Introduction:

The insurance industry plays several important roles in the British economy. Through the accumulation of substantial funds which are available for long-term investment, insurance companies are collectively the largest single source of finance to the capital market. Moreover, through their willingness to hold a small proportion of their investments in unquoted companies, and to act as underwriters to new issues of securities, the help to improve the working of the capital and new issue markets.

The industry also makes an important contribution to the country’s invisible exports through the operating profits of the overseas branches and subsidiaries of the companies, brokers’ commissions on overseas business, profits on overseas business placed on the London market, and investment income from portfolio investment abroad.

The Economic Value of Insurance

The direct value of insurance is to the insured that prefers the certainty of the known premium to the uncertainty regarding the timing and extent of possible losses.

Economic theory is not altogether satisfactory on this point partly because it is based on hypotheses which cannot be tested empirically. If it is assumed that money is subject to the law of diminishing marginal utility, then each additional tk. 1 of income yields less and less extra utility, so that tk. 1 of income lost is worth more than tk. 1 gained.

This analysis, however, does not allow for the fact the loss of utility through the payment of the premium is certain, whereas there is no certainty that a loss will occur. Consequently, the final decision of the individual (or firm) will depend on his attitude to risk and in the majority of cases degree of risk must be based on a subjective evaluation. Economists in attempting to analyze attitude to risk have experienced difficulty in formulating a theory because of the evidence that there are many gamblers who prefer to forgo a certain income in the hope certain gain. Nevertheless, existence of a demand for insurance is evidence that many persons on balance derive greater satisfaction from the protection insurance provides against the uncertainty of losses than from the utility which is forgone through the payment of the premium. The one major qualification which must be made to this statement is that in arriving at the decision to insure the individual or firm obviously is influenced by the size of the probable loss in relation both to the premium and present income/ wealth.

Particularly in relation to business enterprise, insurance and the accompanying services offered by insurers provide both private and social benefits.

The ability of a firm to eliminate pure risks by means of insurance enables management to concentrate its attention on those risks which cannot be insured and in particular the speculative risks, thereby increasing efficiency and enterprise. Moreover, it may be argued that it enables small and new firms to compete more effectively against larger established competitors, which frequently control more than one exposure unit so that to a degree they enjoy the advantages of risk combination without having to insure. The lowering of the barriers to entry to industry is, it will be recalled, one of the safeguards against monopoly.

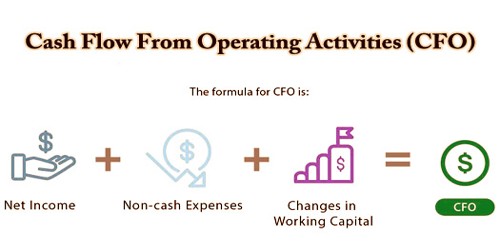

Premium cost certainty

The cost certainty provide by the payment of a premium is also of importance from the standpoint of the efficient use of scarce financial resources. In the absence of insurance firms would either have to assume the risk of a loss occurring which may cause insolvency, or maintain large contingency reserves in a highly liquid form, or avoid the risk entirely. Whichever course was adopted the social costs would be large. The first would lead to greater dislocation of economic activity through firms being forced out of business. The second would increase the capital needs of firms, with funds being inefficiently used. The last method would deprive society of goods and services currently being produced.

In relation to the personal sector of the economy the existence of insurance not only provides greater financial security for families but also thereby reduces the demands on the welfare services provided by society. This statement, however, should not necessarily be interpreted as implying that private insurance arrangements are the most efficient way of dealing with all sure risks. Sometimes a universal scheme operated by the state may be more cost-effective for a number of reasons.

Often, as implied above, insurance is the cheapest way of handling risks. This arises from the operations of insures leading to like risks being combined, thereby reducing the level of risk in society.

In addition to the pure insurance function, insurers can assist in the more efficient handling of risks through the experienced loss prevention advice they can provide to insured.

Finally, the accumulation of insurance funds, particularly through the mobilization of savings by the life offices, provides the most important single source of finance for business and government.

The insurance industry is not without its disadvantages too. It uses substantial labour and capital resources which from the standpoint of society could be otherwise employed in the production of other commodities, and for the insured the cost takes the form of the expenses and profit loading in the premium.

A less readily identifiable cost to society is the effect of the accompanying moral hazard on the level of actual losses that occur. Unquestionably the availability of insurance does lead to some losses due to fraud and lack of care, but no one has been able to estimate the cost. Until such time as reliable figures can be produced, it must be assumed that the social benefits far outweigh such costs.

History

Insurance began as a way of reducing the risk of traders, as early as 5000 BC in China and 4500 BC in Babylon. Life insurance dates only to ancient Rome; “burial clubs” covered the cost of members’ funeral expenses and helped survivors monetarily. Modern life insurance started in late 17th century England, originally as insurance for traders: merchants, ship owners and underwriters met to discuss deals at Lloyd’s Coffee House, predecessor to the famous Lloyd’s of London.

The first insurance company in the United States was formed in Charleston, South Carolina in 1732, but it provided only fire insurance. The sale of life insurance in the U.S. began in the late 1760s. The Presbyterian Synods in Philadelphia and New York created the Corporation for Relief of Poor and Distressed Widows and Children of Presbyterian Ministers in 1759; Episcopalian priests organized a similar fund in 1769. Between 1787 and 1837 more than two dozen life insurance companies were started, but fewer than half a dozen survived.

Prior to the American Civil War, many insurance companies in the United States insured the lives of slaves for their owners. In response to bills passed in California in 2001 and in Illinois in 2003, the companies have been required to search their records for such policies. New York Life for example reported that Nautilus sold 485 slaveholder life insurance policies during a two-year period in the 1840s; they added that their trustees voted to end the sale of such policies 15 years before the Emancipation Proclamation.

Basics of Insurance

Meaning of Insurance

Insurance provides financial protection against a loss arising out of happening of an uncertain event. A person can avail this protection by paying premium to an insurance company.

A pool is created through contributions made by persons seeking to protect themselves from common risk. Premium is collected by insurance companies which also act as trustee to the pool. Any loss to the insured in case of happening of an uncertain event is paid out of this pool.

Insurance works on the basic principle of risk-sharing. A great advantage of insurance is that it spreads the risk of a few people over a large group of people exposed to risk of similar type.

Definition

Insurance is a contract between two parties whereby one party agrees to undertake the risk of another in exchange for consideration known as premium and promises to pay a fixed sum of money to the other party on happening of an uncertain event (death) or after the expiry of a certain period in case of life insurance or to indemnify the other party on happening of an uncertain event in case of general insurance.

The party bearing the risk is known as the ‘insurer’ or ‘assurer’ and the party whose risk is covered is known as the ‘insured’ or ‘assured’.

Concept of Insurance / How Insurance Works

The concept behind insurance is that a group of people exposed to similar risk come together and make contributions towards formation of a pool of funds. In case a person actually suffers a loss on account of such risk, he is compensated out of the same pool of funds. Contribution to the pool is made by a group of people sharing common risks and collected by the insurance companies in the form of premiums.

Life insurance or life assurance is a contract between the policy owner and the insurer, where the insurer agrees to pay a sum of money upon the occurrence of the insured individual’s or individuals’ death or other event, such as terminal illness or critical illness. In return, the policy owner agrees to pay a stipulated amount called a premium at regular intervals or in lump sums. There may be designs in some countries where bills and death expenses plus catering for after funeral expenses should be included in Policy Premium. In the United States, the predominant form simply specifies a lump sum to be paid on the insured’s demise.

As with most insurance policies, life insurance is a contract between the insurer and the policy owner whereby a benefit is paid to the designated beneficiaries if an insured event occurs which is covered by the policy. To be a life policy the insured event must be based upon the lives of the people named in the policy.

Insured events that may be covered include:

- Serious illness

Life policies are legal contracts and the terms of the contract describe the limitations of the insured events. Specific exclusions are often written into the contract to limit the liability of the insurer; for example claims relating to suicide, fraud, war, riot and civil commotion.

Life-based contracts tend to fall into two major categories:

- Protection policies – designed to provide a benefit in the event of specified event, typically a lump sum payment. A common form of this design is term insurance.

- Investment policies – where the main objective is to facilitate the growth of capital by regular or single premiums. Common forms (in the US anyway) are whole life, universal life and variable life policies.

Parties to contract

There is a difference between the insured and the policy owner (policy holder), although the owner and the insured are often the same person. For example, if Joe buys a policy on his own life, he is both the owner and the insured. But if Jane, his wife, buys a policy on Joe’s life, she is the owner and he is the insured. The policy owner is the guarantee and he or she will be the person who will pay for the policy. The insured is a participant in the contract, but not necessarily a party to it.

The beneficiary receives policy proceeds upon the insured’s death. The owner designates the beneficiary, but the beneficiary is not a party to the policy. The owner can change the beneficiary unless the policy has an irrevocable beneficiary designation. With an irrevocable beneficiary, that beneficiary must agree to any beneficiary changes, policy assignments, or cash value borrowing.

In cases where the policy owner is not the insured (also referred to as the cestui qui vit or CQV), insurance companies have sought to limit policy purchases to those with an “insurable interest” in the CQV. For life insurance policies, close family members and business partners will usually be found to have an insurable interest. The “insurable interest” requirement usually demonstrates that the purchaser will actually suffer some kind of loss if the CQV dies. Such a requirement prevents people from benefiting from the purchase of purely speculative policies on people they expect to die. With no insurable interest requirement, the risk that a purchaser would murder the CQV for insurance proceeds would be great. In at least one case, an insurance company which sold a policy to a purchaser with no insurable interest (who later murdered the CQV for the proceeds), was found liable in court for contributing to the wrongful death of the victim (Liberty National Life v. Weldon, 267 Ala.171 (1957)).

Contract terms

Special provisions may apply, such as suicide clauses wherein the policy becomes null if the insured commits suicide within a specified time (usually two years after the purchase date; some states provide a statutory one-year suicide clause). Any misrepresentations by the insured on the application are also grounds for nullification. Most US states specify that the contestability period cannot be longer than two years; only if the insured dies within this period will the insurer have a legal right to contest the claim on the basis of misrepresentation and request additional information before deciding to pay or deny the claim.

The face amount on the policy is the initial amount that the policy will pay at the death of the insured or when the policy matures, although the actual death benefit can provide for greater or lesser than the face amount. The policy matures when the insured dies or reaches a specified age (such as 100 years old).

Costs, insurability, and underwriting

The insurer (the life insurance company) calculates the policy prices with intent to fund claims to be paid and administrative costs, and to make a profit. The cost of insurance is determined using mortality tables calculated by actuaries. Actuaries are professionals who employ actuarial science, which is based in mathematics (primarily probability and statistics). Mortality tables are statistically-based tables showing expected annual mortality rates. It is possible to derive life expectancy estimates from these mortality assumptions. Such estimates can be important in taxation regulation.[1] [2]

The three main variables in a mortality table have been age, gender, and use of tobacco. More recently in the US, preferred class specific tables were introduced. The mortality tables provide a baseline for the cost of insurance. In practice, these mortality tables are used in conjunction with the health and family history of the individual applying for a policy in order to determine premiums and insurability. Mortality tables currently in use by life insurance companies in the United States are individually modified by each company using pooled industry experience studies as a starting point. In the 1980s and 90’s the SOA 1975-80 Basic Select & Ultimate tables were the typical reference points, while the 2001 VBT and 2001 CSO tables were published more recently. The newer tables include separate mortality tables for smokers and non-smokers and the CSO tables include separate tables for preferred classes.

Recent US select mortality tables predict that roughly 0.35 in 1,000 non-smoking males aged 25 will die during the first year of coverage after underwriting.[2] Mortality approximately doubles for every extra ten years of age so that the mortality rate in the first year for underwritten non-smoking men is about 2.5 in 1,000 people at age 65.[3] Compare this with the US population male mortality rates of 1.3 per 1,000 at age 25 and 19.3 at age 65 (without regard to health or smoking status). The mortality of underwritten persons rises much more quickly than the general population. At the end of 10 years the mortality of that 25 year-old, non-smoking male is 0.66/1000/year. Consequently, in a group of one thousand 25 year old males with a $100,000 policy, all of average health, a life insurance company would have to collect approximately $50 a year from each of a large group to cover the relatively few expected claims. (0.35 to 0.66 expected deaths in each year x $100,000 payout per death = $35 per policy). Administrative and sales commissions need to be accounted for in order for this to make business sense. A 10 year policy for a 25 year old non-smoking male person with preferred medical history may get offers as low as $90 per year for a $100,000 policy in the competitive US life insurance market.

The insurance company receives the premiums from the policy owner and invests them to create a pool of money from which it can pay claims and finance the insurance company’s operations. Contrary to popular belief, the majority of the money that insurance companies make comes directly from premiums paid, as money gained through investment of premiums can never, in even the most ideal market conditions, vest enough money per year to pay out claims. Rates charged for life insurance increase with the insurer’s age because, statistically, people are more likely to die as they get older.

Given that adverse selection can have a negative impact on the insurer’s financial situation, the insurer investigates each proposed insured individual unless the policy is below a company-established minimum amount, beginning with the application process. Group Insurance policies are an exception.

This investigation and resulting evaluation of the risk is termed underwriting. Health and lifestyle questions are asked. Certain responses or information received may merit further investigation. Life insurance companies in the United States support the Medical Information Bureau (MIB) [4], which is a clearinghouse of information on persons who have applied for life insurance with participating companies in the last seven years. As part of the application, the insurer receives permission to obtain information from the proposed insured’s physicians.[5]

Underwriters will determine the purpose of insurance. The most common is to protect the owner’s family or financial interests in the event of the insurer’s demise. Other purposes include estate planning or, in the case of cash-value contracts, investment for retirement planning. Bank loans or buy-sell provisions of business agreements are another acceptable purpose.

Life insurance companies are never required by law to underwrite or to provide coverage to anyone, with the exception of Civil Rights Act compliance requirements. Insurance companies alone determine insurability, and some people, for their own health or lifestyle reasons, are deemed uninsurable. The policy can be declined (turned down) or rated.[citation needed] Rating increases the premiums to provide for additional risks relative to the particular insured.[citation needed]

Many companies use four general health categories for those evaluated for a life insurance policy. These categories are Preferred Best, Preferred, Standard, and Tobacco.[citation needed] Preferred Best is reserved only for the healthiest individuals in the general population. This means, for instance, that the proposed insured has no adverse medical history, is not under medication for any condition, and his family (immediate and extended) have no history of early cancer, diabetes, or other conditions.[5] Preferred means that the proposed insured is currently under medication for a medical condition and has a family history of particular illnesses.[citation needed] Most people are in the Standard category.[citation needed] Profession, travel, and lifestyle factor into whether the proposed insured will be granted a policy, and which category the insured falls. For example, a person who would otherwise be classified as Preferred Best may be denied a policy if he or she travels to a high risk country.[citation needed] Underwriting practices can vary from insurer to insurer which provide for more competitive offers in certain circumstances.

Life insurance contracts are written on the basis of utmost good faith. That is, the proposer and the insurer both accept that the other is acting in good faith. This means that the proposer can assume the contract offers what it represents without having to fine comb the small print and the insurer assumes the proposer is being honest when providing details to underwriter.

Death proceeds

Upon the insured’s death, the insurer requires acceptable proof of death before it pays the claim. The normal minimum proof required is a death certificate and the insurer’s claim form completed, signed (and typically notarized).[citation needed] If the insured’s death is suspicious and the policy amount is large, the insurer may investigate the circumstances surrounding the death before deciding whether it has an obligation to pay the claim.

Proceeds from the policy may be paid as a lump sum or as an annuity, which is paid over time in regular recurring payments for either a specified period or for a beneficiary’s lifetime.

Insurance vs. assurance

Outside the United States, the specific uses of the terms “insurance” and “assurance” are sometimes confused. In general, in these jurisdictions “insurance” refers to providing cover for an event that might happen (fire, theft, flood, etc.), while “assurance” is the provision of cover for an event that is certain to happen. However, in the United States both forms of coverage are called “insurance”, principally due to many companies offering both types of policy, and rather than refer to themselves using both insurance and assurance titles, they instead use just one.

Classification of Insurance

Historically, insurance was divided into four main departments of marine, fire, life and accident. In large companies there were separate departments each dealing with a single class of business. Sometimes specialist companies were formed which confined their operation’s to one type of business alone. Although in the company market the pattern largely remains, there are signs that it is beginning to undergo modifications; because of the similarity of some companies are being amalgamated, and in the larger organizations it is already commonplace to have engineering and aviation departments separate from the accident department.

Marine-Insurance of (a) hull, (b) cargo, (c) freight;

Fire-Insurance of (a) material loss or damage by fire and special perils, (b) consequential loss arising from such material damage;

Accident-Insurance those are not dealt with in the other main departments, for example, motor, personal accident and sickness, liability, theft and fidelity guarantee and contingency insurance;

Engineering – (a) boilers, (b) electrical plant, (c) lifts and cranes;

Aviation-(a) damage to aircraft, (b) legal liabilities, (c) personal accident;

Life-(a) ordinary life assurance, including individual assurances and group life and pensions insurance, (b) industrial life insurance, (c) personal accident and sickness insurance;

Types of life insurance

Life insurance may be divided into two basic classes – temporary and permanent or following subclasses – term, universal, whole life, variable, variable universal and endowment life insurance.

Temporary (Term)

Term life insurance or ‘term assurance’ provides for life insurance coverage for a specified term of years for a specified premium. The policy does not accumulate cash value. Term is generally considered “pure” insurance, where the premium buys protection in the event of death and nothing else. (See Theory of Decreasing Responsibility and buy term and invest the difference.)

The three key factors to be considered in term insurance are: face amount (protection or death benefit), premium to be paid (cost to the insured), and length of coverage (term).

Various insurance companies sell term insurance with many different combinations of these three parameters. The face amount can remain constant or decline. The term can be for one or more years. The premium can remain level or increase. A common type of term is called annual renewable term. It is a one year policy but the insurance company guarantees it will issue a policy of equal or lesser amount without regard to the insurability of the insured and with a premium set for the insured’s age at that time. Another common type of term insurance is mortgage insurance, which is usually a level premium, declining face value policy. The face amount is intended to equal the amount of the mortgage on the policy owner’s residence so the mortgage will be paid if the insured dies.

A policy holder insures his life for a specified term. If he dies before that specified term is up, his estate or named beneficiary(ies) receive(s) a payout. If he does not die before the term is up, he receives nothing. In the past these policies would almost always exclude suicide. However, after a number of court judgments against the industry, payouts do occur on death by suicide (presumably except for in the unlikely case that it can be shown that the suicide was just to benefit from the policy). Generally, if an insured person commits suicide within the first two policy years, the insurer will return the premiums paid. However, a death benefit will usually be paid if the suicide occurs after the two year period.

Permanent

Permanent life insurance is life insurance that remains in force (in-line) until the policy matures (pays out), unless the owner fails to pay the premium when due (the policy expires OR policies lapse). The policy cannot be canceled by the insurer for any reason except fraud in the application, and that cancellation must occur within a period of time defined by law (usually two years). Permanent insurance builds a cash value that reduces the amount at risk to the insurance company and thus the insurance expense over time. This means that a policy with a million dollars face value can be relatively expensive to a 70 year old. The owner can access the money in the cash value by withdrawing money, borrowing the cash value, or surrendering the policy and receiving the surrender value.

The three basic types of permanent insurance are whole life, universal life, and endowment.

Whole life coverage

Whole life insurance provides for a level premium, and a cash value table included in the policy guaranteed by the company. The primary advantages of whole life are guaranteed death benefits, guaranteed cash values, fixed and known annual premiums, and mortality and expense charges will not reduce the cash value shown in the policy. The primary disadvantages of whole life are premium inflexibility, and the internal rate of return in the policy may not be competitive with other savings alternatives. Riders are available that can allow one to increase the death benefit by paying additional premium. The death benefit can also be increased through the use of policy dividends. Dividends cannot be guaranteed and may be higher or lower than historical rates over time. Premiums are much higher than term insurance in the short-term, but cumulative premiums are roughly equal if policies are kept in force until average life expectancy.

Cash value can be accessed at any time through policy “loans”. Since these loans decrease the death benefit if not paid back, payback is optional. Cash values are not paid to the beneficiary upon the death of the insured; the beneficiary receives the death benefit only. If the dividend option: Paid up additions is elected, dividend cash values will purchase additional death benefit which will increase the death benefit of the policy to the named beneficiary.

Universal life coverage

Universal life insurance (UL) is a relatively new insurance product intended to provide permanent insurance coverage with greater flexibility in premium payment and the potential for a higher internal rate of return. There are several types of universal life insurance policies which include “interest sensitive” (also known as “traditional fixed universal life insurance”), variable universal life insurance, and equity indexed universal life insurance.

A universal life insurance policy includes a cash account. Premiums increase the cash account. Interest is paid within the policy (credited) on the account at a rate specified by the company. This rate may have a guaranteed minimum (for fixed ULs) or no minimum (for variable ULs). Mortality charges and administrative costs are then charged against (reduce) the cash account. The surrender value of the policy is the amount remaining in the cash account less applicable surrender charges, if any.

With all life insurance, there are basically two functions that make it work. There’s a mortality function and a cash function. The mortality function would be the classical notion of pooling risk where the premiums paid by everybody else would cover the death benefit for the one or two who will die for a given period of time. The cash function inherent in all life insurance says that if a person is to reach age 95 to 100 (the age varies depending on state and company), then the policy matures and endows the face value of the policy.

Actuarially, it is reasoned that out of a group of 1000 people, if even 10 of them live to age 95, then the mortality function alone will not be able to cover the cash function. So in order to cover the cash function, a minimum rate of investment return on the premiums will be required in the event that a policy matures.

Universal life insurance addresses the perceived disadvantages of whole life. Premiums are flexible. Depending on how interest is credited, the internal rate of return can be higher because it moves with prevailing interest rates (interest-sensitive) or the financial markets (Equity Indexed Universal Life and Variable Universal Life). Mortality costs and administrative charges are known. And cash value may be considered more easily attainable because the owner can discontinue premiums if the cash value allows it. And universal life has a more flexible death benefit because the owner can select one of two death benefit options, Option A and Option B.

Option A pays the face amount at death as it’s designed to have the cash value equal the death benefit at maturity (usually at age 95 or 100). With each premium payment, the policy owner is reducing the cost of insurance until the cash value reaches the face amount upon maturity.

Option B pays the face amount plus the cash value, as it’s designed to increase the net death benefit as cash values accumulate. Option B offers the benefit of an increasing death benefit every year that the policy stays in force. The drawback to option B is that because the cash value is accumulated “on top of” the death benefit, the cost of insurance never decreases as premium payments are made. Thus, as the insured gets older, the policy owner is faced with an ever increasing cost of insurance (it costs more money to provide the same initial face amount of insurance as the insured gets older).

Both death benefit options – A (level) and B (increasing) – are subject to the same IRS rules and guidelines concerning premium payments and tax-favored treatment of cash values. In order for the policy to keep its tax favored life insurance status, it must stay within a corridor specified by state and federal laws that prevent abuses such as attaching a million dollars in cash value to a two dollar insurance policy. The interesting part about this corridor is that for those people who can make it to age 95-100, this corridor requirement goes away and your cash value can equal exactly the face amount of insurance. If this corridor is ever violated, then the universal life policy will be treated as, and in effect turn into, a Modified Endowment Contract (or more commonly referred to as a MEC).

But universal life has its own disadvantages which stem primarily from this flexibility. The policy lacks the fundamental guarantee that the policy will be in force unless sufficient premiums have been paid and cash values are not guaranteed.

Limited-pay

Another type of permanent insurance is Limited-pay life insurance, in which all the premiums are paid over a specified period after which no additional premiums are due to keep the policy in force. Common limited pay periods include 10-year, 20-year, and paid-up at age 65.

Endowments

Endowments are policies in which the cash value built up inside the policy, equals the death benefit (face amount) at a certain age. The age this commences is known as the endowment age. Endowments are considerably more expensive (in terms of annual premiums) than either whole life or universal life because the premium paying period is shortened and the endowment date is earlier.

In the United States, the Technical Corrections Act of 1988 tightened the rules on tax shelters (creating modified endowments). These follow tax rules as annuities and IRAs do.

Endowment Insurance is paid out whether the insured lives or dies, after a specific period (e.g. 15 years) or a specific age (e.g. 65).

Accidental death

Accidental death is a limited life insurance that is designed to cover the insured when they pass away due to an accident. Accidents include anything from an injury, but do not typically cover any deaths resulting from health problems or suicide. Because they only cover accidents, these policies are much less expensive than other life insurances.

It is also very commonly offered as “accidental death and dismemberment insurance”, also known as an AD&D policy. In an AD&D policy, benefits are available not only for accidental death, but also for loss of limbs or bodily functions such as sight and hearing, etc.

Accidental death and AD&D policies very rarely pay a benefit; either the cause of death is not covered, or the coverage is not maintained after the accident until death occurs. To be aware of what coverage they have, an insured should always review their policy for what it covers and what it excludes. Often, it does not cover an insured who puts themselves at risk in activities such as: parachuting, flying an airplane, professional sports, or involvement in a war (military or not). Also, some insurers will exclude death and injury caused by proximate causes due to (but not limited to) racing on wheels and mountaineering.

Accidental death benefits can also be added to a standard life insurance policy as a rider. If this rider is purchased, the policy will generally pay double the face amount if the insured dies due to an accident. This used to be commonly referred to as a double indemnity coverage. In some cases, some companies may even offer a triple indemnity cover.

the premiums paid. However, a death benefit will usually be paid if the suicide occurs after the two year period.

Annuities

An annuity is a contract with an insurance company whereby the purchaser pays an initial premium or premiums into a tax-deferred account, which pays out a sum at pre-determined intervals. There are two periods: the accumulation (when payments are paid into the account) and the annuitization (when the insurance company pays out). For example, a policy holder may pay tk.10,000, and in return receive £150 each month until he dies; or tk.1,000 for each of 14 years or death benefits if he dies before the full term of the annuity has elapsed. Tax penalties and insurance company surrender charges may apply to premature withdrawals (if indeed these are allowed; in most markets outside the U.S. the policy owner has no right to end the contract prematurely).

Comparative Analysis Of Green Delta Insurance Ltd And Pragati Life Insurance Ltd.

“A COMPARATIVE ANALYSIS”

Corporate Profile

Green Delta Insurance Company Limited (GDIC) is one of the leading general insurance companies in Bangladesh. The Company was incorporated on December 14,1985 as public limited company under the companies act 1913 with a paid up capital of Tk.30,00 million, It Started its operation on January 01, 1986, Under Insurance act 1938 with the slogan of “Marches with time”. GDIC was listed in Dhaka Stock Exchange (DSE) on January 12, 1990 and Chittagong Stock Exchange (CSE) on October 21, 1995.

The Company is a “A” category company in both DSE & CSE according to the categorization of the Securities and Exchange Commission. Its year-end shares price stood at taka 2000.00 around(face value being Tk.100). During the last 19 years, GDIC has achieved a good market reputation in the General insurance business, introduced a number of new products in the market and established a strong branch network of 34 in six different zones all over the country.

Pragati Life Insurance Limited, a third generation life insurance company, was set

up on January 30, 2000 as a public limited company under the Companies Act, 1994

with the philosophy of maintaining competitiveness, balanced with prudent

management and fairness to all the policyholders. It obtained registration from

the Department of Insurance on April 11, 2000 under the Insurance Act, 1938 to carry

out life insurance business. The company started with a paid up capital of TK. 30

million against an authorized capital of TK. 250 million.

PLIL is the life insurance company of Pragati family which started its operation in 1986 through the incorporation of Pragati Insurance Limited, a general insurance company which is considered to be one of the leading private sector general insurance companies in Bangladesh. The initiative of Pragati life was driven by the success story of the general insurance business. With all these resources in hand we are able to provide you efficient service and tailor-made product to meet your needs. Our attention is always focused on the individual client and his special needs. Furthermore, we are continuously developing IT aids and expert systems to carry on our life insurance business efficiently. We are available to deal with all your questions concerning these new products. And as we have entered into a new millennium, we will keep you informed about new trends and developments in the life insurance industry worldwide.

Products and Service:

Green Delta Insurance Co. Ltd.

Corporate

Risk Management

Property All Risks Insurance including Business interruption

Electronic Equipments and Computer insurance

Corporate Hospitalization cover

Corporate Overseas Health policy

Financial

Portfolio cover

Credit card Protection Insurance

Bankers Blanket Insurance

Money Insurance

Ideality Bond

Conventional

Fire & Allied Perils Insurance

Marine Cargo & Hull Insurance

All types of Aviation Insurance

All types of Automobile Insurance

All types of Accident, Miscellanious & Liability Insurance

All types of Engineering Insurance

Takaful (Islamic)

All types of (non life) Takaful Products

Investment & Portfolio Management

Underwriting

Pre-IPO placement Syndicate

Trusteership

Pragati Life Insurance Company Ltd.

Plan 01 – JIBON SATHI (with Bonus)

Plan 02 – JIBON PROTTASHA (with Bonus)

Plan 03 – JIBON TORI (with Profit)

Plan 04 – JIBON SOMAHAR ( with Profit)

Plan 05 – JIBON ALO (with Bonus)

Plan 06 – JIBON BONDHU (with Bonus)

Plan 07 – JIBON ABOKASH (Pension)

Plan 08 – JIBON BIKASH (Child Education)

Plan 09 – CORPORATE PLAN

Plan 10 – JIBON UTTORON (Joint Life)

Plan 11 – JIBON PARASH (Health Insurance)

Plan 12 – JIBON SHONCHOI (Single Premium)

Plan 13 – Jibon Purnota (Hajj Bima)

Islami Insurance

Plan 14 – Jibon Bondhon Insurance

Islami Insurance

Pragati Bima (Rural Insurance)

Pragati Bima is the innovative product offering from Pragati Life Insurance Limited. Feel free to contact us on any of the following.

Plan A – Shonchoi 3-in-1 Policy

Plan B – Shonchoi 3 payments Policy

Plan C – Shonchoi 4 payments Policy

Plan D – Sonchoi somahar policy

Plan E – Education Endowment Policy

Plan F – DPS (Pension Policy)

Plan G – Jibon Sanchay

Credit Rating Report on Green Delta Insurance Co. Ltd.

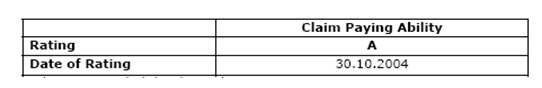

Credit Rating Report on Pragati Life Insurance Limited

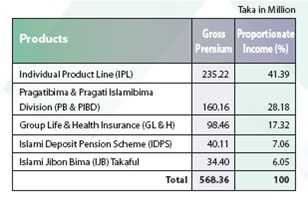

Premium Income of Pragati Life Insurance Company Ltd

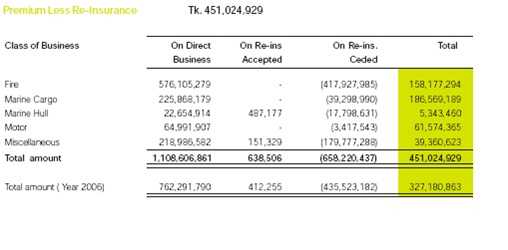

Premium Income of Green Delta Insurance Company Ltd

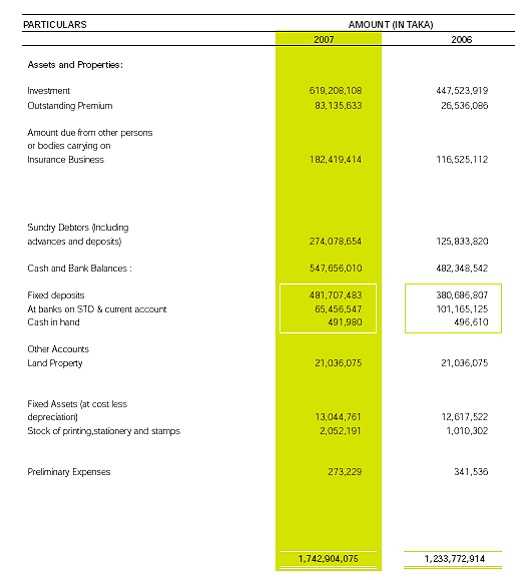

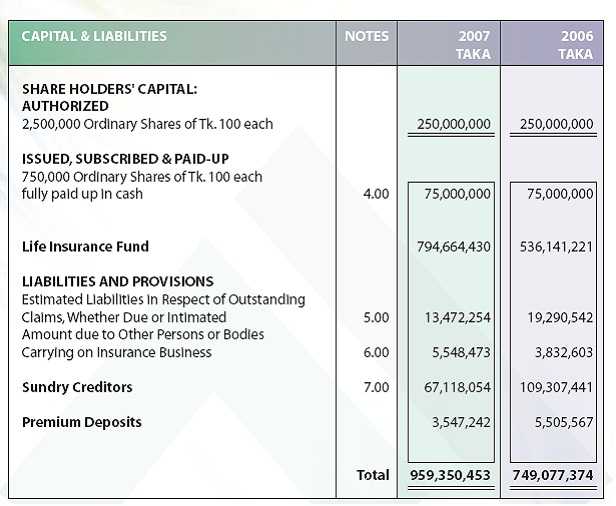

Green Delta Insurance Co. Ltd

Consolidate Balance Sheet

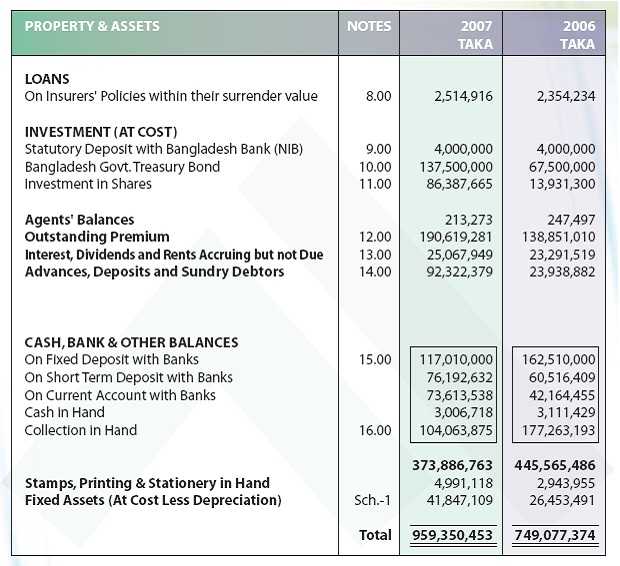

Pragati Life Insurance Co. Ltd

Consolidate Balance Sheet

Conclusion and Recommendations:

Companies’ philosophy should be best described as maintaining competitive balance with prudent management and fairness to all our policyholders’. We believe in adhering to basic principles of insurance and financial management while balancing the scales between safety of principle and competitive rate of return to our policyholders’.

Insurance both General and Life insurance companies objectives should to conduct transparent business operation based on market mechanism within the legal & social framework with aims to attain the mission reflected by our vision.

They should dedicated to provide innovative products, specially designed to meet our objectives while furnishing you with safety, liquidity and a competitive rate of return at present and in the future.

Companies vision, mission and objectives should to emphasize on the quality of product, process and services leading on growth of the company imbibed with good governance practices as well as country.