank play a vital role of the country General banking is one of the profitable sites for the all bank. On the other investment also a strong silt of the EXIM Bank Ltd. But EXIM Bank (Export Import Bank of Bangladesh) is most popular for its foreign trade. Besides it have very strong relationship with the foreign customer. EXIM Bank’s foreign trade policy is huge. Basically most of the customer is made an import & export by the EXIM Bank. So the foreign trade policy is selected by me to submit a internship report up to EXIM Bank of Bangladesh Ltd.

Objectives of the study:

The objective of the study is to gather practical knowledge on banking system and operation. This internship gives us a chance to co-ordinate with the theoretical knowledge and the practical experience and to evaluate the performance of general banking & foreign exchange banking of Exim Bank. The following are of objective for internship in bank:

General Objective

The general objective is to prepare & submit a report on the topic of “General Banking with foreign exchange activities of Exim Bank of Bangladesh Ltd.”

Specific Objective

- To apply theoretical knowledge in the practical field.

- To be familiar with the banking management system.

- To have exposure to the functions of general banking section.

- To analyze the service procedure of Exim Bank Ltd.

- To evaluate the performance of foreign exchange banking division.

- To come up with a SWOT analysis of Exim Bank.

- To know the return on export, import & remittance.

- To familiarize the working hours, values and environment of the bank.

- To analyze the financing system of the Bank and find out whether the bank needs any improvement.

- To familiarize different rules and regulations of export and import formalities.

- To find out the contribution of private commercial banks for the economic development of the country.

Methodology of the study

The planned methodology of the research is given below:

(A) Sources of data

Data regarding the completion of this research will be collected from both primary and secondary sources.

The core information and data source is expected to be primary, because it will involve interviewing officials of Exim Bank, Malibagh branch to get detailed information about the innovative products they offer. The officials who will be interviewed are:

- Branch Sales & Service Manager

- Sales Team Manager

- Cash Manager

- Personal Financial Consultant

Primary sources

- Practical desk work

- Face to face conversation with the officer

- Direct observations

- Face to face conversation with the client

Secondary sources

- Annual reports of Exim Bank Ltd.

- Files & Folders

- Memos & Circulars

- Daily diary (containing my activities of practical orientation) maintained by me,

- Various publications on Bank,

- Websites,

- Different circulars sent by Head Office and Bangladesh Bank.

Scope of the study:

This report has been prepared based on General Banking & foreign exchange. While preparing this report I had a great opportunity to work in those division. And this work experience gives me a idea about in general banking system & foreign exchange department of EXIM Bank. It enhances my practical knowledge in banking activity and I can be able to communicate with practical and theoretical one.

An Overview of Banking sector in Bangladesh

Introduction:

Economic history shows that development has started everywhere with the banking system and its contribution towards financial development of a country is the highest in the initial stage. Schumpeter (1933) regarded the banking system as one of the two main agents (other being entrepreneurship) in the whole process of development. Keynes also emphasized the role of banking services in the process of economic development of a country, while SHE was addressing the House of Lords regarding International and Monetary System (quoted in Sharma 1985). Moreover Alexander Gerashchenko (1962) in his popularly known “Gerschenkron’s Hypothesis” explained the banking system as the key role player at certain stage of the industrialization process.

In today’s world the life of the people directly or indirectly are within the arena of banking whether conventional or Islamic banking. Although Islamic banking is not a newer concept in Bangladesh as it has started its operation since 1983, very few people are aware about its operation. But things are changing. Now the emerging question is what are the grounds that differ Islamic banking from conventional banking? In this regard we have to know about the banking in Bangladesh & their operation and also the same things about Islamic banking. Through this we can understand the basic differences between these two banking systems- conventional and Islamic banking.

Modern banking system plays a vital role for a nation’s economic development. Over the last few years the banking world has been undergoing a lot of changes due to deregulation, technological innovations, globalization etc. These changes in the banking system also brought revolutionary changes in a country’s economy. Present world is changing rapidly to face the challenge of competitive free market economy. It is well recognized that there is an urgent need for better, qualified management and better-trained staff in the dynamic global financial market. Bangladesh is no exceptions of this trend. Banking Sector in Bangladesh is facing challenges from different angles though its prospect is bright in the future.

Definition of Bank:

A bank is a financial intermediary that accepts deposits and channels those deposits into lending activities, either directly or through capital markets. A bank connects customers with capital deficits to customers with capital surpluses.

Objective of Bank:

The main objective of commercial banks is to maintain higher profitability by maintaining circular and efficient flow of amount of money deposited by the customers and the lenders. Commercial banks contribute to the economic cycle by keeping the money circulation among households, government and corporate businesses. The commercial banks lend money to the economic agents through their various products and services by earning interest income on the borrowed money. Commercial banks design their short term and long term loans and other products to cater to the need of customers while enhancing their own returns. Their objective is to attract more customers and build profitable relationships with the new and existing customers.

The role of Banks:

Banks are engage in the following activities:

* processing of payments by way of telegraphic transfer, EFTPOS, internet banking, or other means

* Issuing bank drafts and bank cheques

* Accepting money on term deposit

* Lending money by overdraft, installment loan, or other means

* Providing documentary and standby letter of credit, guarantees, performance bonds, securities underwriting commitments and other forms of off balance sheet exposures

* Safekeeping of documents and other items in safe deposit boxes

* Sale, distribution or brokerage, with or without advice, of insurance, unit trusts and similar financial products as a “financial supermarket”

* Cash management and treasury services

* Merchant banking and private equity financing

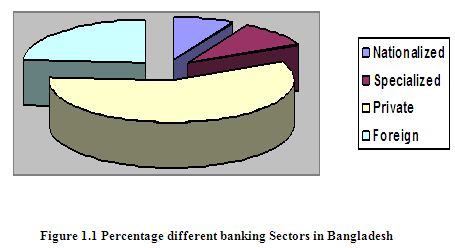

Banking Industry in Bangladesh: An Overview

The gradual improvement in the overall policy environment has enabled Bangladesh to improve its economic performance in recent years. Successive governments in Bangladesh have been confronted with the problem of stimulating the economic growth rate in a country where a substantial segment of the population lives below the subsistence level. Economic policies are still guided by five year plans. The prospect of economic growth in Bangladesh in the near future will depend on the pace of economic reforms and the quality of macroeconomic management. Accelerating the rate of economic growth will require higher levels of investment. This will primarily come from private flows of foreign direct investment. This can be established by reforming the financial system and continuing the process of financial deepening.

The banking industry in Bangladesh is one characterized by strict regulations and monitoring from the central governing body, The Bangladesh Bank. As the government is often the owner and regulator as well as the supervisor and customer of a bank, there has been ample opportunity for mismanagement over the years. The banking sector is plagued with a lack of credit discipline, archaic loan recovery law, corruption, inefficiency, overstaffing, etc. Several reform measures of the financial sector have been taken to improve the situation. Relative stability achieved by the support extended by both the central bank and the Government of Bangladesh in the past has restored public confidence in the country’s banking sector. Moreover, Nationalized Commercial Banks (NCBs) and old generation Private Commercial Banks (PCBs) would have to lower the rate of NPAs in their portfolios. Failure to do so would mean re-capitalization, at least for the NCBs. This may in turn lead to a further drain on the limited resources of the Government of Bangladesh at this time or in the immediate future this recapitalization would not be feasible. With these conditions in place, the World Bank anticipates the likelihood of a situation where the ever-increasing burden of non-performing

Loans and growing rate of debt servicing would place the economy under enormous strain and result in a crisis in the banking sector in the long term.

The main concern is that currently there are far too many banks for the bank to sustain.

As a result the market will accommodate only those banks that can transpire as the most competitive and profitable ones in the future.

Currently the major financial institutions under the banking system include

- Bangladesh Bank

- Commercial Banks

- Islamic Banks

- Leasing Companies

- Finance Companies

Generally, the commercial banks and the finance companies provide

Myriad of banking products/services to cater to the needs of their customers. However, the Bangladeshi Banking industry is characterized by the tight Banking rules and regulations set by the Bangladesh Bank. All banks and financial institutions are highly governed and controlled under the Banking Companies Act 1993. The range of banking products and services is also limited in scope. With the liberalization of markets competitions among the banking products seems to be growing more instances each day. In addition, the banking products offered in Bangladesh are fairly homogeneous in nature due to the tight regulations imposed by the central bank. Competing through differentiation is increasingly difficult and other banks quickly duplicate any innovative banking service.

These private banks are popularly known to public as First Generation Banks (9 banks opened during 1982-88), Second Generation banks (13 banks opened during 1992-96) and Third Generation banks (13 banks opened during 1999-2001).

Name and Location of the EXIM Bank

Export Import Bank of Bangladesh Limited is commonly known as EXIM Bank ltd. As the name replies a newly formed commercial bank but is the First of its kind of bank in Bangladesh. It has incorporated in Dhaka, Bangladesh as public Limited company and its head office is located at “SYMPHONY”Plot # SE (F): 9, Road # 142,Gulshan Avenue, Dhaka- 1212

Phone: 880-2-9889363, 9891489Fax: 880-2-8828962

Historical Background of EXIM Bank

EXIm Bank Limited was established under the rules & regulations of Bangladesh bank & the Bank companies’ Act 1991, on the 3rd August 1999 with the leadership of Late Mr. Shahjahan Kabir, Founder Chairman who had a long dream of floating as commercial bank which would contribute to the social-economic development of our country. He had a long experience as a good banker. A group of highly qualified and successful entrepreneurs joined their hands with the founder chairman to materialize his dream. In deed, all of them proved themselves in their respective business as most successful star with their endeavor, intelligence, hard working and talent entrepreneurship. Among them, Mr. Nazrul Islam Mazumder became the honorable chairman after the demise of the honorable founder chairman.

Of its very beginning, EXIM Bank Bangladesh limited was known as BEXIM Bank, which stands for Bangladesh Export Import Bank Limited. But for some legal constraints the bank renamed as EXIM Bank, which means Export Import Bank Of Bangladesh Limited.

The Bank starts its functioning from 3rd August 1999 with Mr. Alamgir Kabir, FCA as the advisor and Mr. Mohammad Lakiotullah as the Managing Director. Both of them have long experience in the financial sector of our country. By their pragmatic decision and management directives in the operational activities, this bank has earned a secured and distinctive position in the banking industry in terms of performance, growth, and excellent management.

The bank has migrated all of its conventional banking operation into Shariah based Islamic banking since July/2004.

Vision of EXIM Bank

The gist of our vision is “Together towards Tomorrow”. Export Import Bank of Bangladesh Limited believes in togetherness with its customers, in its march on the road to growth and progress with services. To achieve the desired goal, there will be pursuit of excellence at all stages with a climate of continuous improvement, because, in EXIM Bank, we believe, the line of excellence is never ending. Bank’s strategic plans and networking will strengthen its competitive edge over others in rapidly changing competitive environments. Its personalized quality services to the customer with the trend of constant improvement will be cornerstone to achieve our operational success.

Mission of EXIM Bank

- To be the first bank in the banking arena of Bangladesh under the Shariah guidelines.

- To maintain Corporate and business ethics.

- To become a trusted repository of customers’ money and their financial advisor

- To make our stock superior and rewarding to the customers/share holders.

- To display team spirit and professionalism.

- To maintain a Sound Capital Base.

- To provide high quality financial services in export and import trade.

- To provide excellent quality Customer service.

EXIM’s Objectives

Based on their mission and vision, Exim Bank has come up with few objectives, which they believe will help them reach their desired destination. They are:

Gaining a larger market share: Exim Bank currently has a quite low market share of less than 6%. They want to increase their market share in the coming years.

Strengthening brand image: Exim wants to establish them as a bank providing excellent service in the minds of the customers. This will help them strengthen their brand image.

Provide technologically advanced services: Exim wants to provide technologically advanced services for the convenience of their customers. They were the first bank in the country to introduce Money link ATM cards. Now they have introduced Phone-banking, Internet banking and sms banking.

Making banking comfortable and convenient for customers: Exim wants to retain their customers by making customers feel comfortable while they are at the banking premises. For this reason they have arranged for adequate seating facilities. Now customers do not have to wait for long hours in queues, they can sit with their token until their token number appears on the screen and they are called to the counter.

Encourage and motivate customers so as to increase sales and profits: Exim wants to retain their previous customers by keeping them motivated by providing them with gifts for extensive use of ATM cards and Credit Cards and by providing higher interest rates to customers who open their accounts with a higher initial balance. This will also help them to attract new customers.

Ensuring customer satisfaction: Standard Chartered Bank has made use of different means of getting feedback from customers so as to understand their level of satisfaction, based on which they can take the necessary actions to ensure customer satisfaction.

Management:

EXIM is managed by highly professional people. The present Managing Director of the bank is a forward looking senior banker having decades of experience and multi discipline knowledge to his credit both at home and abroad. He is supported by an educated and skilled professional team with diversified experience in finance and banking. The management of the bank constantly focuses on the understanding and anticipating customers’ needs and offer solution thereof. EXIM Bank Limited has already achieved tremendous progress within a short period of its operation. The bank is already ranked as one of the quality service providers and known for its reputation.

Planning

EXIM now follows a top down planning approach. The top managers have the authority to decide how they will achieve their goal. The Business Bank mainly does planning and Retail Bank Division, IT Department provides all the assistance and information that is required to create and execute long term and short term planning. Planning and IR Department provides all the assistance and IT and other infrastructure in order to reduce the paperwork IT has taken a plan to achieve the long term plan.

Organizing

Each branch is being managed by one branch sales and service manager (BSSM). The performance of each branch is mainly dependent on the branch manager.

Directing and Controlling

Management is partly authoritative and participant at the top level of EXIM But every one has some assigned work to do for the day and they cannot deny this. Sitting arrangement is created in such a way that co-workers can sit close to each other and have sharing of their work and at the same time can have easy contact with each department coordinator/ Head. The work environment is very friendly. The room contains sufficient amount of light and is always kept cool by high capacity air conditioners.

Human Resources Division

This department manages recruitment, training and career progression plan. Standard Chartered Bank highlights the importance of developing its people to create a culture of customer service, innovation, teamwork and professional excellence.

IT Department

This department is instrumental in the running of all the computerized operations of the bank. They help in the implementation and generation of computerized reports. Another major duty of the department is to maintain communication with the rest of the world.

Recruitment

Recruitment is the process of gathering a group of qualified applicants. Job analysis provides information about what the job entails and what human characteristics are required to perform these activities. This information, in the form of job descriptions and job specifications, helps managements decide what sort of people to recruit and hire. Organizations want to be able to identify and hire the best people for the job and the organization in a fair and efficient manner. A properly developed assessment tool may provide a way to select successful sales people, concerned customer service representatives, and effective workers in many other occupations

Recruitment Sources:

There are different sources of recruitment process that can be used by a company. These are:

- Internal versus External Sources

- Direct Applicants and Referrals

- Advertisements in Newspapers and Periodicals

- Public Employment Agencies

- Private Employment Agencies

- College and Universities

- Electronic Recruiting

Recruitment Process

EXIM BANK is following the “Judgmental Method” for recruitment. At the beginning of the recruitment process, EXIM BANK sends a form to all the managers to let the authority know about the current human resource. Are there any shortage of human resources and how many employees they needed to run the operation smoothly? Based on the decision from upper level employees are hired from different sources.

Motivational Program

Employee benefits packages are provided as an addition to compensation in order to attract and retain employees, which are worked as motivational issue for employees. Best practice organizations align the employee benefits policies with policies on compensation and reward and recognition as part of “Total Compensation” approach. The current motivational programs of EXIM BANK are:

- Health care/ Medical facilities provided for the employees.

- The employees get bonus in two Eid at a rate of their basic salary.

- Pay for time not worked facilities is available for all the employees.

Training and development

Training represents a positive hope for persons first entering the world of work or for individuals changing their work environment. When training is designed well, it gives individuals opportunities to enter the job market with needed skills, to perform new functions, and to be promoted into new situations. Therefore, it is not surprising that labor unions have included training opportunities as an item in contract bargaining negotiations.

Training Objectives

Objectives for training should relate to training needs identified in the need analysis. The success of the training should be measured in terms of the objectives set. AB BANK has set their training objective as:

- Increase quality of work

- Reduce failure of timeliness of work

Training Evaluation

Evaluation of training compares the post- training results to the objectives expected by managers, trainers, and trainees. EXIM bank has no formal post training evaluation program, but they monitor the following thing after training:

- Reduction in errors

- Less supervision necessary

- New skills that lead to ability to do more jobs

- Whether attitudes changes or not

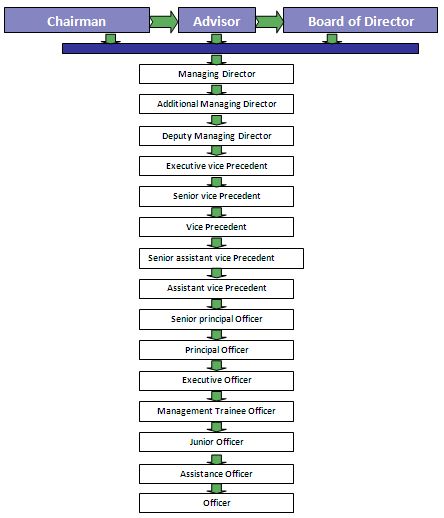

Management Hierarchy of EXIM Bank:

Management hierarchy of EXIM Bank compares four significant levels, this are follows:

- Top level management

- Executive level management

- Mid level management &

- Junior level management.

EXIM’s Strategies

EXIM Bank has formulated some strategies to achieve their desired Objective. These are:

Promotional activities: Exim Bank is trying to achieve their objective of increasing their market share by engaging in promotional activities. Example: They are offering free shopping worth Tk 2,000 from Agora to customers who will be able to refer at least 5 new customers to EXIM.

Assigning targets to salespeople: The salespeople of Exim Bank are assigned targets based on their desired increase in market share. Salespeople are paid based on the number of sales they can make. If they are unable to achieve their target, they are not paid. This acts as a negative motivational factor, which is a driving force for the salespeople.

Offering a very wide range of innovative products: Exim Bank wants to establish themselves as a strong brand name in the minds of customers. In order to achieve this objective they are continuously coming up with innovative products such as night banking, 24 hours ATM banking, 24 hours Phone banking, Internet banking, Sms banking, platinum credit cards having a maximum credit limit of BDT 1,000,000 and many more.

Introducing more convenient and comfortable means of banking: The innovative products offered by Exim have already made banking more convenient for customers. They have introduced token systems for customers who want to engage in cash and cheque transactions or want to make remittances. Customers no longer have to wait for long hours in the queue; they can sit making themselves comfortable and wait for their token number to appear on the screen before they go to the counter.

Corporate Culture

EXIM bank is one of the most disciplined Banks with a distinctive corporate culture. Here the bank believes in shared meaning, shared understanding and shared sense making. Banks people can see and understand events, activities, objectives and situation in a distinctive way. They mould their manners and etiquette, character individually to suit the purpose of the Bank and the needs of the customers who are of paramount importance to the bank. The people in the Banks see themselves as a tight knit team or as family that they believe in working together for growth their corporate conduct.

Social Commitment

The purpose of our banking business is, obviously, to earn profit, but the promoters and the equity holders are aware of their commitment to the society to which they belong. A mass of the profit is kept aside to spend for socio-economic development through trustee and in patronization of an art, culture where it operates.

EXIM Bank Foundation and CSR Activities

At least 2% of our annual profit of every year is put aside for the foundation to conduct Corporate Social Responsibilities (CSR) activities. The mainstream CSR activities that are carried out through this foundation are:

- Healthcare service.

- Scholarship program for brilliant poor student.

- Education Promotion Scheme (Interest free loan).

- Helping people affected by natural calamities.

- Helping people in slum areas.

- Donation to educational institutions to setup computer lab.

- Beautification of Dhaka City.

Product & services of Exim Bank:

EXIM bank is foreign commercial bank in the arena of banking business, To all intents and purposes; it’s on time delivered service to the customers as demand is considerably better than others. By means of day to day customer service, the customers are being well-informed concerned with its contemporary and up – to -the- minute invented products easily. It also thinks that Customer Care brings perfection to a bank and believes that effective Customer Care strengthens the product knowledge in to customer’s mind more positively and precisely.

The products are customers friendly and easy to use. The product mix is maintained in accordance with the need basis for the customers and profit generating for the banks as well. The following financial products are available for the customers,

- Deposit Products:

- Investment Products

- Plastic Card Products

- Remittance Service

- L/C (Import & Export) Products

- Other Products

Bank Operational Area:

Export and Import Trade Handling and Financing

As a commercial Bank, they do all traditional Banking business including the wide range of savings and credit scheme products, retail banking and ancillary services with the support of modern technology and professional Excellency. But their main focus is, for obvious reason, on export and import trade handling and the development of entrepreneurship and patronization of private sectors.

The Operational sectors are:

- Agro processing industry

- Textile spinning, Dyeing/printing

- Export oriented Garments, Sweater

- Foods & Allied

- Paper & products

- Engineering steel mills

- Chemical, Pharmaceuticals etc.

- Telecommunication

- Computer Software and information technology

- Manufacturing of artificial flowers

- Electronics

- Infrastructures

- Oil & gas

- Jewelry and diamond cutting and polishing

- Liquefied petroleum Gas (LPG)

- Compressed Natural Gas (CNG)

- Tiles

- Ceramics

- Small and Medium Enterprises (SME)

Export and Import Trade Handling and Financing

As a commercial Bank, EXIM Bank Ltd performs all traditional Banking business including the wide range of savings and credit scheme products, retail banking with the support of modern technology and professional Excellency. But its main focus is, on export and import trade handling and the development of entrepreneurship of private sectors.

Sources and Uses of Fund

The compositions of sources of banks fund are paid up capital, reserve, customer deposit and call loan from different banks. The bank used major portion of this fund for investment in loans and advance. The bank also invested in securities and shares. The surplus fund was applied in call money market to earn satisfactory returns.

Deposit

The total deposit of the bank increased to Tk. 5,758.70 corers as on December 31, 2008 from Tk. 4,746.65 corers as at the end of the previous year indicating an increase of 21.32% than the previous year. The EXIM Bank remains committed to increasing its deposit base on lowering the banks overall cost of fund.

Loans and Advance in EXIM Bank Limited

During the year 2008, total loans and advances increased by tk. 2,894.02 corers in the change of 17.75% growth over the preceding period. This is due to increased commercial and trade financing, term leading and working capital support. The classified loan position is almost nil. This was achieved by rendering due attention and monitoring high-risk advance. As a result classified advance is amounted to Tk. 2,457.72 corers in 2008. The bank is trying to operate its credit activities with the target of achieving Zero classified loans. The notable investment represents deployment in Treasury bills and Shares, Prize bond & others.

Investment of EXIM Bank Limited

The size of investment portfolio of the bank as on December 31, 2008 stood at Tk. 5,363.77 corers against Tk. 4,019.52 corers in the previous year showing an increase of 33.44%. The notable investment represents general investment & bills discounted & purchased.

Import Business

The total import business handled by the EXIM Bank during the year 2008 was Tk. 7,854.05 corers as compared to Tk. 6,139.94 corers in the previous year showing an increased rate of 27.92%. The significant items of imports were industrial raw materials, consumer goods, machinery, Fabrics and accessories etc.

Export Business

The total volume of export handled by the bank during 2008 was TK. 7,646.56 corers compared to TK. 5,579.04 corers in the previous year are showing an increased rate of 37.06%. The export trade continuous to be a major growth area for the bank and the bank intends to concentrate in this of business in the coming years.

SWIFT Service

The SWIFT services helped the bank in sending and receiving the messages and instructions related to its NOSTRO account operations and L/C related matters. The Bank has brought 8 of its branches under SWIFT network.

Performance of EXIM Bank

Within a short time period EXIM Bank Ltd has been successful to position itself as a progressive and dynamic financial institution in the country. The Bank widely acclaimed by the business community, from small business/entrepreneurs to large traders and industrial conglomerates, including the top rated corporate borrowers from forward-looking business outlook and innovative financing solutions. The bank achieved satisfactory progress in all areas of its operation and earned a positive operating profit almost in every year.

Six years financial Growth of EXIM Bank at a glance (Figure in Crore):

Sl. | Particulars | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

1 | Authorized Capital | 100.00 | 100.00 | 350.00 | 350.00 | 350.00 | 1000.00 |

2 | Paid-up Capital | 62.78 | 87.90 | 171.38 | 214.22 | 267.78 | 337.39 |

3 | Reserve Fund | 35.73 | 57.00 | 81.09 | 113.46 | 153.26 | 209.29 |

4 | Deposits | 1907.82 | 2831.90 | 3503.20 | 4154.66 | 5758.70 | 7383.54 |

5 | Investment (General) | 1933.20 | 2604.60 | 3264.13 | 4019.52 | 5363.77 | 6860.99 |

6 | Investment ( Shares on Bonds) | 154.30 | 163.30 | 223.33 | 245.77 | 289.40 | 216.94 |

7 | Foreign Exchange Business | 4931.24 | 7294.00 | 9617.51 | 11790.01 | 15643.46 | 16260.46 |

| a) Import Business | 2678.10 | 4143.20 | 4959.67 | 6139.94 | 7854.05 | 8391.15 | |

| b) Export Business | 2241.84 | 3128.50 | 4623.46 | 5579.04 | 7646.56 | 7624.07 | |

| c) Remittance | 11.31 | 22.30 | 34.38 | 71.03 | 142.85 | 245.23 | |

8 | Operating Profit | 83.58 | 117.58 | 137.87 | 190.82 | 251.84 | 381.98 |

9 | Loan as a % of total Deposit | 101.33% | 91.97% | 93.18% | 96.75% | 93.14% | 92.92% |

10 | No. of Foreign Correspondent | 200 | 222 | 246 | 246 | 278 | 333 |

11 | Number of Employees | 768 | 934 | 1020 | 1104 | 1312 | 1440 |

12 | Number of Branches | 28 | 28 | 30 | 35 | 42 | 53 |

13 | Return on Assets | 1.57% | 1.65% | 1.73% | 2.00% | 1.83% | 2.19% |

Over all Banking process of Exim Bank

Department wise Activities

The General Banking Department does the most important and basic work of the banks. All other department is linked with this department. It does play a vital role in deposit mobilization of the branch. EXIM Bank provides different types of accounts & special types of saving scheme under general banking. For proper functioning & excellent customer service this department is divided under the customer relation desk. This are-

v Account opening, Transfer & Closing

v Remittance & Bill section

v Deposit section

v Cash section

v Clearing section

v Accounts section

Account opening, Transfer & Closing section:

Account opening:

This section deals with opening of different types of accounts. It is also deal with issuing of cheque-books & different account openers. A client/ customer can open different types of accounts through this department such as:

- Al-Wadia Current Deposit

The characteristics of this account are almost similar to current account of conventional banks. The owner of the fund doesn’t enjoy any profit nor bear any loss. But the bank obtains the permission from the depositors so that the bank has the option to use the fund when it is necessary.

- Mudaraba Savings Deposit

Mechanism is almost similar to the savings account of the conventional banks. The basic difference in this case is that the bank & the owner of the fund will share the profit from the operating income while the loss from the operating income will be borne by the owner of the fund unless the loss is incurred due to the negligence or convenience of the bank. Generally, current account is opened for businessmen & traders for easy transaction. But a person can open CD account for special purpose investment also.

- Mudaraba Short Term Deposit

In short term deposit, the deposit should be kept for at least seven days to get interest. The interest offered for STD is less than that of saving deposit. In EXIM Bank various big companies, organizations, govt. departments keep money in STD Accounts. EXIM Bank offers 5.5% interest on short-term deposit account. Profit will be divided for staff daily basis. Frequent withdrawal is discouraged & requires prior notice. The account holder must give notice seven days before the withdrawal that is why short term deposit is called “seven days notice” current account. Under the current account, saving account & short term deposit account, Individual/joint account, partnership account, proprietorship account, limited company, club/society account can be open.

Limited Account:

- Account opening form

- Two photographs of the signatories duly adjusted by the introducer

- Valid copy of trade license

- Board resolution of opening account duly certificate by the chairman, managing director

- Certificate of Incorporation

- Certified [join stock] true copy of the memorandum and Article of association of the company. Duly attested by the chairman or managing director

- List of director along with designation and specimen signature. Also, need the list of the name of operating body

- Latest certified copy of form- X11 [ to be certified by the register of join stock companies, in case of directorship change]

- Rubber stamp [seal]

- Certificate of registration [in case of insurance company]

Opening of Term Deposit Account:

The depositors has to fill an application form in he/she mentions the amount of deposit, the period for which deposit is to be made the name/names in which the term deposit receipt is to be issued. In case of a deposit in joint name, EXIM Bank also takes the instructions regarding payment of money maturity of the deposit. The banker also takes the instructions regarding payment of money on maturity of the deposit. The banker also takes specimen signature of the depositors. A term deposit account is then issued to the depositor acknowledging receipt of the sum of money mentioned therein. It also contains the rate of profit & the date on which the deposit will fall due for payment. Organization can open a term deposit account.

Payment of profit:

It is usually paid on maturity of the term deposit. EXIM Bank calculates profit at each maturity date & provision is made on that “mudaraba term deposit (MTD) expenditure payable account” is debited for the accrued profit.

Encashment of MTD:

In case of premature MTD, EXIM Bank is not bound to accept surrender of the deposit before its maturity date. In order to dater such a tendency the profit on such a term deposit is made cut a certain percentage less on agreed rate. Normally less than one month or one month no profit will get. If deposit is more than one month then STD profit rate (6%) is allowed.

Loss of MTD:

In case of loss MTD, the client has to inform, then has to application to the bank. Then he/she is asked to record GD (General Diary) in the nearest police station. After that, the client has to furnish am Indemnity Bond to EXIM Bank a duplicate MTD is then issued to the client by the bank.

Monthly Income Scheme (Steady Money):

Objectives of the scheme:

• A monthly scheme that really makes good sense. A sure investment for a steady return. Actually, steady money makes your money work for you.

• Proper utilization of savings from stipend, wage earning, retirement benefit and so on.

• Higher monthly income for higher deposit.

Formalities of opening an account:

• An account is to be opened by filling up a form.

• The Bank will provide the customer a deposit receipt after opening the account. This receipt is non-transferable.

Highlights of the scheme:

• Minimum deposit Tk. 1,00,000/-.

• The scheme is for a 3 (three)-year period.

Deposit Amount | Income (Tk.) |

1,00,000/- | 1,000/- |

• The income is estimated which may be more or less at the year end and accordingly the same shall be adjusted. The deposit will bear 1.15 weightage.

• Not less than 65% of Investment Income shall be distributed among the Mudaraba Deposit holders as per weightage.

• Bank reserves the right to change the weightage of deposit & percentage of distribution of Investment Income.

Quard facility:

A depositor can enjoy investment facility (excluding Quard) up to 80% of the deposited amount under this scheme complying investment norms of the bank. In this case, profit, will be charged against the investment facility as per Bank’s norms. During the tenure of the investment, the Monthly Income will be credited to the investment account until liquidation of the invested amount inclusive of profit.

Disbursement of monthly income:

Monthly income will be credited after one month i.e., on the due date of the next month to the depositor’s account.

Premature encashment of the account:

If the deposit is withdrawn before a 3 (three)-year term, then saving rate plus 0.75% of profit will be applicable and paid to the depositor. However, no profit will be paid if the deposit is withdrawn within 1 (one) year of opening the account and monthly income paid to the customer will be adjusted from the principal amount.

Additional terms and conditions:

• Applicant must open/have a Al-wadia CD or Mudaraba SB A/C with the branch in which monthly income will be credited automatically.

• The government taxes will be paid to the debit of monthly income.

More than double the deposit in 6 years (Super Savings):

Objectives of the Scheme:

Savings help to build up capital and capital is the principal source of business investment in a country. That is why savings is treated as the very foundation of development. To create more awareness and motivate people to save, EXIM Bank offers super savings scheme.

Terms and Conditions of the Scheme:

• Any individual, company, educational institution, government organization, NGO, trust, society etc. may invest their savings under this scheme.

• The deposit can be made in multiples of Tk. 5,000.00.

• Any customer can open more than one account in a branch in his/her name or in joint names. A Deposit Receipt will be issued at the time of opening the account.

• The Deposit will approximately be double in 6 (six) years.

Highlights of the Scheme:

• Some examples are given in the table below. Any amount can be deposited in multiples of Tk. 5,000.00.

Deposit | Payable (approximately) at maturity |

5,000.00 | 10,002.00 |

10,000.00 | 20,004.00 |

20,000.00 | 40,008.00 |

50,000.00 | 1,00,020.00 |

1,00,000.00 | 2,00,040.00 |

2,00,000.00 | 4,00,081.00 |

5,00,000.00 | 10,00,203.00 |

• Savings will be treated as projected and it will be adjusted after the declaration of profit at the end of the year. The weightage of deposit will be 1.17.

• Not less than 65% of investment income shall be distributed among the Mudaraba Deposit holders as per weightage of deposit.

Premature encashment of the scheme:

• In case of premature encashment before 1 year no profit shall be paid.

• In case of premature encashment after 1 year but before 3 years profit shall be paid at Savings Rate plus 0.75%.

• In case of premature encashment after 3 years but before maturity profit shall be paid at Savings Rate plus 1.00%.

In case of any unexpected situation:

• In case of death of depositor before the term, the amount will be given to the nominee according to the rules of premature encashment. In the absence of nominee, the heirs/ successors will be paid as per succession certificate.

• In case of issuing duplicate receipt the rules of issuing a duplicate receipt of Term Deposit will be applicable.

• The nominee may, at his option continue the scheme for the full term.

Quard facility under the scheme:

• A depositor can avail quard up to 90% of the deposit under this scheme.

Additional terms and conditions:

• Bank reserves the right to change the weightage of deposit & percentage of distribution of Investment Income.

• At the time of payment, Income Tax shall be deducted upon profit.

Closing of an account:

A client can close his or her account anytime by submitting an application to the branch. There must be a signature of the client in the application and the account opening officer will verify it. The account then checks the clients account position. The client then ask to draw a final cheque for the credit amount in the account excluding account close charge Tk. 50 plus VAT 7.50 and other incidental charges. The closing charge of current deposit account (Tk. 200), closing charge of savings account 200 + VAT 30 (Tk. 230), and the closing charge of short term deposit account is 200 + VAT 30(Tk. 230). To close the account the cheque book is to be returned to the bank. Vouchers are then issued with debiting the particular account and crediting incidental charges account.In case of joint account the application for closing the account should be signed by all the joint account holder, even if the account is operated by either of them. The last cheque for withdrawal of the available balance in the account should also be signed by all the joint account holder.

The closing of an account may happen,

- If the customer/client is desirous to close the account

- If EXIM bank finds that the account is inoperative for a long duration

- If the court on EXIM bank issues garnishee, order.

Deposit section:

The function of deposit section is very important. It is fully computerized. The officer of the deposit section maintains account no. of all the customer of the bank. They are used different code no. for different account. By the section a depositor/drawer can know what is the present position his or her account. The officer makes posting three types of transaction such as cash, clearing & transfer.

This section performs the following tasks

- Post all kind of transaction

- Provide all demand report

- Check maintenance

- Preparation of day transaction position

- Preparation of closing monthly transaction

Cash counter section:

Cash is the key instrument of all financial transaction. The cash section plays a significant role. It is a very sensitive part of the bank because it deals with most liquid assets. This section receives cash from depositors and pays cash against cheques, demand draft, pay order and pay in slip over the counter. This section deals with all types of negotiable instruments. Operation of this section begins with the banking hour. The cash officer begins transaction with taking money from the vault, known as “opening cash balance”. Vault is kept in most secured place. The amount of opening cash balance is entered into a register. After whole days transaction, the money remains in the cash counter is deposited back into the vault, known as the closing balance. The functions of a cash department are described below

Cash department:

Cash section of any bank plays a vital role in general banking procedure. Because it deals with the most liquid assets. There is several counters work simultaneously in cash section of EXIM bank. There is also some electronic machines by which a huge amount of cash money can be counted within a few minutes.

Cash receiving procedure:

The work of cash receiving counter is examining deposit slips. Depositor uses the prescribed deposit slip supplied by the bank for deposit cash, cheque, draft; pay order etc. in all types of deposit the letter must check the following things:

- q The slip has been properly filled up

- q The title of the account and in its number & branch

- q The amount of figure and in words is same

- q Instrument signed by the depositor

- q Date of the instrument

After checking all these things the letter will accept cash, cheque, draft, pay order etc. against deposit slip. The letter will place the cash in the cash is drawer according to denominations. The letter will place signature and affix cash receipt, rubber stamp seal and record in the cash received register book against the account number. At the end of this procedure, the cash officer passes the deposit slip to the computer section for posting purpose and returns the customer’s copy.

Cash payment procedures precaution:

In order to safe guard the position the paying banker has to observe the following precaution before honoring a cheque.

- A cheque must be looked whether it is an opened or crossed cheque.

- The paying officer should see whether the cheque is drawn on his/her branch

- He must see if the cheque is post dated or predated. A letter mind not pay any post dated cheque

- The officer must carefully see the apparent tenor of the cheque. If it is mutilated or materially altered then the officer must not honor it.

- The officer must compare the signature of the cheque with the signature on specimen card

- The officer must verify the regularity of the endorsement

- The officer may allow overdue against a cheque if prior arrangement is done with the bank.

Allocation of currency:

Before start the banking hour all tellers give requisition of money through “teller cash proof sheet”. The head teller writes the number of the packed denomination wise in “Reserve sheet” at the end of the day; all the notes remain are recorded in the sheet.

Rules for passing a cheque:

In order to enable the branches to facilitate their day to day transaction smoothly, efficiently, accurately, the following schedule power for passing cheque/instrument signature of vouchers shall come into force with immediate effect

v An authorized officer shall pass cheque for less than Tk. 10,000 singly after proper supervision in computer print out.

v Cheques for Tk. 10,000 and above but below Tk. 50,000 shall be passed jointly by any two authorized officer. After proper supervision by any one officer in computer print out. He will also ensure that no fictitious/long credit in the account has been posted on the day by referring to credit vouchers of the day.

v Cheque for TK. 50, 000 & above shall be passed under the joint signatures of two officers, one of whom must be Manager of the branch. If the cheque for less than TK.10, 000 then deposit in charge will cancel the cheque.

v All the suspense’s A/C (Debit) vouchers, credit A/C debit vouchers, Expenditure A/C vouchers must be signed by the incumbent in charge of the branch with any other authorized officer. As at the close of business of the day all transactions (both debit & credit) shall be checked by referring to computer print out & relative cheque/vouchers.

Remittance and bill section

Remittance section:

Remittance is another significant part of the general banking carrying cash money is trouble same and risky. Mat s why money can be transferred from one place to another through banking channel. This is called remittance. Remittance of founds are one of the most important aspects of the Commercial Banks in rendering services to its customers.

Types of local remittance:

- Between banks and non banks customer.

- Between banks in the same country.

- Between banks in different centers

- Between banks and central bank in the same country.

- Between central bank of different customers.

The main ways used by EXIM Bank for remitting funds are:

- Payment Order (PO)

- Demand Draft (DD)

- Telegraph Transfer (TT)

So the basic three types of local remittances are discussed below:

| Points | Pay Order | Demand Draft | Telegraphic Transfer |

| Explanation | Pay order gives the payee the right to claim payment from the issuing bank. | Demand draft is an order of issuing bank on another branch of the same bank to pay specified sum of money to payee on demand. | Issuing branch requests another branch to pay specified money to the specific payee on demand by Telegraph/Telephone |

| Payment form | Payment from issuing branch only. | Payment from ordered branch. | Payment from ordered branch. |

| Generally used to remit fund | Within the clearing house area of issuing branch. | Outside the clearing house area of issuing branch. Payee can also be the purchaser. | Anywhere in the country. |

| Payment process of the paying bank | Payment is made through clearing. | Confirm that the DD is not forged one. |

Confirm with sent advice.

Check the “Test Code”.

Make payment.Confirm issuing branch.

Confirm payee account.

Confirm the amount.

Make payment.

Receive advice.ChargeOnly commissionCommission + telex chargeCommission telephone.

Foreign Remittance:

People from outside of country send money to homeland is called foreign remittance

EXIM bank conduct foreign remittance agreement in the three country of the world as per below chart

| Remittance agreement Country | Number of remittance agreement |

| United Kingdom | 2 |

| Italy | 1 |

| United Arab Emirate(UAE) | 1 |

Types of foreign remittances:

People can transfer money in three ways:

v CYLINCO FAST CASH

v WESTERN UNION

v SWIFT CODE

Procedure:

If any one transfer money through any of above three ways then the procedure will be same which are:

- A person come to the bank with information like pin no., sender name, receiver name, national id bring to the bank

- He or she must fill up a foreign remittance form

- Bank requires a copy of passport/driving licensee/national ID/etc. & 13 digit PIN no. with the form

- Bank will check online information of above ways according to his or her filled up form

- EXIM bank will collect money through IBCA from the head office & give pay order to that person.

Bills Section:

For safety & security in financial transaction people use financial instruments like DD, PO, cheque etc. Commercial bank’s duty is to collect these financial instruments on behalf of their customer. This process that the banks use is known as clearing & collection. The main function of this section is to collect instruments on behalf of the customer through Bangladesh Bank Clearing House, Outside Bank Clearing, Inter Branch Clearing. Upon the receipt of the instruments this section examines the following things:

- Whether the paying bank within the Dhaka city.

- Whether the paying bank outside the Dhaka city.

- Whether the paying bank is their own branch.

Inward bills for collection (IBC):

When the banks collect bills as an agent of the collecting branch, the system is known as Inward bills for collection (IBC). In this case the bank will work as an agent of the collection bank. The branch receives a forwarding letter & the bill. Next steps are as follows:

- Entry in the IBC register.

- An IBC number is given on the bill.

- Endorsement given “Our branch endorsement confirmed”.

- Give posting to the computer.

- The instrument is sent for clearing.

- If dishonored, the instrument is returned to the collecting branch along with a return memo

Outward bills for collection (OBC):

If the bill is beyond the clearing range then it is collected by OBC mechanism. Client deposit cheque, drafts etc. for collection, attaching with their deposit sleep. Instrument within the

range of clearing are collected through local clearing house, but the other which are outside the clearing range are collected through (OBC) mechanism. A customer of JBL, Main branch, Dhaka is depositing a cheque, of Sonali Bank Cox’s Bazar. Now as a collecting bank JBL local office will perform the following task:

Procedure:

- Depositing the cheque along with deposit slip.

- Crossing of the cheque are done indicating Cox’s bazar as collecting bank.

- Endorsement “payee’s A/C will be certified on realization” is given.

- Entries are given in the Outward Clearing Register (OBC).

Clearing Section:

According to the article 37(2) of Bangladesh Bank Order, 1972, the banks which are a member of the clearing house are called as Scheduled Bank. The Scheduled Banks clear the cheque drawn upon one another through the clearing house. This is an arrangement by the central bank where everybody the representative of the member banks sits to clear the cheques. For clearing there is a department in every bank. This department receives cheques, drafts & like instruments from its client for the purpose of collection with a deposit slip over the counter crediting their accounts. Clearing of cheque is done through the clearing house in Bangladesh Bank. Every day the first hour starts at 10.30 am. & returns house at 5.00 pm.

Function in clearing house

- The clearing house is an assembly of the locally operating scheduled banks. For exchange of cheques, drafts and other demand instrument drawn on each other & receive from their respective customers for collection.

- The house meets at the appointed hour on all working days under the chairmanship of the central bank. The clearing house sits twice in a working day

- The numbers submit the flammable cheques in the respective desks of the bank & vice versa.

- Consequently, the debit & credit entries are given

- At the end, the debit summation and the credit summation are calculated. Then the banks clear the balances through the cheque of Bangladesh Bank.

- The dishonored cheques are sorted and returned with return memo.

Accounts section:

Functions:

- Asset & liability side adjustment

- To maintain EXIM general account

- Depreciation

- To maintain other sid

Now describe briefly above functions:

- Asset & liability side adjustment:

Bank will try to adjust balance of assets & liabilities sides at the end of the year

- To maintain EXIM general account:

EXIM general account is one of the main functions of EXIM bank. It has particular advantages which EXIM bank executes. Some branches of EXIM bank have low deposit & high investment. Basically, high investment branches demand more liability. That’s why; head office charges @13.50 % from those investment branches. On the other side, some other branches have high deposit & low investment. For that reason, asset leads to liability of those high deposit branches. That’s why they get profit @13.25% from the head office. Special types of reconciliation A/C among the bank branches.

- Depreciation:

EXIM bank has some fixed assets & depreciation is charges for those assets (like furniture & fixture à 10%, equipment & machineries à 20%). Depreciation always holds on purchase value of fixed asset through the straight line method. The amount of each month depreciation comes from assets are preserved in accumulated depreciation account in balance sheet liability side. At the end of the year, those accumulated depreciation amounts wash out & then reduce it from asset side.

Foreign Trade Operation

Foreign Trade:

The Foreign Trade of a country refers to its imports and exports of goods and services from and to other countries under contract of sale. No country in the world produces all the commodities it requires. A country may produce more goods if it has comparative advantage in producing such goods. A country exports its surplus goods after the fulfillment of its domestic needs. On the contrary, for domestic needs it imports necessary goods from other countries.

The composition of import and export is an important aspect of a country’s foreign trade. Difference between total import and export of a country is called trade balance of that country. Positive trade balance shows if total exports received exceeds total imports payments and vice versa.

Fundamentals of Foreign Policy:

There are 3 fundamental aspects in the general mechanisms of foreign exchange banking:

- Every country has its own currency legal distinctive unit account.

- The exchange rate affected by means of credit instruments e.g. draft, mail, transfer, telegraphic transfer etc.

- Banks by book keeping entry carried out in the two centers concerned effect the conversion of one currency into another.

Application for Issuing Letter of Credit:

The importer would apply on bank’s standard form to his bank (say, Modern Bank) for issuing a letter of credit. In addition to recording the full details of the proposed credit, the application also serves as an agreement between -he bank and the buyer. The credit application must be clear and precise and generally included the following items:

- Þ Full name and address of the supplier, manufacturer or beneficiary (including his bank).

- Þ Opener’s name and address (including import licence no. etc.)

- Þ The total amount of credit asked for and whether the credit is a

- Þ Specific credit or a revolving letter of credit and amount of the currency in which the documents are to be drawn.

- Þ The type of credit to be opened, i.e. whether revocable or

- Þ Irrevocable, confirmed or unconfirmed, transferable etc.

- Þ The terms of sale, i.e. whether the contract is on CIF, C Ec F, FOB basis.

- Þ The risks to be covered under the policy and the amount of insurance.

- Þ Brief description of goods including quantity, quality and unit price.

- Þ The terms of payment; Whether on DA (Documents against

- Þ Acceptance) or DP (Documents against Payment) basis.

- Þ Specified documents required, such as, invoice, bill of lading, marine

- Þ Insurance policy, certificate of origin, consular invoice, certificate of analysis, packing lists etc.

- Þ Place of shipment, destination and latest dated for shipment.

- Þ The details of the mode of shipment and the documents which are to accompany the bill of Exchange, viz, Airway Bill or Air Consignment. Note, Bill of Lading or Post Parcel Receipt, whether part shipment or transshipment will be allowable.

- Þ The date up to which the credit will remain valid and the dated within which documents should be presented for negotiation.

- Þ Method of advice of credit, whether it should be sent by mail, telecommunicated or electronically conveyed.

Foreign Remittance procedure

The word “Remittance” means sending of money from one place to another place through post and telegraph. Commercial Banks expose this facility to its customers by means of receiving money from one branch of the bank and making an easier arrangement for payment to another branch within the country.

Foreign Remittance section of EXIM Bank Ltd, Main Branch is an integral of Foreign Exchange Department. And its section of Foreign Exchange Banking Department deals with incoming & outgoing foreign currencies. Therefore on the basis of its function, foreign remittance is divided into types. These are

- Outward Foreign Remittance

- Inward Foreign Remittance.

Outward Foreign Remittance:

Remittances issued by EXIM Bank Ltd, Main Branch to foreign corresponding to fulfill its customer’s needs are considered to be the Outward Foreign Remittances. It comprises the following:

- Issuing of Cash Dollar (Buy & Sell)

- Issuing of Traveler Cheque (Buy & Sell)

- Issuing Foreign Demand Draft (FDD)

- Issuing of Foreign T.T (FTT)

- Endorsement of foreign currencies in the passport

- Maintain Foreign Bills Collection

- Opening Foreign Currency account

- Non Residential Foreign Currency Deposit A/C (NFCD)

- Resident Foreign Currency Deposit A/C (RFCD)

- Export Retention Quota A/C (ERQ Account)

- Education File Open.

1. Issuing of Cash Dollar:

This types Bank Cash dollar buy & sell from customer. EXIM Bank provides Saarc Country Cash $500 for Road; Cash $1000 for Air. And bank provides Non Saarc Country Cash $3000. This cash is divided Cash $2000 is for Road & Cash $1000 is Traveler Cheque.

2.Issuing of Traveler Cheque:

EXIM Bank issues only American Express Traveler’s Cheque (TC). For TC, customer has to fill up from. He has to fill up the purchase from also. Purchase from has four copies. One copy for America Express Bank, one copy for EXIM Bank & two copy for the customer. For TC EXIM Bank charges 1% as commission.

Inward Foreign Remittance:

Normally, Inward Foreign Remittance comprises of all incoming foreign currencies. Remittance issued by the correspondent banks situated in the foreign countries & thereby drawn on EXIM Bank, Main branch are considered to be its Inward Foreign Remittance. Followings are the Inward Foreign Remittance of, Main branch.

- FDD Payable

- FTT payable

- TC Payable

- Encashment of foreign currencies endorsed in the passport

- Purchase of foreign currencies.

Import Procedure:

One of the important functions of the EXIM bank is to undertake import of merchandise into the country and payment of foreign exchange forwards the cost of the merchandise to foreign suppliers.

In almost all the countries of the world there is import trade control in one form or the other which supervises the import into the country and controls certain items of exports depending upon national exigencies. The main object of the import trade control is to conserve the scarce foreign exchange resources of the country with a view to meeting the needs of development of its expanding economy. In Bangladesh, the import of goods is regulated by the Ministry of Commerce in terms of the Import and Export (Control) Act, 1950, with Import Policy Orders issued biannually, and Public Notices issued from time to time by the Chief Controller of Import and Export (C C. I. & E) which payments for these imports are regulated by Central Bank, i.e. Bangladesh Bank, through its Exchange Control Department. So, Import Trade Control and Exchange Control are complementary and supplementary to each other.

According to the Imports and Exports Act, 1950 as adopted in Bangladesh any one willing to carry import business needs registration with the licensing authority, i.e. Chief Controller of Imports and Exports and its offices at the important trade centers of the country.

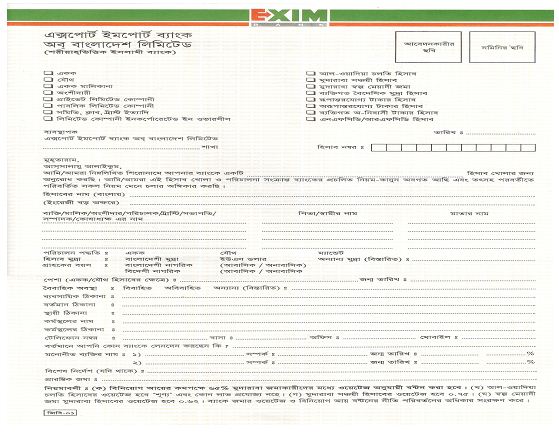

2 Licensing for Imports:

Most imports into Bangladesh require a license from the authority. From 1983-84 shipping banks have been entrusted with the responsibility of licensing imports in both industrial and commercial sectors. Licensing is done by commercial banks by means of a specially designed form known as letter of Credit Authorization Forms simply LCAF, LCA Forms are security documents printed by the respective bank. Bankers must not handover these to others. This form is in reality a substitute for the conventional import license.

The following documents are required to be submitted by the importer to his banker for licensing:

ü The LCA Form properly filled in quintuplicate signed by the importer,

ü L/C Application duly signed by the importer.

ü Purchase contract i.e. indent for the goods issued by an indentor or proforma invoice as the case may be. iv. Insurance cover note.

ü Membership certificate from a recognized Chamber of Commerce and Industry of Town Association or registered Trade Association.

ü Proof of payment of renewal fees for the Import Registration Certificate.

ü A declaration, in triplicate, that the importer has paid income tax or submitted income-tax return for the preceding year.

ü In case of Public Sector, attested photocopy of allocation letter issued by the allocation authority, Administrative Ministry or Division specifying the source amount purpose, validity and other terms and conditions against the imports.

Any such documents as may be required as per instructions issued/to be issued by Chief Controller of Imports 8c Exports from time to time.

On receipt of the LCA Form and the other documents the bank should carefully scrutinize the documents and lodge the same in their respective registration books and duly verify

the signature of the importer put on LCA Form.

Any such documents as may be required as per instructions issued/to be issued by Chief Controller of Imports 8c Exports from time to time.

On receipt of the LCA Form and the other documents the bank should carefully scrutinize the documents and lodge the same in their respective registration books and duly verify the signature of the importer put on LCA Form.

Issuance of license

LCA Form is a set in quadruplicate as mentioned above but licenses are issued in duplicate.

i. Custom Purpose Copy:

The custom copy is to be presented to the custom authority together with a copy of the invoice attested by the banker through whom remittance will be made for obtaining clearance of goods imported.

ii. Exchange Control Copy:

The Exchange Control copy is to be presented to the bank for opening a letter of credit or for making remittance of foreign exchange banking against imports made under the license. The bank should deal with the Exchange control copy of the license only.

On receipt of license, the importer is to make contract with the overseas supplier and arranges to obtain proforma invoice from them for the goods to be imported or will collect indent from the local agent of the supplier for the imports. He will then apply to the bank to open letter of credit in favor of foreign supplier.

Shipment:

To handle the goods for export in the port of shipment banks nominate clearing agents to handle the goods for pass on custom formalities. The bank from amongst the C & F agent of custom authority appoints clearing agents.

The clearing agent on behalf of the bank arrange shipping space in the overseas vessel as per shippers instructions and also pays all the relevant dues payable to the custom authority shipping company as freight, bank or the shipper is to reimburse these to the C&F agent to the debit of party account.

Lodgment of Documents:

After shipment of contracted goods, the supplier prepares shipping documents and presents these to negotiating bank. On being satisfied that the documents are in order in terms of letter of credit, the negotiating bank makes payment to the supplier by debiting the opening bank’s account, if any, maintained with it or claim reimbursement from another bank as stipulated in the reimbursement clause of letter of credit and forwards the shipping documents to the opening bank the importer is to be advised with full particulars of shipment to retire the documents against payment or to dispose the import document as per pre- arrangement, if any.

On receipt of the shipping documents from the negotiating bank, L/C opening bank should carefully examine these to ensure that they conform to the terms of the credit.

Payment:

Payment if not done as per tenor of the draft, the matter must be brought to the notice of the foreign correspondent to ascertain the fate and or the reason for nonpayment. The exporter should also be informed in the matter to peruse the buyer for early payment. If payment is delayed beyond the tenor period the foreign correspondent may claim penal interest from the issuing bank for the delayed period. If a sight bill is not paid within 21 days from the date of purchase/negotiation the negotiating bank realize overdue interest from the beneficiary of the draft for the delayed period after 21 days at prescribed rate. In case of usance bill overdue interest is claimed for the period of delay for payment from the maturity date.

Common Discrepancies of the Import Documents:

The following are the discrepancies usually found in the documentary operation:

- Inadequate number of invoices

- Submission of shipping documents after expiry of L/C 3. Late shipment

- State documents

- Stale B/L.

- Excess drawing

- Shipment made from and to ports other than those permitted in the relevant L/C.

- B/L not properly authenticated or full set not submitted.

- No indication of “Freight Prepaid”

- On board endorsement unsigned or not dated on the B/L.

- Difference in weight in the invoice & with certificate

- Specification of goods is not as per terms of L/C.

- Short submission of documents.

- LCA Number, Bangladesh Bank permission. No or Indenter’s Registration number not mentioned in the Invoice.

- Good short shipped etc.

The above discrepancies must be carefully noted and referred to the Imported for acceptance otherwise Bank would be liable for any problems arising out of them.

Export Process Guidelines:

All exports from Bangladesh are subject to export trade control exercised by the Ministry of Commerce through Chief Controller of Imports and Exports (CCI&E) under the provisions of “Import & Exports (Control) Act 1950” read with provisions of Importers, Exporters and Indenters (Registrations) Order, 1981.

The ensuing Export Process Guidelines have been presented in six (6) sections covering under mentioned areas:

(I) Receiving export LC & advising to beneficiary

(II) Procurement of raw material by opening BTB LCs or Export-Reprocessing LC.

(III) Pre-shipment finance

(IV) Export document scrutiny, processing and negotiation

(V) Post shipment finance

(VI) Proceed realization

Receiving export LC and advising to beneficiary

Scrutiny of export/master LC:

On receipt of the Airmail LC or Cable/Telex/SWIFT LC (short or full), the branch should proceed in the following manner to scrutinize the LC after filling the checklist

v See whether the issuing bank is our correspondent bank.

v Verify the signatures appearing on the airmail LC with the specimen signature of the authorized officials of the issuing bank recorded with us.

v If the signature of the authorized official on the airmail LC differs, bring the same to the notice of the issuing bank immediately by mail/telex/SWIFT for proper authentication.

v See that the goods specified in the LC are permissible for export.

v Examine the terms and conditions of LC very carefully ensuring its conformity with the existing Guidelines for Foreign Exchange Transactions (GFET) or Trade Regulations. If any term or condition in the LC is not in accordance with these regulations, advise the issuing bank by telex (at beneficiary’s or opener’s cost) to get the terms and conditions amended. The beneficiary should also be kept posted with the developments in the matter.

v If the test number of the cable/telex LC does not agree or if the cable/telex in not a tested one, take up the matter at once with the issuing bank through telex for proper authentication and wait for the mail confirmation or tested telex confirmation. The charges incurred in this regard should be recovered from the beneficiary immediately. Only after receipt of mail confirmation or tested telex confirmation, LC should be advised to the beneficiary. Branches may however give preliminary notice to the beneficiary only for his information without any responsibility on our part.