Adverse selection occurs when there’s a lack of symmetric information prior to a deal between a buyer and a seller. In economics, insurance, and risk management, adverse selection is a market situation where buyers and sellers have different information so that a participant might participate selectively in trades that benefit them the most, at the expense of the other trader. It describes a situation in which one party in a deal has more accurate and different information than the other party.

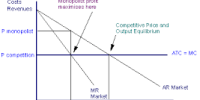

Buyers sometimes have better information about how much benefit they can extract from a service. It occurs when there is asymmetric (unequal) information between buyers and sellers. The party with less information is at a disadvantage to the party with more information. This unequal information distorts the market and leads to market failure. Most information in a market economy is transferred through prices, which means that adverse selection tends to result from ineffective price signals. For example, an all-you-can-eat buffet restaurant that sets one price for all customers risks being adversely selected against by high appetite and hence, the least profitable customers. The restaurant has no way of knowing whether a given customer has a high or low appetite. The customer is the only one who knows if they have a high or low appetite. In this case, the high appetite customers are more likely to use the information they have and to go to the restaurant.

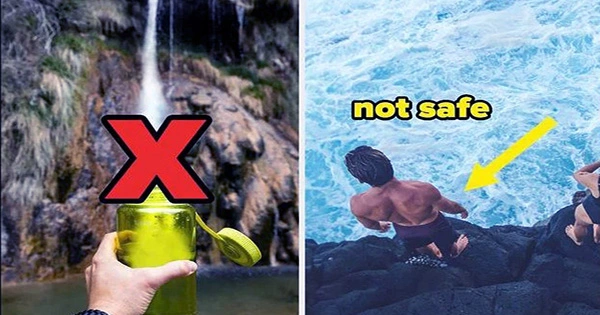

In this case, the seller suffering from the adverse selection can protect himself by screening customers or by identifying credible signals of appetite. Some examples of this phenomenon occur in signaling games and screening games. For example, buyers of insurance may have better information than sellers. Those who want to buy insurance are those most likely to make a claim. Therefore firms are reluctant to sell insurance.

Typically, the more knowledgeable party is the seller. Symmetric information is when both parties have equal knowledge. An example where the buyer is adversely selected against is in financial markets. A company is more likely to offer stock when managers privately know that the current stock price exceeds the fundamental value of the firm. Uninformed investors rationally demand a premium to participate in the equity offer. To fight adverse selection, insurance companies reduce exposure to large claims by limiting coverage or raising premiums. While this example functions as a good hypothetical example of the buyer being adversely selected against, in reality, the market can know that the managers are selling stocks (perhaps in required company reports). The information imbalance causes inefficiency in the price charged on specific goods or services. The market price of stocks will then reflect the information that managers are selling stocks.