Auditing is the method of examining and confirming the quality and fairness of a company’s financial statements. Auditors protect investors by issuing reliable, open, and unbiased audit reports based on evidence. Audit evidence is evidence gotten by inspectors during a monetary review and recorded in the review working papers. The nature of audit evidence is vital to ensure that the end that makes by the inspector is right. The audit risks of making incorrect audit opinions are high if the information is weak or of poor quality.

The auditor can acquire various sorts of review proof, and it incorporates Physical Examination, documentation, insightful strategy, perceptions, affirmations, requests, and so on. Audits are often necessary to ensure that an organization is adhering to applicable accounting standards, such as the International Financial Reporting Standards (IFRS), Generally Accepted Accounting Principles (GAAP), or other applicable accounting standards. The form and amount are determined by the type of company being audited as well as the nature of the audit.

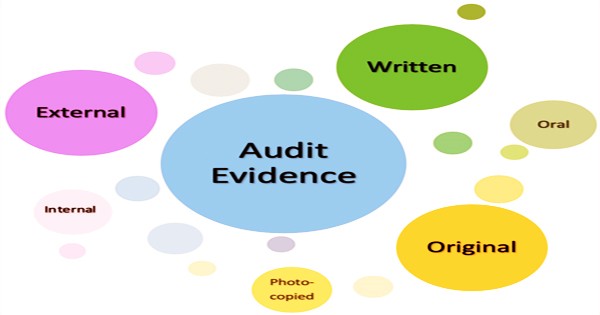

Public organizations are needed to give completely inspected fiscal reports to proprietors and investors occasionally. In this manner, inspecting is significant in keeping up the straightforwardness and precision of the monetary records to ensure investors. Review can be gotten from the inward just as outer sources. However, information collected from outside sources is more credible than evidence obtained from the company’s internal sources. The type and source of audit evidence determine the consistency of the evidence. Here is the detail:

- External Source: Data obtained directly from third parties, such as consumers, manufacturers, or banks, is more trustworthy than evidence obtained from clients. Accounts receivable confirmations obtained from clients’ customers, for example, are more accurate than reports prepared by clients.

- Prepare by Auditor: The information that auditors prepare themselves is more accurate than the evidence that the client prepares or obtains. The bank reconciliation prepared by the auditor, for example, is more trustworthy than the bank reconciliation prepared by the accountant.

- Prepare by client: The extent of trustworthiness of evidence obtained from clients is determined by the client’s internal control.

- Written form: The audit evidence that is created in writing is more accurate than the audit evidence that is created orally. For example, management confirmation via email is more trustworthy than verbal confirmation.

- Original Form: Original invoices are more accurate than copy invoices when it comes to supporting payment transactions.

Inspectors need audit evidence to check whether an organization has the right data thinking about their monetary exchanges so a CPA (Certified Public Accountant) can affirm their fiscal reports. Since the quality of audit evidence is so critical, the standard or local authority in charge of audit firms needed the audit firm to have the correct audit manual, policies, and procedures in place so that the audit firm could ensure the quality of both the audit and the audit evidence. In the audit commitment acknowledgment or reappointment stage, review proof is the data that the examiner considers for the arrangement.

As part of their materiality evaluation in the financial statements, auditors should prepare audit procedures to validate and check the financial statements’ assertions. Auditor practices should be tailored to collect audit proof that would support their verification and affirmation of financial statement assertions. Fiscal summaries are produced inside an organization. The cycle presents a degree of hazard for control or deceitful conduct from insiders who can change data while setting up the financials. Auditing is a critical tool for ensuring that no manipulation or fraudulent activity is taking place.

Advantages of Audit Evidence:

- It assists the auditor in ensuring the consistency and reliability of the information provided to him by his client.

- It is on this basis that the company’s auditor expresses his opinion on the company’s financial statements for the period under consideration, i.e., whether the financial statements offer a true and reasonable image or not.

Disadvantages of Audit Evidence:

- Clients can manipulate information obtained as audit proof, which is primarily derived from internal sources. If the auditors depend on that information, they will issue an incorrect audit opinion on the company’s financial statements.

- When the amount of data is large, the auditor usually only considers the material items as a sample for data review rather than the whole data. If the auditor leaves the data with the issue out of his study, the business will not be seen in its true light.

Audit evidence is data that the reviewer is to consider whether the fiscal reports all in all present with culmination, legitimacy, exactness and consistency with the examiner’s comprehension of the substance. It is the critical details that the company’s appointed auditor gathers as part of his auditing work in order to express his opinion on the company’s financial statements for the period under consideration, i.e., whether the financial statements show a true and reasonable image or not.

Information Sources: