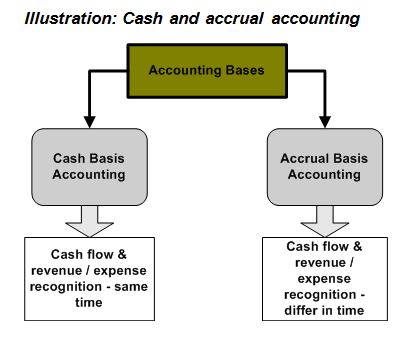

Cash and accrual bases of accounting

We have discussed transactions that include direct and immediate cash flows. Cash was received in the period of earning revenue, or cash was paid in the period of incurring expenses. This is called cash accounting.

Cash (or cash-basis) accounting recognizes the effects of accounting events when cash is exchanged regardless of the time events occur. Cash-basis accounting is not in accordance with generally accepted accounting principles (GAAP).

However, more than often another situation takes place. Cash flows do not match with revenue and expense recognition in the books. This situation falls under accrual accounting.

Accrual (or accrual-based) accounting recognizes the effects of accounting events when such events occur regardless of the time cash is exchanged.

Accrual accounting closely relates to the definition of accounting events recognition.

Recognition is the fact of recording an event in financial records (books).

A recognition act may occur before or after cash has been collected or paid.

The term accrual means that recognition is made before cash is paid or collected

Illustration #1 of accrual accounting

The following illustration will provide a good example of accrual accounting.

Candely Services started its operations on January 1, 20X6 when the business owner contributed $3,500 in cash. During the accounting period of 20X6 the owner, Mr. Candely, provided consulting services to customers and billed them $2,800 for such services. By the end of the accounting period he was able to collect $2,000 of $2,800 billed, leaving a balance of $800 due at the year-end. In addition, Mr. Candely incurred $1,500 liabilities for the only employee’s salary. The company had paid $1,000 of this amount in 20X6, leaving a year-end balance due of $500. As of December 31, 20X6 Mr. Candely had outstanding contracts for consulting services to be performed in 20X7 that amounted to $1,600.

The paragraph above includes the following five accounting events that we will discuss:

- The owner contributed $3,500 into the business.

- Assets obtained in 20X6 accounting period through performing services amounted to $2,800 and contracts for services to be performed in 20X7 amounted to $1,600.

- $2,000 cash was collected from the customers who had been billed for services provided.

- Salary expense for the employee amounted to $1,500.

- The employee was only paid $1,000 during 20X6 accounting period for her work (see Event No. 4) and was to receive another $500 during the following period.

Let us look at each of these accounting events.

Capital acquisition transaction analysis

1) Capital acquisition of $3,500 is an asset source transaction. It acts to increase assets (Cash) and equity (Contributed Capital).

Note: While looking at the scheme below ignore account titles that are unfamiliar at this time; they will be explained later when introduced:

Illustration : Effect of capital acquisition

Assets | = | Liabilities | + | Equity | |||||

Cash | + | Accounts Receivable | = | Salaries Payable | + | Contributed Capital | + | Retained Earnings | |

| Beginning Balances | $0 | $0 | = | $0 | $0 | $0 | |||

| Capital Acquisition | 3,500 | 3,500 | |||||||

| Ending Balances | $3,500 | + | $0 | = | $0 | + | $3,500 | + | $0 |

Recording revenue on account transaction analysis

2) According to the accrual accounting rules, the $2,800 of revenue should be recognized in 20X6, although only $2,000 of this amount is collected in that period. As you can see, revenue recognition and cash collection do not go side by side (they are separated in time). In our case, the productive activity of Mr. Candely has resulted in an asset increase by $2,800. This asset is called an account receivable.

Accounts receivable refer to amounts of future cash receipts that are due from customers (i.e., amounts to be collected in the future). Accounts receivable are shown on the asset side of the balance sheet.

The transaction of revenue recognition is an asset source transaction:

Illustration : Effect of recognizing accounts receivable and revenue

Assets | = | Liabilities | + | Equity | |||||

Cash | + | Accounts Receivable | = | Salaries Payable | + | Contributed Capital | + | Retained Earnings | |

| Beginning Balances | $3,500 | + | $ 0 | = | $ 0 | + | $3,500 | + | $ 0 |

| Recognizing Assets / Revenue | +2,800 | +2,800 | |||||||

| Ending Balances | $3,500 | + | $2,800 | = | $ 0 | + | $3,500 | + | $2,800 |

Note that the contracts for $1,600 of consulting services to be performed in 20X7 are not recognized in 20X6. The reason is that revenue is recorded only when work is accomplished. Thus we will leave this $1,600 without recording until Mr. Candely provides services in 20X7.

Cash collection transaction analysis

3) Now we will record the collection of $2,000 in cash. Because we have already recorded that amount as an account receivable (Event No. 2), we just need to transfer the amount from account receivable to cash $2,000. Cash account will increase and the account receivable will decrease. This is an asset exchange transaction.

Asset exchange transactions occur when only asset accounts are engaged in a transaction. For example, collection of cash on accounts receivable is an asset exchange transaction. Total assets remain unchanged after such transactions.

Illustration : Effect of cash collection

Assets | = | Liabilities | + | Equity | |||||

Cash | + | Accounts Receivable | = | Salaries Payable | + | Contributed Capital | + | Retained Earnings | |

| Beginning Balances | $3,500 | + | $2,800 | = | $ 0 | + | $3,500 | + | $2,800 |

| Cash Collection | + 2,000 | (2,000) | |||||||

| Ending Balances | $5,500 | + | $800 | = | $ 0 | + | $3,500 | + | $2,800 |

Also make certain to note that in this transaction revenue is not affected. The revenue recognition of $2,800 already happened when we recorded the increase in the account receivable (Event No. 2). If we had recorded revenue again when we received cash, then the revenue would have been recorded twice. This would not be in accordance with generally accepted accounting principles.

Recording salary payable transaction analysis

4) Liabilities and corresponding expenses can also be recorded before cash is paid (the same accrual accounting). Mr. Candely would recognize salary obligations and expenses in the amount of $1,500 in 20X6.

Salary payable represents amounts of future cash payments to employees for work that has already been performed.

Such accruals as salary payable are also called accrued expenses.

Accrued expenses are expenses incurred but not yet paid in cash. When recorded, such expenses are usually shown in the liabilities section of the balance sheet.

The transaction to record the accrued salary is shown as follows:

Illustration: Effect of recognizing liability and expense

Assets | = | Liabilities | + | Equity | |||||

Cash | + | Accounts Receivable | = | Salaries Payable | + | Contributed Capital | + | Retained Earnings | |

| Beginning Balances | $5,500 | + | $800 | = | $ 0 | + | $3,500 | + | $2,800 |

| Recognizing Liability / Expense | +1,500 | (1,500) | |||||||

| Ending Balances | $5,500 | + | $800 | = | $1,500 | + | $3,500 | + | $1,300 |

Liabilities increase (Salaries Payable) and the equity decreases (Retained Earnings) by $1,500. However, total claims remain unchanged. The expense recognition is a claim exchange transaction.

Claim exchange transactions occur when only claim accounts are engaged and impacted. For example, recording salaries payable is an example of a claim exchange transaction.

Cash payment on salary payable transaction analysis

5) Cash payment to creditors (an employee, in our example) is an asset use transaction. When the employee is paid the salary, both Cash (asset account) and Salaries Payable (liability account) decrease by $1,000:

Illustration : Effect of cash payment

Assets | = | Liabilities | + | Equity | |||||

Cash | + | Accounts Receivable | = | Salaries Payable | + | Contributed Capital | + | Retained Earnings | |

| Beginning Balances | $5,500 | + | $800 | = | $1,500 | + | $3,500 | + | $1,300 |

| Cash Payment | (1,000) | (1,000) | |||||||

| Ending Balances | $4,500 | + | $800 | = | $500 | + | $3,500 | + | $1,300 |

Again, notice that the cash payment does not cause expense recognition. The expense was already recognized in full when we recorded the salary liability. Doubling of the expenses would take place if we recorded the expense again.

Finally, the summary of all transactions is presented below. If you would like to check whether your understanding of these transactions is correct, try to perform their reverse identification. That means you look at the accounts and try to identify the type / nature of the transaction without looking at its description.

Illustration: Summary of transactions for Candely Services for 20X6

Assets | = | Liabilities | + | Equity | |||||

Cash | + | Accounts Receivable | = | Salaries Payable | + | Contributed Capital | + | Retained Earnings | |

| Beginning Balances | $ 0 | $ 0 | = | $ 0 | $ 0 | $ 0 | |||

| 1) Capital Acquisition | + 3,500 | + 3,500 | |||||||

| 2) Recognizing Assets / Revenue | +2,800 | +2,800 | |||||||

| 3) Cash Collection | + 2,000 | (2,000) | |||||||

| 4) Recognizing Liability / Expense | +1,500 | (1,500) | |||||||

| 5) Cash Payment | (1,000) | (1,000) | |||||||

| Ending Balances | $4,500 | + | $800 | = | $500 | + | $3,500 | + | $1,300 |

Financial statements for illustration #1 of accrual accounting

The next step is to prepare financial statements.

The income statement looks as follows:

Illustration: Income statement for Candely Services for 20X6

Candely Services | |

| Consulting Revenue | $ 2,800 |

| Salary Expenses | (1,500) |

| Net Income | 1,300 |

The income statement shows changes in equity from all sources other than transactions with owners. In our example, the increase in assets (specifically, account receivable) from consulting services was $2,800; the liabilities increased by $1,500 (salaries payable). Because net assets are defined as total assets minus total liabilities, net assets increased by $1,300 ($2,800 – $1,500). There is one important point to be remembered. Previously we defined expenses as economic sacrifices from a decrease in assets. Now, look at the income statement and you will see that expenses can also be recorded with an increase in liabilities. Accordingly:

Expenses can be defined as a decrease in assets or increase in liabilities that result from operating activities undertaken to generate revenue.

Similarly, revenue can increase by decreasing liabilities.

Revenue is an increase in assets or decrease in liabilities resulting from the operating activities of an entity.

The statement of changes in equity is presented below:

Illustration: Statement of changes in equity for Candely Services for 20X6

Candely Services Statement of Changes in Equity Period Ended 20X6 | |

| Beginning Contributed Capital | $0 |

| Plus: Capital Acquisition | 3,500 |

| Ending Contributed Capital | 3,500 |

| Beginning Retained Earnings | $0 |

| Plus: Net Income | 1,300 |

| Less: Distribution | 0 |

| Ending Retained Earnings | 1,300 |

| Total Equity | 4,800 |

The statement of changes in equity provides us with information about effects of capital acquisitions and distributions. Capital acquisitions were $3,500. The statement also indicates that net income amounted to $1,300. No distributions to owners took place in accounting period 20X6. The total equity, therein, is $4,800.

The balance sheet has such a form:

Illustration: Balance sheet for Candely Services at 20X6 end

Candely Services | |

| Assets | |

| Cash | $ 4,500 |

| Accounts Receivable | 800 |

| Total Assets | 5,300 |

| Liabilities | |

| Salaries Payable | 500 |

| Total Liabilities | 500 |

| Equity | |

| Contributed Capital | 3,500 |

| Retained Earnings | 1,300 |

| Total Equity | 4,800 |

| Total Liability and Equity (Claims) | 5,300 |

The balance sheet provides information about the entity’s assets, liabilities, and equity. In our example we have assets: cash in the amount of $4,500, and accounts receivable of $800; liabilities include only salaries payable amounting to $500; and, finally, equity consisting of contributed capital of $3,500 and retained earnings with a $1,300 balance.

The statement of cash flows follows:

Illustration : Statement of cash flows for Candely Services for 20X6

Candely Services | |

| Cash Flows from Operating Activities | |

| Cash Receipts from Revenue | $ 2,000 |

| Cash Payments for Expenses | (1,000) |

| Net Cash Flow from Operating Activities | 1,000 |

| Cash Flows from Investing Activities | 0 |

| Cash Flows from Financing Activities | |

| Cash Receipts from Borrowing | 0 |

| Cash Receipts from Capital Acquisitions | 3,500 |

| Cash Payments for Distributions | 0 |

| Net Cash Flow from Financing Activities | 3,500 |

| Net Increase in Cash | 4,500 |

| Plus: Beginning Cash Balance | 0 |

| Ending Cash Balance | $ 4,500 |

The statement of cash flows explains the movements (inflows and outflows) of cash during an accounting period. Candely Services was established in 20X6. Therefore, the beginning cash balance is zero. Due to consulting services provided by Mr. Candely, the cash account balance increased by $2,000. In the same period $1,000 was spent on operating the business (salary expense). This creates the net cash flow from operating activities of $1,000 ($2,000 – $1,000). In addition, the capital acquisition contributed $3,500 to the cash inflow (financing activities). The combination of these factors explains the $4,500 ($1,000 + $3,500) increase in cash during the 20X6 accounting period.

Observe that the amount of net income ($1,300) reported on the income statement is different from the amount of net cash flows from operations ($1,000) as well as from net change in cash ($4,500). This takes place because the accrual accounting is used. Under the accrual accounting, as we stated above, cash flows do not go side-by-side with recognition of events, recognition of revenue and expense in particular.

Illustration #2 of accrual accounting

Let us expand the example with Candely Services until the next accounting period. We will introduce a few more transactions that apply to 20X7. The transactions are listed below:

- During 20X7 revenue of $2,700 was recognized on account.

- $3,000 of accounts receivable was collected.

- Salary expense of $1,400 was incurred.

- $1,200 cash was paid to settle salaries payable.

- $500 cash was distributed to the owner.

- On April 31, 20X7 Mr. Candely’s business invested into a $1,000 certificate of deposit (CD). The CD carries a 6% annual interest and 1-year maturity term.

- On December 31, 20X7 the company adjusted the books to recognize interest revenue earned on the CD.

The table below summaries the effects of the 20X7 transactions on the accounting equation.

Summary of transactions for illustration #2 of accrual accounting

Illustration: Effects of transactions for Candely Services for 20X7

Assets | = | Liab. | + | Equity | |||||||||

# | Cash | + | Accounts Receivable | + | % Rec. | + | CD | = | Salaries Payable | + | Cont. Capital | + | Retained Earnings |

BB | $4,500 | $800 | $ 0 | $ 0 | = | $500 | $3,500 | $1,300 | |||||

1) | + 2,700 | + 2,700 | |||||||||||

2) | + 3,000 | (3,000) | |||||||||||

3) | 1,400 | (1,400) | |||||||||||

4) | (1,200) | (1,200) | |||||||||||

5) | (500) | (500) | |||||||||||

6) | (1,000) | +1,000 | |||||||||||

7) | 40 | 40 | |||||||||||

EB | $4,800 | + | $500 | + | $40 | + | $1,000 | = | $700 | + | $3,500 | + | $2,140 |

The first five transactions are familiar to us, so we will go straight to Event No. 6 and No. 7.

Accounting for Accruals

Purchase of certificate of deposit transaction analysis

The purchase of a certificate of deposit represents an investment. The event acts to decrease the cash account and to increase the certificate of deposit (CD) account. As both accounts involved in the transaction are asset accounts, it is an asset exchange transaction.

When Mr. Candely invested into a CD, he effectively loaned money to the bank. In return for using his money, the bank agreed to pay back an amount greater than the amount borrowed.

The amount initially invested (or borrowed) is called the principal.

Excess of money over the initial invested amount (principal) is called interest and is usually set as a percentage to the principal.

In our situation, the interest on the CD is 6%. That means that on May 1, 20X8 Mr. Candely will get back the principal ($1,000) and the interest in the amount of $60 ($1,000 x 6%), or $1,060 in total.

It is important to note that the interest is earned on a continuous basis even though the payment of investment return is made on the maturity date. In other words, the amount of interest due increases proportionally with the passage of time. When a portion of interest is earned, the interest receivable account (i.e., amount due from the bank) increases along with an increase in the interest revenue account.

Interest receivable represents future cash receipts of interest by a company. Interest receivable account is shown on the asset side of the balance sheet.

Interest revenue is the amount of interest earned. Interest revenue (or just interest) may be earned on an investment such as a savings account or certificate of deposit. Interest revenue is an income statement account that increases equity.

Later, at the accounting period end, the bank will pay interest to the creditor and the creditor (our company) will decrease interest revenue account and increase cash account.

We do not recognize interest revenue until the date of financial statements on December 31, 20X7. At that time, a single entry could be made to recognize the accrual of 8 months of interest (from May 1 to December 31). This entry is called an adjusting entry.

Adjusting entries adjust the account balances before the final financial statements are prepared. Each adjusting entry affects one balance sheet account and one income statement account.

The amount of interest to be recognized at period end represents accrued revenue.

Accrued revenue is revenue earned but not yet received. When recorded, such amounts are usually shown as interest receivable in the balance sheet and interest revenue in the income statement.

Interest revenue accrual transaction analysis

Event No. 7 in the table above is the adjusting entry to recognize accrual of interest. The amount is computed by multiplying the face value of the CD by the interest rate by the length of time for which the loan was outstanding:

$1,000 x 6% x (8 / 12) = $40

It is time to look at the financial statements for Candely Services for the accounting period 20X7.

Financial statements for illustration #2 of accrual accounting

Illustration : Income statement for Candely Services for 20X7

Candely Services | |

| Consulting Revenue | $ 2,700 |

| Interest Revenue | 40 |

| Total Revenue | 2,740 |

| Salary Expenses | (1,400) |

| Net Income | 1,340 |

There is a new element called interest revenue in the income statement. The interest revenue is the amount we recognized by posting the adjusting entry on December 31, 20X7.

Illustration: Statement of changes in equity for Candely Services for 20X6

Candely Services | |

| Contributed Capital | $ 3,500 |

| Beginning Retained Earnings | 1,300 |

| Plus: Net Income | 1,340 |

| Less: Distribution | (500) |

| Ending Retained Earnings | 2,140 |

| Total Equity | $ 5,640 |

While looking at the statement of changes in equity, note that there have been cash distributions to the owner ($500) in this accounting period.

Illustration : Balance sheet for Candely Services at 20X7 end

Candely Services Balance Sheet For the Period Ended 20X7 | |

| Assets | |

| Cash | $ 4,800 |

| Accounts Receivable | 500 |

| Interest Receivable | 40 |

| Certification of Deposit | 1,000 |

| Total Assets | 6,340 |

| Liabilities | |

| Salaries Payable | 700 |

| Total Liabilities | 700 |

| Equity | |

| Contributed Capital | 3,500 |

| Retained Earnings | 2,140 |

| Total Equity | 5,640 |

| Total Liability and Equity (Claims) | 6,340 |

Two new elements appear in the balance sheet. Interest receivable is the amount due from the borrower of funds (i.e., from the bank) for using Mr. Candely’s money. Certificate of deposit represents the initial amount loaned to the bank that will be returned on the maturity date (May 1, 20X8).

Illustration: Statement of cash flows for Candely Services for 20X7

Candely Services | |

| Cash Flows from Operating Activities | |

| Cash Receipts from Revenue | $ 3,000 |

| Cash Payments for Expenses | (1,200) |

| Net Cash Flow from Operating Activities | 1,800 |

| Cash Flows from Investing Activities | |

| Cash Payment to Purchase CD | (1,000) |

| Net Cash Flow from Financing Activities | (1,000) |

| Cash Flows from Financing Activities | |

| Cash Payments for Distributions | (500) |

| Net Cash Flow from Financing Activities | (500) |

| Net Increase in Cash | 300 |

| Plus: Beginning Cash Balance | 4,500 |

| Ending Cash Balance | $ 4,800 |

In the statement of cash flows, two new elements are introduced. The first is the cash outflow that occurred as a result of purchasing the certificate of deposit. This is a cash flow for investing activities. The second represents the cash outflow for distributions to the owner, which is an example of financing activities.

Illustration #3 of accrual accounting

Finally, there is the third accounting period (20X8) that we will discuss using the Candely Services example. During this period Mr. Candely’s company experienced the following events:

- $1,000 cash distribution was made to the owner.

- On May 1, 20X8 Mr. Candely received the principal and interest on the certificate of deposit when it matured.

- The business borrowed $2,400 from a local bank on March 1, 20X8. The note carried 10% of annual interest and had a 1-year term.

- On November 1, 20X8, Candely Services purchased a plot of land that cost $5,000. Due to changes in the land market, the value of the land had risen to $5,600 by December 31, 20X8.

- At the end of the accounting period the company made an adjusting entry to record interest expense.

All the transactions are presented below. When reviewing the transactions, keep in mind that only affected accounts are presented. All other accounts are not shown due to space limitations.

For your convenience, we provide the balance sheet amounts at beginning of 20X8:

Illustration: Balance sheet amounts at 20X8 beginning

| Cash | 4,800 |

| Accounts Receivable | 500 |

| Interest Receivable | 40 |

| Certificate of Deposit | 1,000 |

| Land | 0 |

| Salary Payable | 700 |

| Interest Payable | 0 |

| Note Payable | 0 |

| Contributed Capital | 3,500 |

| Retained Earnings | 2,140 |

Let’s move to the events and their impacts on the basic accounting equation.

Cash distribution transaction analysis

1) Event No. 1 is already familiar to us. Cash distribution is an asset use transaction. Both assets (Cash) and equity (Retained Earnings) decrease.

Illustration: Effect of cash distribution

Assets | … | Equity | |

Cash | … | Retained Earnings | |

| Beginning Balances | $4,800 | $2,140 | |

| 1) Cash Distribution | -1,000 | -1,000 | |

| Ending Balances | 3,800 | 1,140 |

Maturity of CD transaction analysis

2) Event No. 2 relates to the maturity of the certificate of deposit. The transaction falls into three parts. The first (2.1 in the table below) is related to recognition of interest accrual for the last 4 months (in 20X8). Recall that we have already recognized interest accrual for first 8 months (in 20X7). Therefore, 4 additional months remain to be accounted for in 20X8. The amount of accrual interest to be recognized is calculated as follows:

$1,000 x 6% x (4 / 12) = $20

The entry will increase assets (Interest Receivable) and equity (Interest Revenue). The transaction is an asset source one.

Illustration: Effect of interest revenue recognition

Assets | … | Equity | |

Interest Receivable | … | Retained Earnings | |

| Beginning Balances | $40 | $1,140 | |

| 2.1) Interest Revenue | +20 | +20 | |

| Ending Balances | 60 | 1,160 |

The second effect (2.2 in the table below) the transaction has on the accounting equation is collection of the interest receivable. Remember that even though $40 of accrued interest was recognized in 20X7, no cash was collected at that time. Thus, the collection of cash in 20X8 covers the entire interest amount for 12 months ($60 = $40 + $20). The event acts to increase Cash account and decrease Interest Receivable. Accordingly, this is an asset exchange transaction.

Illustration: Effect of cash collection

Assets | … | Assets | |

Cash | … | Interest Receivable | |

| Beginning Balances | $3,800 | $60 | |

| 2.2) Collected Cash for Interest | +60 | -60 | |

| Ending Balances | 3,860 | 0 |

The third entry related to the certificate of deposit maturity represents collection of the principal. Recall that on April 31, 20X7, Candely Services bought a CD with a 1-year term from a bank. Respectively, on May 1, 20X8 Mr. Candely’s business should get the invested money back. This transaction increases Cash and decreases Certificate of Deposit account. Both accounts involved are asset accounts, so this is an asset exchange transaction.

Illustration: Effect of certificate of deposit principal collection

Assets | … | Assets | |

Cash | … | Certificate of Deposit | |

| Beginning Balances | $3,860 | $1,000 | |

| 2.3) Redeemed CD | +1,000 | -1,000 | |

| Ending Balances | 4,860 | 0 |

Borrowing from a bank transaction analysis

3) Event No. 3 is borrowing money from a local bank. This is an asset source transaction. The asset account (Cash) and liability account (Note Payable) increase by a like amount.

Note payable is an obligation in the form of a written promissory note signed by the borrower. The note includes the information on the rate of interest, the term of maturity, and collateral pledged to secure the loan.

Illustration: Effect of borrowing funds from a bank

Assets | … | Liabilities | |

Cash | … | Note Payable | |

| Beginning Balances | $4,860 | $ 0 | |

| 3) Borrowed Funds | +2,400 | 2,400 | |

| Ending Balances | 7,260 | 2,400 |

Land purchase transaction analysis

4) Event No. 4 describes a land purchase by Mr. Candely’s business. This is an asset exchange transaction because one asset account (Land) increases and the other asset account (Cash) decreases. Note that the land is recorded at its historical cost of $5,000 (see below). According to the historical cost principle, the increase in the market value of the land does not change its recorded value in the financial statements. So, the increase in land market value to $5,600 does not have any impact on the financial statements

Historical cost is based on the dollar amount originally exchanged to acquire an asset. A historical cost also refers to an accounting principle requiring financial statements to be based on original costs.

Illustration: Effect of land purchase

Assets | … | Assets | |

Cash | … | Land | |

| Beginning Balances | $7,260 | $ 0 | |

| 4) Purchased Land | -5,000 | +5,000 | |

| Ending Balances | 2,260 | 5,000 |

Interest expense accrual transaction analysis

5) Finally, Event No. 5 represents an adjusting entry at the end of accounting period. When Candely Services borrowed money from a bank, the company agreed to pay interest on it. Therefore, the company should record the accrued interest for the period up to the accounting period end (December 31, 20X8), or, in other words, to incur interest expense for 10 months (from March to December). In our situation, the amount of interest will be calculated like this:

$2,400 x 10% x (10/12) = $200

A liability account (Interest Payable) increases, and equity (Retained Earnings) decreases.

Interest payable is a liability account that shows future interest payments for using somebody’s money. For example, taking a long in a bank usually means that the borrower will pay the principal and interest. Such interest is show in the interest payable account until paid.

Retained earnings decrease through an increase in the interest expense.

Interest expense is the charge that a business needs to take and record when using somebody’s money. Interest expense is an income statement account which decreases equity.

Recording the interest expense is a claim exchange transaction. Note that the company did not pay off the amount of interest payable in 20X8, so there were no cash outflows. The company just recorded the interest in the books.

Illustration: Effect of Interest Accrual

Liabilities | … | Equity | |

Interest Payable | … | Retained Earnings | |

| Beginning Balances | $0 | $1,160 | |

| 5) Accrued Interest | +200 | -200 | |

| Ending Balances | 200 | 960 |

Financial statements for illustration #3 of accrual accounting

All four financial statements for 20X8 are presented below.

Illustration: Income statement for Candely Services for 20X8

Candely Services | |

| Interest Revenue | $20 |

| Interest Expense | (200) |

| Net Income | (180) |

One new element in 20X8 income statement is Interest Expense. Interest expense represents the amount Candely Services accrued in 20X8 for using money borrowed from the bank. Note that no cash payment for the interest expense was made in 20X8. Therefore, ending Interest Payable balance (see balance sheet below) is $200.

Illustration: Statement of changes in equity for Candely Services for 20X8

Candely Services | |

| Beginning Contributed Capital | $ 3,500 |

| Ending Contributed Capital | 3,500 |

| Beginning Retained Earnings | $ 2,140 |

| Plus: Net Income | (180) |

| Less: Distribution | (1,000) |

| Ending Retained Earnings | 960 |

| Total Equity | $ 4,460 |

In the statement of changes in equity note that Candely Services has a net loss amounting to $180.

Illustration: Balance sheet for Candely Services at 20X8 end

Candely Services | |

| Assets | |

| Cash | $ 2,260 |

| Accounts Receivable | 500 |

| Interest Receivable | 0 |

| Certification of Deposit | 0 |

| Land | 5,000 |

| Total Assets | 7,760 |

| Liabilities | |

| Salaries Payable | 700 |

| Interest Payable | 200 |

| Note Payable | 2,400 |

| Total Liabilities | 3,300 |

| Equity | |

| Contributed Capital | 3,500 |

| Retained Earnings | 960 |

| Total Equity | 4,460 |

| Total Liability and Equity (Claims) | 7,760 |

Liabilities section of the balance sheet includes Interest Payable and Note Payable, new elements introduced in 20X8. Both terms are explained earlier. Note that total assets equal total claims (liabilities and equity).

Illustration: Statement of cash flows for Candely Services for 20X8

Candely Services | |

| Cash Flows from Operating Activities | |

| Cash Receipts from Interest Revenue | $ 60 |

| Net Cash Flow from Operating Activities | 60 |

| Cash Flows from Investing Activities | |

| Cash Receipt from CD Maturity | 1,000 |

| Cash Payment to Purchase Land | (5,000) |

| Net Cash Flow from Financing Activities | (4,000) |

| Cash Flows from Financing Activities | |

| Cash Receipt from Borrowing | 2,400 |

| Cash Payments for Distributions | (1,000) |

| Net Cash Flow from Financing Activities | 1,400 |

| Net Increase in Cash | (2,540) |

| Plus: Beginning Cash Balance | 4,800 |

| Ending Cash Balance | $2,260 |

In the statement of cash flows there are a few new elements. Those elements are as follows:

- cash receipts from interest revenue (part of this revenue was recognized in 20X7; however, the cash for the whole interest amount is collected in 20X8);

- cash payment for land purchase (in the investing activities section); and

- cash receipt from borrowed money (represents a financing activity).