Loan Classification and Provisioning

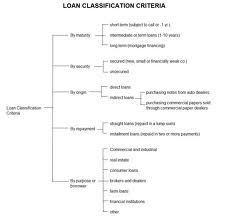

Loan classification is required to have a real picture of the loan and advances provided by the Bank. It helps to monitor and take appropriate decision regarding each loan account like other Banks, all types of loans of BA fall into following four scales:

- Unclassified : Repayment is regular

- Substandard: Repayment is stopped or irregular but has reasonable prospect of improvement.

- Doubtful debt: Unlikely to be repaid but special collection efforts may result in partial recover.

- Bad/Loss: very little chance of recovery.

| Loan Type | Unclassified(Month | Substandard (Month) | Doubtful (Month) | Bad(Month) |

| Continuous LoanDemand Loan | Expiry up to 5 month | 6 to 8 month | 9 to 11 month | 12 month+ |

| Term loan up to 5 year | 0 to 5 month | 6 to 11 month | 12 to 17 month | 18 month+ |

| Term Loan more then 5 years | 0 to 11 month | 12 to 17 month | 18 to 23 month | 24 month+ |

| Micro Credit | 0 to 11 month | 12 to 13 month | 36 to 59 month | 60 month+ |

Loan Provisioning:

A Certain amount of money is kept for the purpose of provisioning. This percentage is set following Bangladesh Bank rules.

| Type of Classification | Rate of Provision |

| Unclassified | 1% |

| Substandard | 20% |

| Doubtful | 50% |

| BAd debt | 100% |

Loan follow-up means the technique of supervision (of loan). The branch manager keep a close and constant watch on all their loans and advances to ensure that timely action is initiated in each case for adjustment of account or its renewal, if it is decided to continue the facility. For this purpose each branch maintain a diary or card in prescribed format in which the due date of expiry of loan facilities are noted down. At least thirty days before the date of expiry of any loan facility, a notice send to the borrower reminding him of the due date of repayment and making formal demand of repayment are renewal as the case may be. Vigorous follow up actions there after taken by issuing repeated reminders and putting pressures on the borrower by calling on him personall